The Producer Price Index (PPI) was released before the market open on Tuesday and showed that inflation at the wholesale level grew faster than expected at 0.8% in November. Additionally, the PPI grew 9.6% from last November which is above the expected 9.2% and is, well, just ugly. At this point, we can probably say that the transitory inflation theory has pretty much been blown out of the water.

S&P 500 futures (/ES) was already trading lower before the PPI report and dropped further after the report. This selloff adds to Monday’s late-day selloff adding to the degree of uncertainty investors are feeling. The Cboe Volatility Index (VIX) rose 6% before the open reflecting rising fears.

Yields remain relatively flat on the news, ticking slightly higher than dropping again. Normally, we hear “buy the rumor and sell the news”; it could be interesting to see how investors react to the Fed’s announcement tomorrow. Perhaps we’ll see “sell the rumor and buy the news”.

The uncertainty is standing in the way of Apple (AAPL) making history by reaching a $3 trillion market cap. The stock fell 2% yesterday but was trading slightly higher in premarket trading. Unfortunately, the stock turned negative with S&P 500 futures after the PPI report.

The major stock indices fell on Monday as uncertainty around Wednesday’s Fed announcement hangs over investors. The Cboe Market Volatility Index (VIX) rose more than 9% and is back to the 20 levels, which is often seen by some investors as a level of caution. The S&P 500 (SPX) fell 0.91% on the day, and the tech-heavy Nasdaq Composite (GIDS) fell 1.39%. Energy, consumer discretionary, and technology sectors were the worst performers on Monday, while investors were buyers in defensive sectors like real estate, utilities, consumer staples, and health care.

The 10-year Treasury yield (TNX) fell more than 4% on Monday. This move may reflect an expectation from investors that the Fed will accelerate its plans to taper off bond buying. But it could also reflect the defensiveness seen in stock buying, which means investors could be looking for safer havens like bonds.

However, not all stock buying was in defensive stocks. Despite the growing uncertainty, investors appear to still like electric vehicles (EVs). On Monday, Harley-Davidson HOG rose more than 10% on the news that its LiveWire unit will merge with AEA-Bridges Impact (IMPX). The plan is to create a separate, publicly-traded EV motorcycle company. EV truck maker Rivian RIVN rallied 3.7% on news that the company was named MotorTrend Truck of the Year for 2022. EV carmaker Lucid LCID rallied 3.96% after being added to the Nasdaq-100 Tech Sector Index (NDXT).

Loss of Appetite

Investors appear to be losing their appetite for risk because many popular pandemic plays have experienced major slides. Dogecoin is down more than 70% from its 2021 high despite rallying more than 30% overnight after Tesla TSLA CEO Elon Musk tweeted that he was going to create merchandise to be purchased with Dogecoin. It’s uncertain how serious Mr. Musk is on the promise. However, many cryptocurrencies have been getting hit lately. Bitcoin and Ethereum are down about 30% and 20% respectively from their November highs.

Cryptos aren’t the only popular pandemic trades that are seeing a lot of volatility. Meme stocks like GameStop GME and AMC AMC are down about 3% and 6% respectively in premarket trading after falling 14% and 15% yesterday.

While these are some of the more extreme examples, even the Russell 2000 (RUT) small-cap index has dropped more than 4% in the last three days and is down nearly 11% from its November high. Instead, investors appear to be opting for steadier stocks like those in the S&P 500 which is about 1% from its all-time high.

Stacking the Box

On Monday, I discussed how the consumer staples and utility sectors were seen by many investors as defensive stocks, but they aren’t the only sectors investors commonly turn to when getting defensive. Real estate and health care stocks are also popular when investors are looking to beef up their defense. The reason these stocks are considered defensive is that they’re the items that must be paid or purchased no matter what the economy does. Consumer staples are companies that help you put food on the table, and eating is always a must.

Sickness and injury happen no matter what the economy is doing. And, of course, people always need a place to live with running water and electricity.

