In the wee hours of Thursday morning, at 4:30 a.m. ET, Manufacturing PMI news for the UK will be released. This is a leading indicator for UK economic activity and health. PMI is the Purchasing Manager’s Index. It is derived from a survey of 600 purchasing managers asked to rate the relative level of business conditions including employment, inventories, supplier deliveries and pricing, etc.

Based on previous market reaction, this news event can get the market to make bigger moves than other news events. A larger move offers a Straddle trading strategy opportunity. This setup uses two Nadex GBP/USD spreads and is set up to literally straddle the market prepared for the market to move up or down.

Straddle Prepared For Move In Either Direction

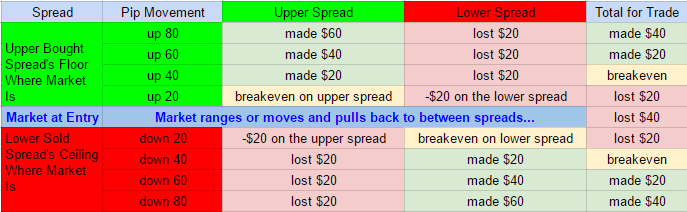

For this strategy, one spread could be bought with the floor of the spread where the market is trading at the time, and one spread could be sold with the ceiling of the spread where the market is trading at the time. In that way, the ceiling of the sold spread meets the floor of the bought spread. Each spread should have a maximum risk of $20 or less, for a combined max risk of $40.

A Straddle is set up in anticipation of the market making a move in one direction and possibly not making an equally strong pullback, causing one spread to lose. Therefore, the profit needs to cover the cost of both spreads. To do this, take profit orders should be set 80 pips above and below from where the market was at entry. Should the market hit one of the take profit orders set, that spread will make $60.

The chart below shows that when the market moves 20 pips in one direction, that side will breakeven and there is a $20 loss from the other side. At 40 pips in one direction, that side has now made $20 and the other side has a loss of $20, so the trade breaks even. When the market reaches 80 pips in one direction, that side has now made $60 and the other side has a $20 loss, making a net profit of $40 for the trade, for a 1:1 risk reward ratio.

To view a larger image click HERE.

The beauty of this trade is that it is low risk with only $40. Enter this trade the night before at 11:00 p.m. ET for 7:00 a.m. ET expirations. There is no need to wake up in the middle of the night to place it. Wouldn’t it be nice to wake up to profits?

For free day trading education, free access to the spread scanner and to the Apex news plan calendar, visit Apex Investing.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.