The annualized, but released quarterly, U.S. Gross Domestic Product (GDP) and unemployment news will be released Thursday at 8:30 a.m. ET. Based on the average market reaction from past news releases, the GDP news can make for a trade opportunity. Moves tend to be a pullback after a move, right after the news release.

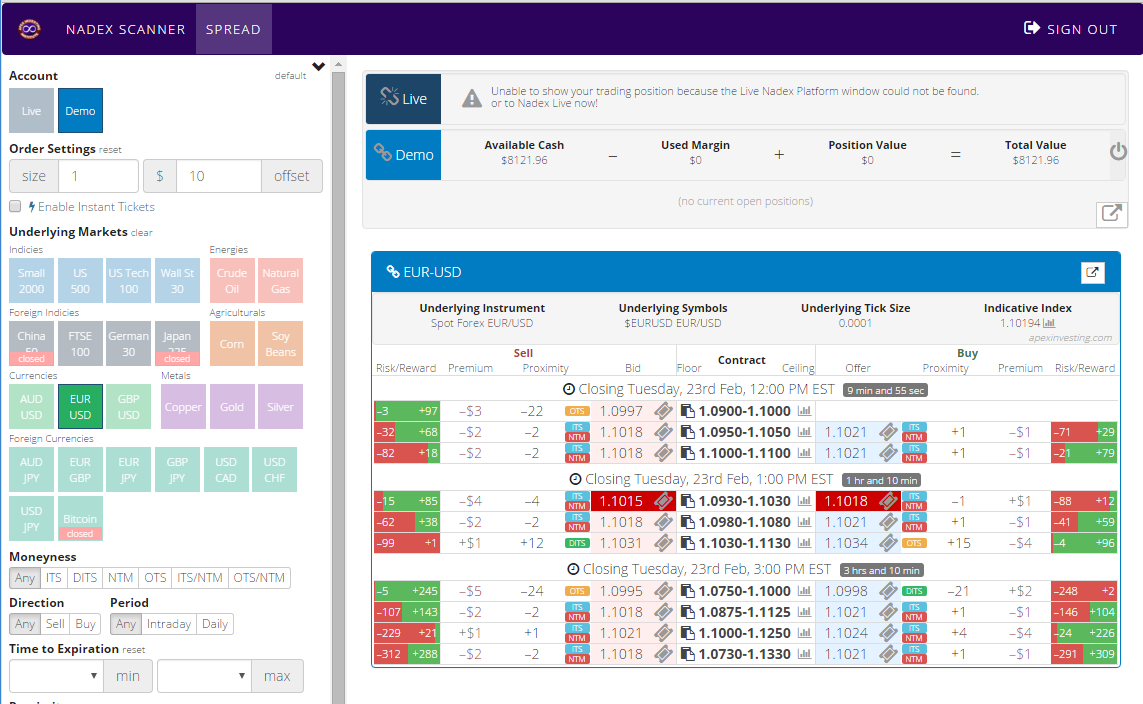

For this kind of action, an Iron Condor strategy works well, trading two Nadex EUR/USD spreads. One spread is bought below the market and the other spread is sold above the market. The ceiling of the bought spread should meet with the floor of the sold spread and be where the market is trading at the time.

With ceilings and floors delineating the boundaries of the range of market that can be traded, spreads provide a limited capped risk unlike trading spot Forex. Based on the average market move from past reaction to this news, it was found that the reward potential should be $35 or more combined for the trade. Entry can be as early as 8:00 a.m. ET for the two hour expiration spreads of 10:00 AM ET.

Using the spread scanner and its filter, find the EUR/USD spreads expiring at 10:00 a.m. ET. Simply look down the reward column, find the spreads that have $17 or more profit potential, and then verify the ceiling floor parameters mentioned above. More contracts can be traded as long as there is the same number of spreads on each side.

To view a larger image click HERE.

When the market pulls back and if it pulls back all the way to center, max profit is made. If the market is anywhere between the two breakeven points for this trade at settlement, then some profit is made. With a $35 profit potential, the breakeven points are 35 pips above and below the entry point. The 1:1 max risk/reward ratio points are 70 pips above and below from where the market was at entry.

For free access to the spread scanner and free day trading education along with a complete calendar of news trades visit Apex Investing.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.