In addition to meeting basic needs, real estate, utilities, and to some extent consumer staples commonly offer higher-than-average and consistent dividend payments. According to Charles Schwab, these groups tend to have lower volatility than other sectors. Income and lower volatility attract risk-averse investors to defensive stocks and bonds. But, while dividend-paying stocks may have lower volatility than other stocks, they’re still riskier than bonds. Additionally, they have other risks (for example, a company could elect to quit paying a dividend or choose to reduce it).

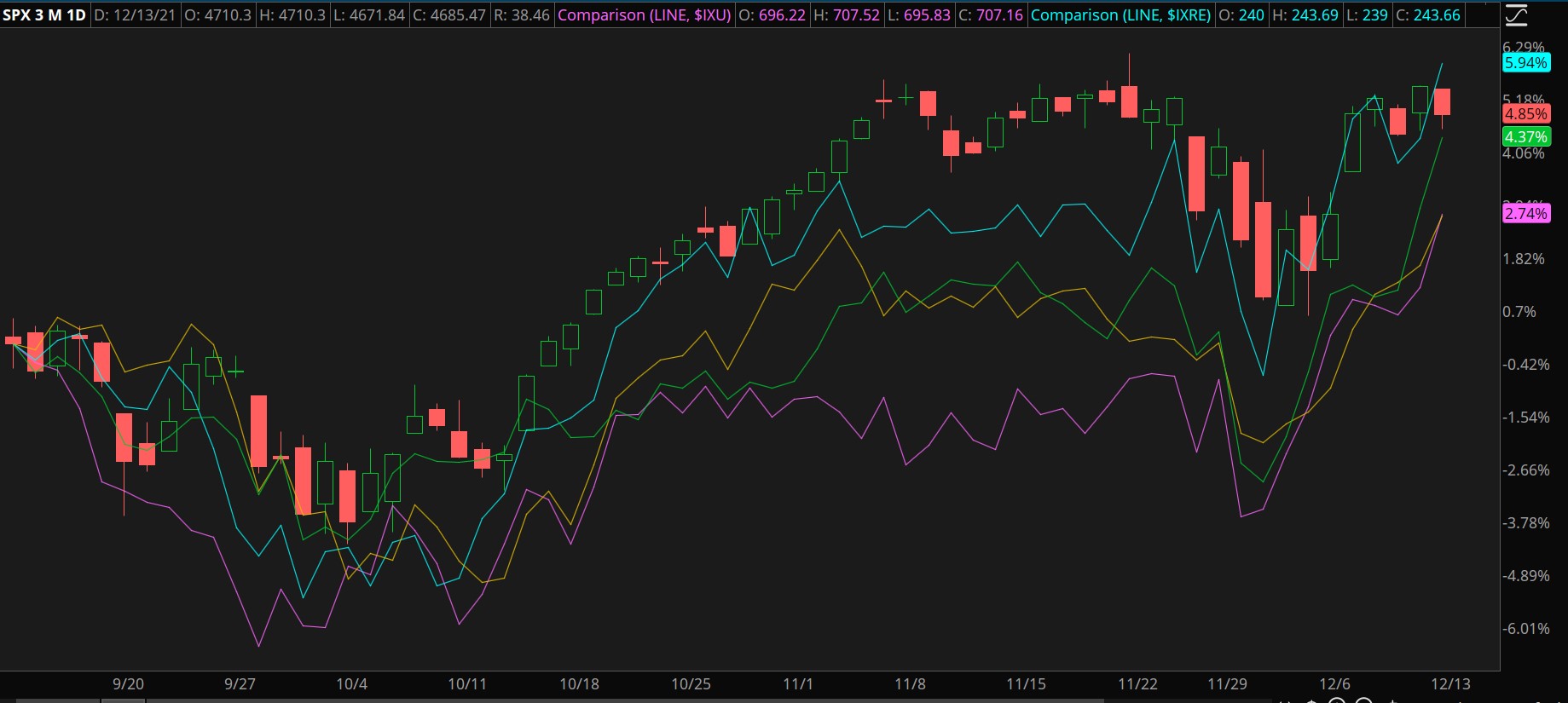

CHART OF THE DAY: STUFFED AT THE LINE. The Real Estate Select Sector Index ($IXRE—blue) is the only defensive sector to outperform the S&P 500 (SPX—candlesticks) in the fourth quarter of 2021. The Consumers Staples Select Sector Index ($IXR—green) has recently rallied close behind the benchmark. The Utilities Select Sector Index ($IXU—pink) and Health Care Select Sector Index (IXV—yellow) are trailing more than 2% behind the S&P 500. Data Sources: ICE, S&P Dow Jones Indices. Chart source: The thinkorswim® platform. For illustrative purposes only. Past performance does not guarantee future results.

Bend; Don’t Break: Some investors mistakenly believe that defensive stocks go up when the stock market goes down. Sadly, this isn’t true. Historically, that’s been the case for stocks and bonds but not for defensive stocks. Instead, defensive stocks tend to be less volatile, which means they tend to fall less than most stocks and rise less than most stocks.

The benefit of lower volatility comes in drawdown. Drawdown is how much a stock or portfolio has fallen and needs to make up just to get back to even. A stock that has fallen 10% must actually rally 11% to get back to breakeven. A stock that falls 50% must rise 100% to get back to even. Lower volatility stocks may fall when the market falls, but they tend to fall less and therefore must make up less ground.

Beta You Than Me: One-way investors measure the volatility of a stock is through its beta. Beta measures a stock’s volatility in relationship with the S&P 500. A stock with a beta of 1 will tend to be about as volatile as the index. A beta less than 1 tends to be less volatile than the index, whereas a stock with a beta of greater than 1 tends to be more volatile.

