Credit Suisse CS is borrowing $54 billion from the Swiss National Bank to help shore up liquidity.

Big week for bank bailouts!

Market

Prices as of 4 pm EST, 3/15/23

Macro

-

An unexpected decline in producer prices might have been the top news yesterday, if not for Credit Suisse’s loud selloff (more on that below). The slowdown in prices was paired with a larger-than-expected decline in retail sales, which together give the Fed some (but not much) room for easing monetary policy.

-

The Atlanta Fed’s GDPNow model estimate for real GDP growth for the first quarter moved up to 3.2% yesterday driven by an increase in consumer spending growth. Just 8 days ago, estimates called for 2%.

-

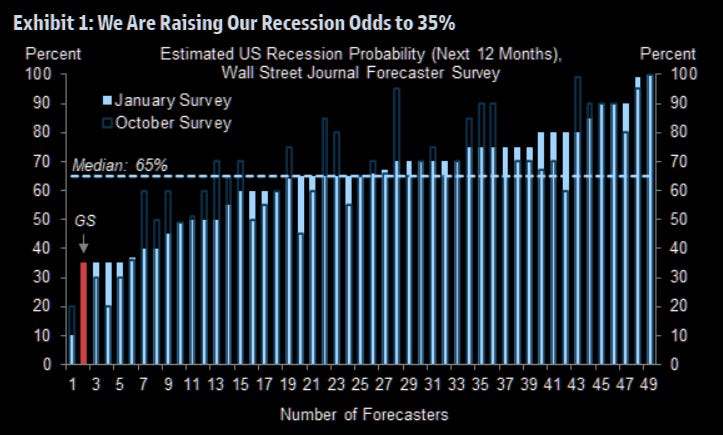

Meanwhile, on the heels of widespread uncertainty surrounding the economic effects of small bank stress, Goldman Sachs has increased its odds of the US entering a recession to 35% from 25%. Those probabilities remain well below consensus, however, which see a 65% chance of an economic downturn in the next 12 months.

Stocks

-

By way of fundamentals, Credit Suisse is no Silicon Valley or Signature Bank, but the troubled lender still stole the spotlight yesterday after its credit spreads went parabolic, suggesting investors anticipated a default on the horizon. Last night, Credit Suisse received a lifeline from the Swiss National bank which will let it borrow up to 50 billion francs to strengthen liquidity.

-

Already under review by Moody’s, the credit rating of First Republic bank is under further pressure. Yesterday, both S&P and Fitch cut the lender to “junk” even after regulators pledged support for the sector.

-

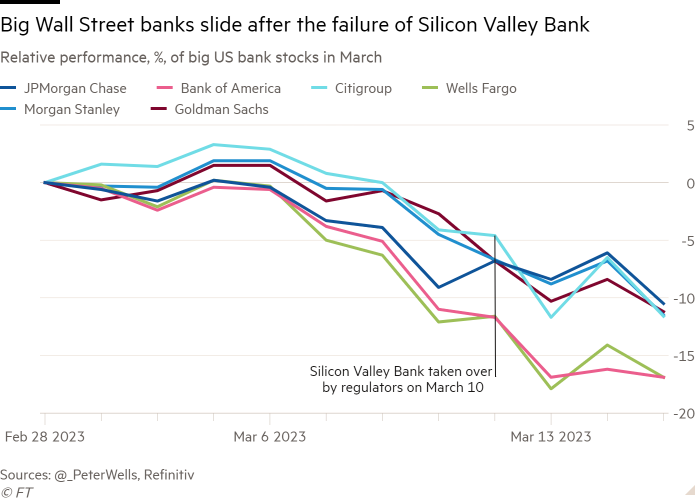

As for Wall Street’s biggest banks, they have not come out of this unscathed. The six largest banks have lost nearly $165 billion in market cap this month, or roughly 13% of their combined value. The drops suggest investors are concerned about cuts to net interest income from deposit outflows.

