Many investments that had performed well for the past years are not thriving this year. We are experiencing high levels of inflation that haven't happened in years. You may or may not have invested in crypto, which has tanked 70% since the end of last year. Is crypto an effective inflation hedge? Should you buy it at a low price? As an investor, you look for places to put your money to earn money for yourself. The return on investment you’re likely to get depends on your risk tolerance.

If you’ve invested in the stock market, you’ve seen your balance drop recently, and you might be wondering if it's time to test the cryptocurrency waters. In today’s inflationary environment, you’re looking for smart ways to mitigate the effects of this economic downturn.

Read on to learn more about Bitcoin, Ethereum, stablecoins, and cryptocurrency-related exchange-traded funds (ETFs); their value as an inflation hedge; and if they are appropriate for your portfolio. It might be time to find a fiduciary financial advisor with crypto expertise for advice.

Traditional Inflation Hedges And Crypto

Inflation simply means a dollar today is going to be worth less in the future. During high inflation, people try to buy things that are in a limited quantity, such as commodities and land. Certain stocks — bank stocks and defensive stocks like consumer staples and healthcare — tend to do well when the Fed raises interest rates; others — like utility stocks — often suffer. Crypto is also available in a limited quantity. One initial hope for cryptocurrencies was that they might not follow the stock market’s ups and downs, becoming a place to flee from a stock bear market. We’ve seen so far that crypto seems to move in lockstep with the broader market. However, many crypto natives tout its benefits as a hedge against inflation.

Cryptocurrency As an Inflation Hedge

Bitcoin and Ethereum are the first cryptocurrencies, and they’ve been joined by 19,000 more varieties and growing. Bitcoin, the original cryptocurrency and the largest by market capitalization, was created with inflation in the back of the creator’s mind. The total supply of Bitcoin is capped at 21 million coins, which will probably be reached in 2140. When the final number of coins is reached, no more will be minted. Theoretically, the consistently low inflation rate and large market cap inherent in its design make Bitcoin a favorable currency to hedge against inflation.

Ethereum is also designed to be deflationary. Even though its network still creates Ether tokens, it burns or destroys them regularly to shrink the supply. A 2% annual decline is expected, meaning the coin should become scarce over time, acting as an inflation hedge.

Other cryptocurrencies display varying degrees of scarcity and deflationary properties.

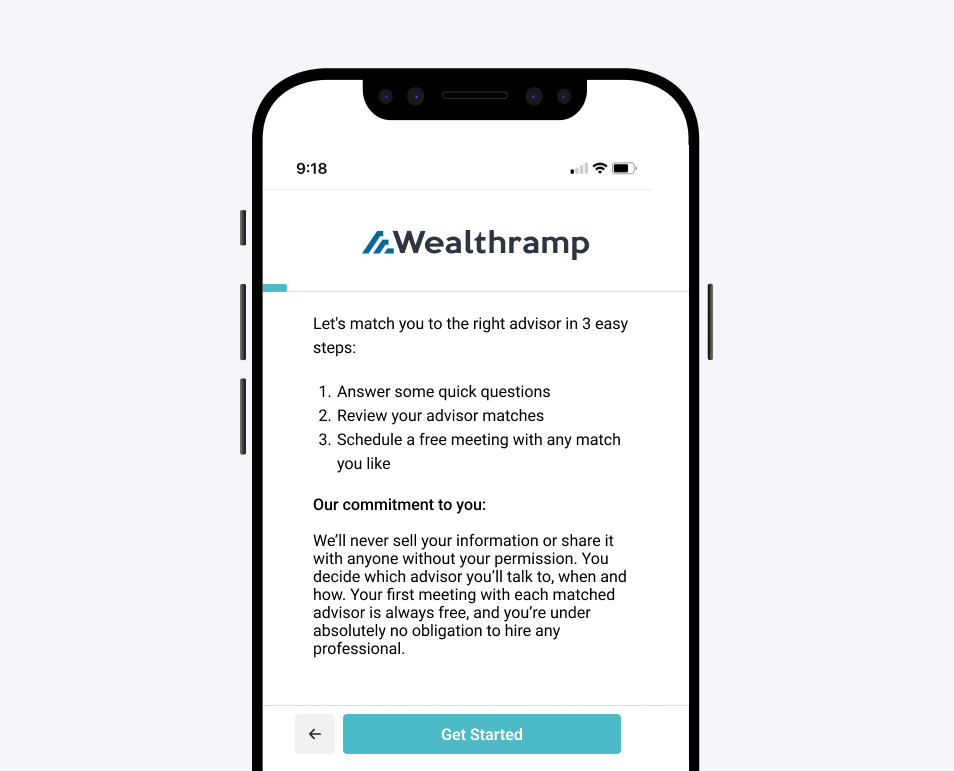

Are cryptocurrencies immune from inflation? As yet, crypto has not proven to be a more effective inflation hedge than stocks. “Traditionally, investments which have the ability to pass on rising costs to consumers have proven to be good inflation hedges,” says Jeffrey George, CFA, CEPA, a financial advisor with deep experience in crypto investing on Wealthramp, a free advisor matching platform. “As cryptocurrencies do not inherently produce a cashflow (staking is more like collateralized lending), their ability to act as an inflation hedge is entirely based on investor demand. In that sense, they’re probably better characterized as a hedge against fears of a rapid decline in the value of the dollar as opposed to above-average inflation rates. It’s a fine line, but there is a difference – you can have one without the other.”

