Good Morning Everyone!

Remember, it’s the best time to buy great companies at a great price and leave them alone.

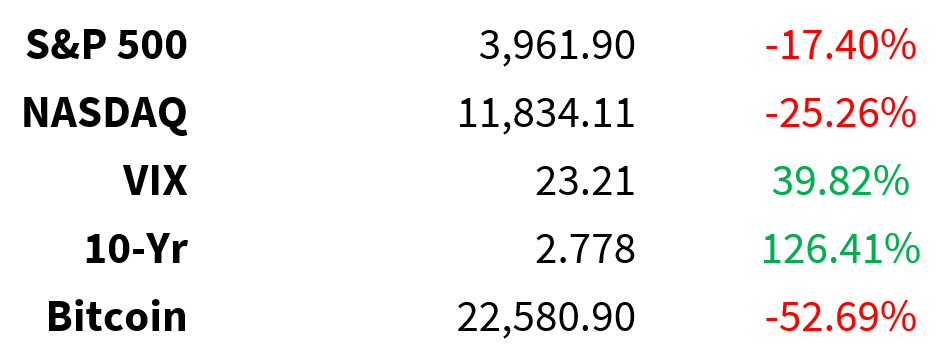

Prices as of 4 pm EST, 7/22/22; % YTD

MARKET UPDATE

>$9 trillion in market cap reporting this week

Apple AAPL, Amazon AMZN, Charter CHTR, Comcast CMCSA, Google GOOGL, Intel INTC, Mastercard MA, Meta META, Microsoft MSFT, ServiceNow NOW, Qualcomm QCOM, Shopify SHOP, Visa V, GM GM, G.E. GE, UPS UPS

With all the bad news on the come (recession, rate hikes, margin hit, estimate cuts),

-

S&P 500 is this a Bear-Market bounce?

Bank of America is this a Bear-Market bounce? BAC

Netflix is this a Bear-Market bounce? NFLX

Wednesday: Federal Reserve 5th Meeting of the year: 75 basis point hike expected

-

75 point hike would bring the target rate to 2.5%

-

2.5% is the peak of the last rate-hiking cycle in 2018-2019

-

Federal Reserve rate cut expected March 2023

-

Will June’s high 9.1% increase in consumer prices be the peak?

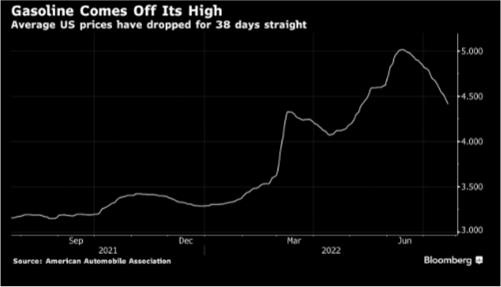

Crude 96 +1%

-

Crude oil back to the level they were at when Russia launched its invasion of Ukraine on February 24, 2022

Biden says: Gasoline prices “still too high”

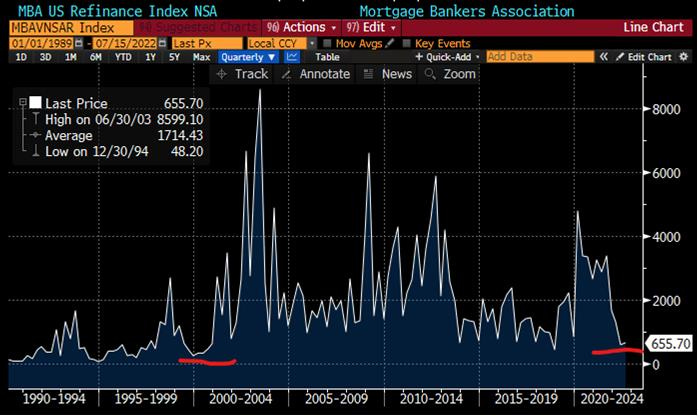

U.S. Housing

-

With Mortgage rates rising sharply, mortgage refinancing activity has fallen to its lowest level since November 2000

-

Average on the 30-year fixed rate mortgage rose to 5.54% vs. 1-year ago when rates were 2.8%

Apple AAPL

-

Leading contender to win 2023 NFL Sunday ticket rights

-

$2.5 billion per season ($1 billion more than the last contract)

-

Google, Amazon and Disney (ESPN+) also bidding for the rights

Airports

-

According to FlightAware, Toronto Airport worst in the world for delays

-

Over 53% of flights departing Toronto Pearson between June 1 – July 18 arrived late

Disney DIS

-

Disney+ adds R-rated content

-

For the first time, Disney pushes further into adult-focused content in pursuit of new subscribers