On Monday, Coca-Cola KO was upgraded by JP Morgan analysts, sparking a 2.63% rally in the stock. While that was a good move, KO is a consumer staples stock and is commonly less volatile than the S&P 500. In fact, it has a beta of 0.69, which means it tends to be less volatile than the index. By contrast, Tesla TSLA is a consumer discretionary/technology company. It has a beta of 2, which suggests it’s twice as volatile as the S&P 500. Defensive investors may choose to look for stocks that have a low beta, while aggressive investors may look for high-beta stocks.

Defense Doesn’t Mean Value: Another way to assess risk in a stock or sector is to look at its forward P/E ratio. The P/E ratio tells an investor what they’re paying for each share of earnings. A forward P/E ratio tells investors what they are paying for the next year’s projected earnings. A high forward P/E is fine as long as the company can deliver on those earnings. However, if the economy turns down, then the likelihood of delivering on earnings decreases. Stocks with the highest ratios reflect higher levels of risk because once those earnings are in doubt, investors may choose to sell those stocks, causing the prices to fall dramatically.

According to research by Yardeni, the S&P 500 Index has an average forward P/E of 20.5. The consumer discretionary stocks in the index have the highest forward P/E of 31.1, followed by technology at 26.9. The lowest sectors are energy at 10.5 and financials at 14.1. The defensive sectors have forward P/E ratios of 16.2 for health care, 18.9 for utilities, and 19.9 for consumer staples. (The report didn’t cover real estate.)

The forward P/E ratios for these defensive stocks are relatively high compared to other sectors, which means that while they are part of the defensive group, there aren’t necessarily the best value stocks in the index. At the same time, they do have lower valuations than the S&P 500, which likely reflects the betas you might find in these sectors.

TD Ameritrade® commentary for educational purposes only. Member SIPC.

The preceding post was written and/or published as a collaboration between Benzinga’s in-house sponsored content team and a financial partner of Benzinga. Although the piece is not and should not be construed as editorial content, the sponsored content team works to ensure that any and all information contained within is true and accurate to the best of their knowledge and research. The content was purely for informational purposes only and not intended to be investing advice.

Image Sourced from Pixabay

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.