Connecting with a fiduciary financial advisor such as those vetted by Wealthramp, can be a way to reduce the risk of investing in crypto.

Is Bitcoin the New Gold?

Gold has been an investor go-to during times of high inflation. Some digital currency experts dub Bitcoin “digital gold” because, like gold, it is in limited supply. Traditional wisdom has held that gold — and land — function as inflation hedges because of scarcity, and, therefore, Bitcoin will too. The comparison is not unwarranted, but a fundamental difference — that you can possess the physical reality of gold or land in a way you can’t with a computer-generated digital asset — weakens the argument. Cryptocurrencies are intangible and exist only on the internet. In 2022, it’s not certain whether Bitcoin will prove to be the gold-like inflation hedge its promoters consider it to be. However, owners of Bitcoin when it touched $68,990.90 a coin in November 2021, might disagree. Even after its recent drop in the price of over 70%, its supporters remain convinced that the digital currency market will rebound.

Setting the Record Straight on Earning Interest from Crypto

When you read about earning 12% interest anywhere, you’re intrigued because the term “interest” may connote there is no risk. Your bank, Certificate of Deposit (CD), I Bond, and money market account pays you interest without the risk of losing principal. If you buy a $1,000 CD, you know for sure you’ll get that $1,000 — your principal — back, plus the agreed-upon interest-less fees, if any. It’s not risky.

When you engage in financial transactions like that, you are saving — as opposed to investing, which carries some risk that you might not get all of your principal back. When you use a crypto platform to earn interest, you don’t have the guarantee that you’ll get your principal back. You probably will, but you might not. That’s investing for a return, not saving for an interest payment.

Risks of Cryptocurrency Investment You Need to Know

Crypto investment can take different forms, including direct purchase of coins, stablecoin conversions, and earning interest. Buying crypto outright is one way to invest, but the recent 70%+ drop as crypto entered a roaring bear market has given most investors pause.

If you’re not sure about jumping in on your own, an experienced fiduciary financial advisor with crypto expertise on Wealthramp can help. The right fiduciary financial advisor can help you rethink about how you should diversify your portfolio. If you dipped a toe in the crypto waters and are suffering frostbite from the current crypto winter, it might be time to warm up to an advisor who can help. They can review your portfolio and work with you to figure out if you should invest in crypto as part of your portfolio now, given its low price, and if so, how to do it in a way that matches your risk tolerance. A good financial advisor will talk to you about your financial goals and investment strategies and help you create a plan.

Stablecoins Are Not the Same As Dollars

Stablecoins are another seductive investment, promising interest rates in the double digits, far above that you can earn at a bank. Stablecoins are digital assets that are designed to maintain a stable value relative to a national currency or other reference assets. A stablecoin is a cryptocurrency whose value is tied to another asset to attempt to reduce volatility and increase safety.

Confidence in stablecoins can be undermined because of its reserve assets that could fall in price or become illiquid. Sometimes redemption attempts fail, as when the Celsius network refused to return deposits to account holders. Cryptocurrency is not a silver bullet to hedge inflation, and stablecoins are not risk-free.

Beware Crypto Sales Narratives from Promoters

Crypto sales narratives can be misleading. Before you listen to advice on crypto or other financial matters, ask if the writer is a promoter or real expert. Determine their background and motivations and make sure their aim is to build investors’ confidence in crypto. In perhaps no other financial sector is it more important today to have a fiduciary financial advisor who is looking out for you.

A new financial opportunity like digital currency hasn’t been around long enough for regulators to work out the kinks, so you’re less protected than with other long-available investment opportunities. If you’re interested in crypto investments, Wealthramp can help you find an advisor who knows the ins and outs and who will guide you on a safer, more positive crypto investment journey and dynamic investing strategies.

Carry On, Keep Calm — Crypto Investment Works Best With A Trusted Financial Advisor

Crypto has not been proven to be an effective inflation hedge. It’s a new investment vehicle you may want to consider as part of your portfolio, but it’s no magic bullet. With its high risks, rampant scams, and confusing narratives, it’s important to consult with an expert who acts in your best interests rather than invest in crypto on your own. Whether you are considering investing in crypto or need help creating a new strategy for today’s down markets and high inflation economy, consider working with an experienced fiduciary financial advisor — like the ones Wealthramp can match you with — who can help you look at the overall picture of your specific needs, financial goals, and risk tolerance and partner with you to create a plan with effective investment strategies. A fiduciary advisor is legally required to provide you with advice that is in your best interests.

Pam Krueger is the founder and CEO of Wealthramp, a free adviser-matching platform that connects people with rigorously vetted and qualified fee-only financial advisers. She is also the creator and co-host of MoneyTrack on PBS and Friends Talk Money podcast for PBS Next Avenue.

This post contains sponsored advertising content. This content is for informational purposes only and not intended to be investing advice.

Featured image sourced from Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.