Energy

-

After being rangebound since December, US oil prices have broken down with prices falling to their lowest in 15 months. For investors, expanding US stockpiles and growing concerns over an economic slowdown at home and abroad are overshadowing an increase in demand from China’s reopening.

Earnings

-

FedEx FDX

-

Dollar General DG

-

Jabil JBL

-

Williams-Sonoma WSM

-

Yamana Gold AUY

-

Academy Sports ASO

-

Signet Jewelers ASO

News

-

Disney: Bob Iger is weighing the possibility of selling off Hulu, ESPN, or both.

-

Reverse tigthening: According to JPMorgan, the Fed’s emergency loan program could inject $2 trillion in the US banking system.

-

Ernie: Baidu shares plunged after the Chinese tech company unveiled its AI chatbot Ernie to the public in an underwhelming pre-recorded video.

-

Potential ban: The Biden administration is threatening to ban TikTok in the US if its Chinese owners don’t sell their interests.

-

2023 GDP: Anticipating a pullback in lending and tighter standards for banks, Goldman Sachs has lowered its annual growth forecast to 1.2% from 1.5%.

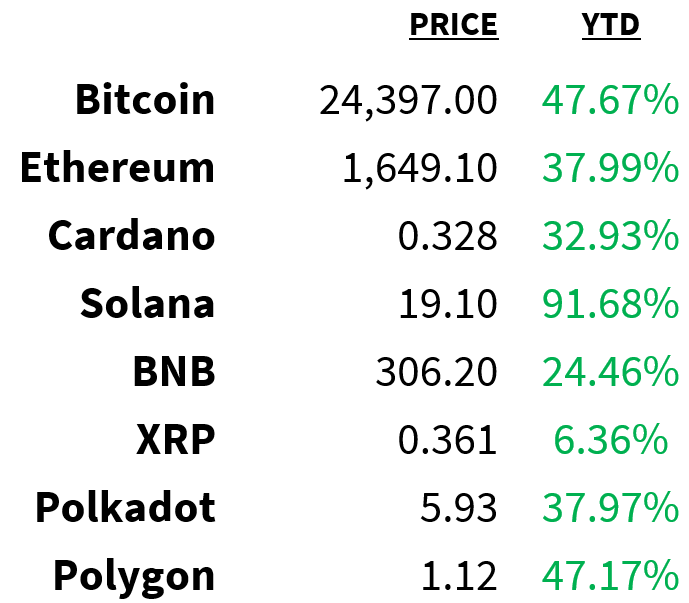

Crypto

Prices as of 4 pm EST, 3/15/23

-

$2.2 billion: That’s how much Sam Bankman-Fried paid himself from FTX to run the business (into the ground).

-

Laundering: US and German authorities have taken down ChipMixer–a crypto mixer like Tornado Cash–which is alleged to have facilitated the laundering of 152k Bitcoin.

-

Pause denied: A New York bankruptcy denied the government’s request to block a $1 billion deal between Binance.US and Voyager Digital.

-

Bitcoin funds: The number of coins held by Bitcoin BTC/USD funds–a widely used proxy for institutional activity–has fallen to a 17-month low.

Deals

-

New environment: Stripe raised $6.5 billion at a $50 billion valuation, which is a far cry from its peak of $95 billion in 2021.

-

Ryan Reynolds: T-Mobile is buying Mint Mobile (of which Reynolds is a significant shareholder) for $1.35 billion.

-

Metals: Brazilian mining giant Vale is exploring a spinoff or IPO of its metals unit after selling a 10% stake.

-

Locomotives: Regulators have greenlit Canadian Pacific Railway’s $27 billion acquisition of Kansas City Southern.

-

More CoD: After inking its third Call of Duty distribution deal yesterday, Microsoft has already added its fourth by reaching an agreement with Japanese cloud gaming provider Ubitus.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.