News on two leading indicators for economic health will be released Friday, January 13, at 8:30 AM ET, Retail Sales and the Producer Price Index (PPI). Both reports also have a Core version. Core Retail Sales excludes the volatile auto sales and the Core PPI excludes food and energy, which makes up 40 percent of the PPI and can overshadow the data. All four news releases are tradable with the right strategy using the right instruments.

Often, with these kinds of news events, the market will react with a move, followed by a pull back. That kind of movement can make an Iron Condor strategy using Nadex EUR/USD spreads a high probability trade with the right profit potential. Based on previous market moves to these reports, the profit potential recommended for this trade setup is a combined $35 equally split between the spreads, or about $17 or more each spread.

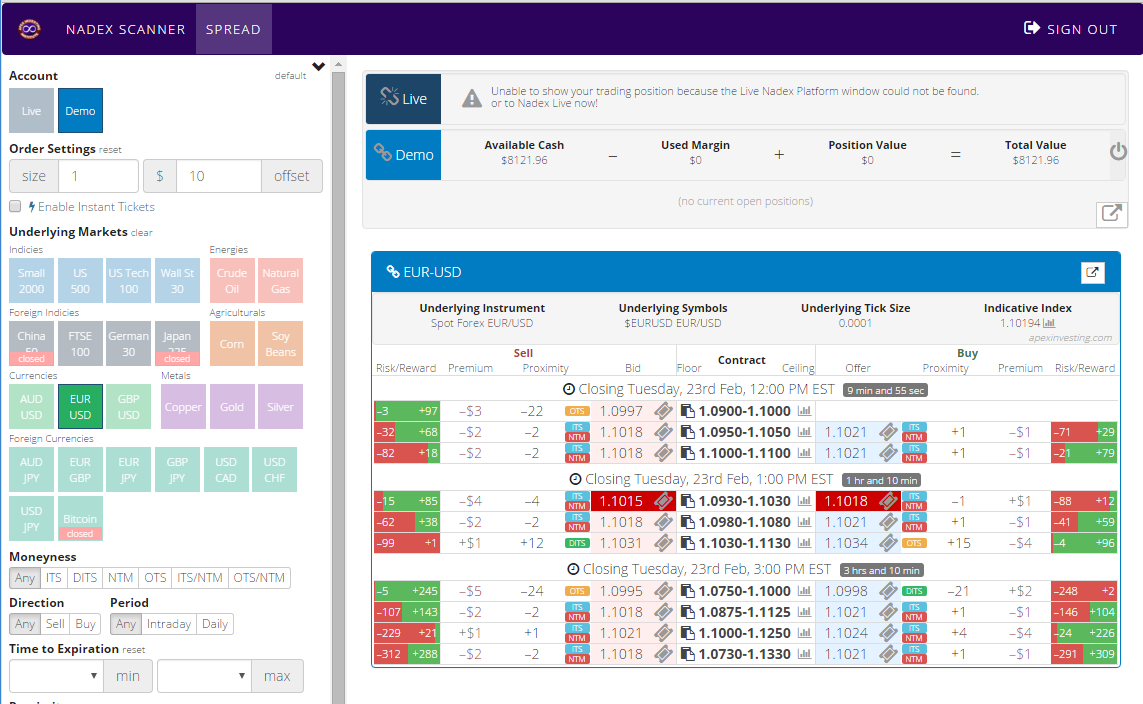

One spread is bought with the ceiling where the market is trading at the time while another spread is sold with the floor where the market is trading at the time. With the recommended profit potential, both spread’s prices will be around 17 pips away from the market price. The sold spread will be above the market and the bought spread will be below. This will give the market around 35 pips up and down before it will hit a break even point. The trade profits if it settles anywhere in between. Should the market come right back between the two spreads and is there at settlement, the trade will achieve max profit.

If profit anywhere between $1 and $35 doesn’t seem like much, more contracts can be traded. The only requirement is that the same number of spreads are set on each side of the trade. Stops should be set in the event the market does take off and doesn’t make the pull back. In this case, the 1:1 risk reward ratio points are 70 pips above and below from where the market was at entry. With a release time of 8:30 AM ET, entry can be as early as 8:00 AM ET for 10:00 AM ET expiration.

Either beginner or advanced traders can easily execute the trade using the spread scanner, which will filter all the markets and spreads for only the desired market and expiration times. Then, when looking for spreads with minimum profit potentials such as the case with this trade, red and green bars along with numbers will visibly show the current profit and loss whether buying or selling the spread. Even a brand new trader could find the spreads and practice the trade in demo. For the advanced trader, multiple markets, along with complete information on each spread is visible in one screen for various strategies, including current proximity and premium. Get a glimpse in the image below.

For free access to the spread scanner and free day trading education, visit Apex Investing.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.