Popular trading platform Robinhood has delayed its IPO plans, which were originally scheduled for later this month after its prospectus became the subject of regulatory scrutiny.

What Happened: According to a report from Bloomberg, sources close to the matter disclosed that the U.S. Securities and Exchange Commission has been asking questions about Robinhood’s cryptocurrency business specifically.

While a public listing this summer may still be on the cards for Robinhood, the sources said there is a chance it could even be pushed back into the fall.

“The company aims to reveal its financials as soon as possible and to go public as soon as the SEC finishes its review,” they said.

Why It Matters: After launching its zero-fee crypto trading platform in 2018, Robinhood has seen a massive growth in users, most of whom are trading crypto for the first time.

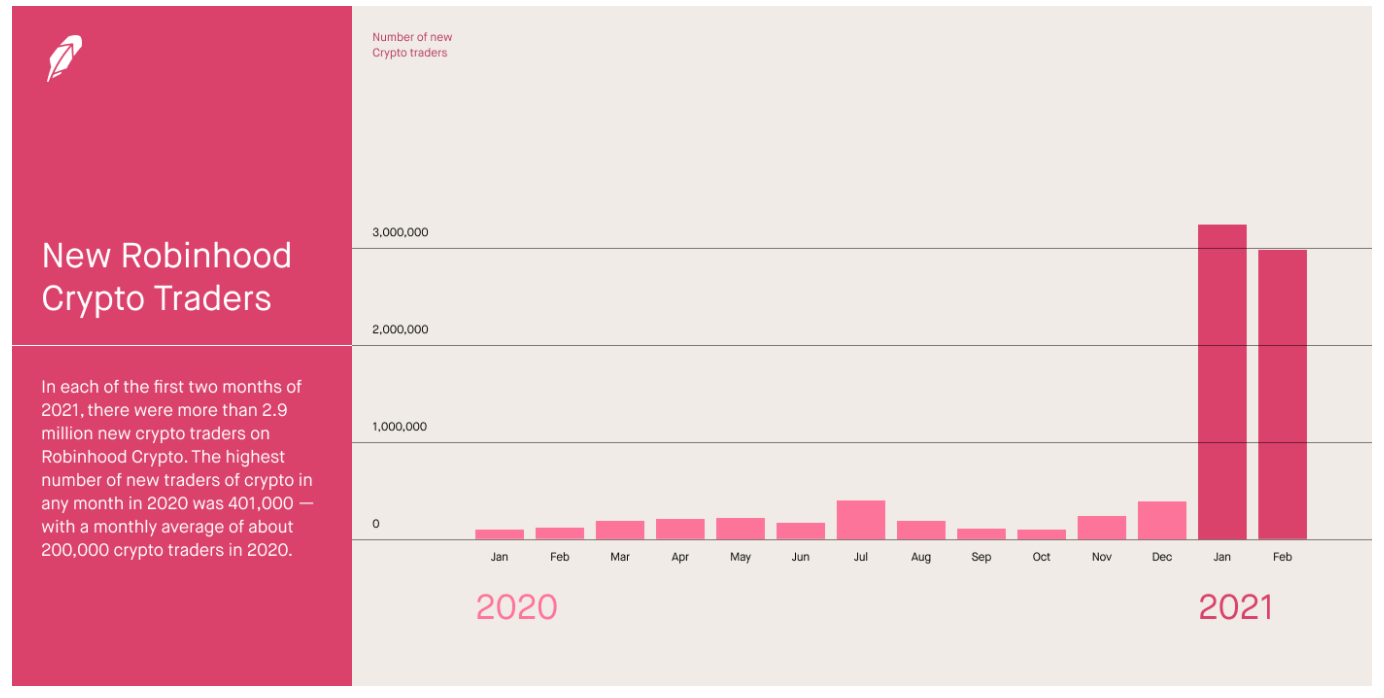

The biggest surge in user growth came in 2021, where the company reported 6 million new users after just two months into the year.

The platform offers seven cryptocurrencies for trading, including Bitcoin BTC/USD, Bitcoin Cash BCH/USD, Bitcoin SV BSV/USD, Dogecoin DOGE/USD, Ethereum ETH/USD, Ethereum Classic ETC/USD, and Litecoin LTC/USD.

Read also: 2021 Robinhood App Review

What Else: Robinhood has remained a popular trading avenue for users, despite being the subject of controversy earlier this year when it restricted users from purchasing Dogecoin and GameStop Corp. GME due to “extraordinary market conditions.”

Price Action: At press time, market-leading cryptocurrency Bitcoin was trading at $33,487, losing 1.70% over the past 24-hours.

The overall market cap for cryptocurrency stood at $1.34 trillion after a 0.34% decrease overnight.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.