-

Added Deadpool, Deadpool 2 and Logan

Earnings today

-

Infosys INFY

-

Newmont NEM

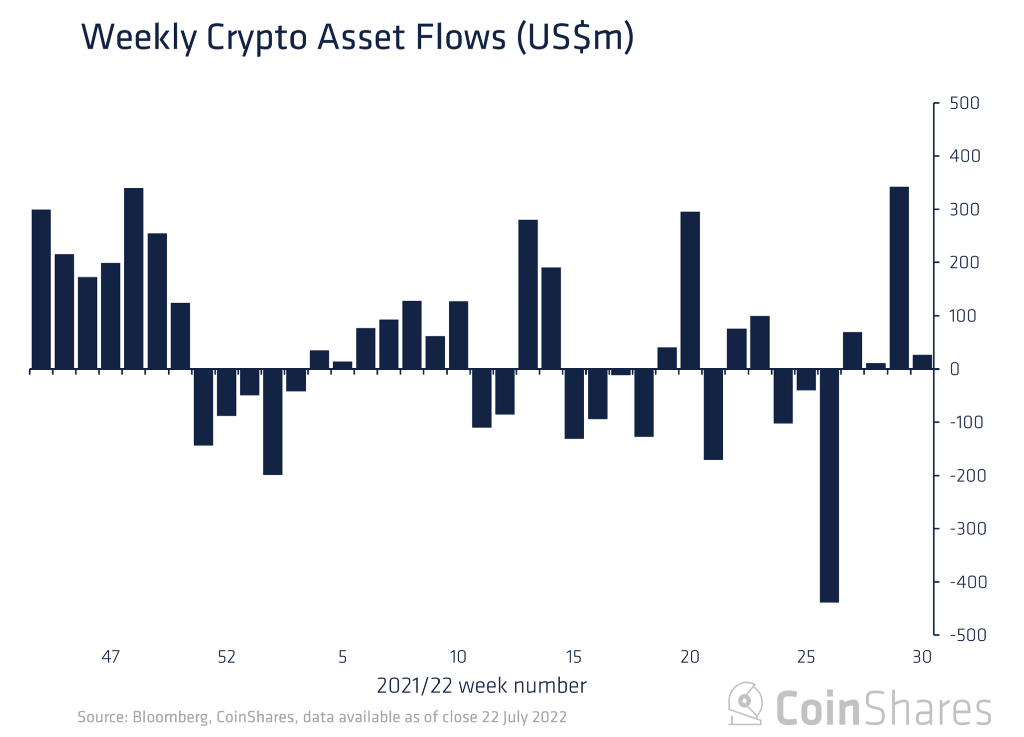

CRYPTO UPDATE

Inflows are picking up

-

A correction to Week 28 (2 weeks ago) flows puts total inflows for the week at $343M — the largest since November 2021

-

Bitcoin BTC/USD inflows over last 2 weeks total $225M

-

Ethereum ETH/USD inflows totaled $128M over the same period

-

YTD flows

-

BTC +$241.3M

-

ETH -$315.8M

-

SOL +1$12.6m

-

-

Total inflows for digital assets totaled $30M

MEME OF THE DAY

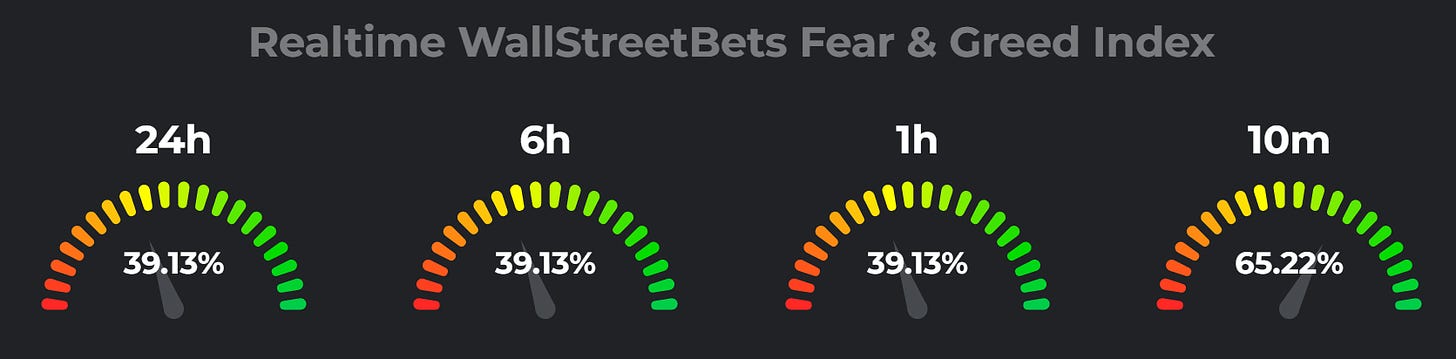

How’s WallStreetBets feeling to start the week?

data from Swaggy Stocks

Disclaimer: The publisher does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Grit Capital Corporation is a publisher of financial information, not an investment advisor. We do not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.