Warren Buffett has donated another $4.64 billion of Berkshire Hathaway stock to five charities. This boosts his total giving since 2006 to more than $51 billion.

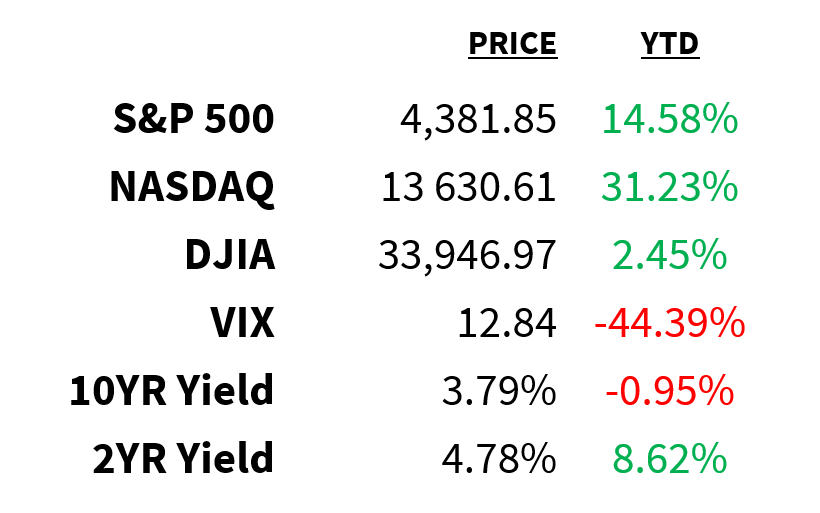

Market

Prices as of 4 pm EST, 6/22/23

Macro

New filings for unemployment benefits are hovering at the highest level since October 2021.

-

Initial jobless claims totaled 264,000 last week.

-

The figure was unchanged from the previous print but above market expectations of 260,000.

-

This points to a cooling labor market.

-

Continuing claims, on the other hand, dropped to 1.76 million from 1.77 million and suggest a tight market where laid-off workers are quickly finding new jobs.

Sales of existing US homes were flat in May, rising 0.2% from the previous month.

-

On an annual basis, sales posted their 21st consecutive decline, falling by over 20%.

-

The drop comes despite mortgage rates falling (slightly) for the 3rd consecutive week to 6.67%.

-

Median prices, meanwhile, experienced their largest annual drop since December 2011, falling by 3.1% in May to $396,100.

Even after May’s big drop, the median household would need to spend more than 40% of their income to afford today’s median-priced home.

-

Three years ago, that figure was just 28%.

-

Since the beginning of last year, the monthly mortgage payment for the average loan size has roughly doubled to nearly $3,000.

-

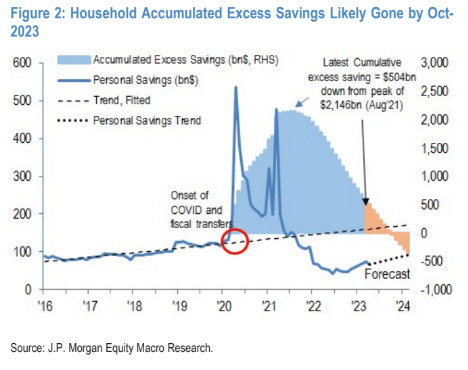

As households run down their excess savings, these payments will take a higher toll on the consumer and the housing market.

-

According to JPMorgan, those savings are likely to be drained before the end of the year:

JPMorgan

Stocks

The quality of new vehicles is getting worse, according to J.D. Power.

-

The firm’s latest Initial Quality Study revealed the number of problems per 100 vehicles increased by 12 to an average of 192.

-

Last year, the number of problems increased by 18.

-

Growing problems include advanced driver-assistance features as well as those related to other technologies like wireless charging pads.

-

EVs accounted for 7 of the top 10 worst autos, with Tesla ranking second-worst in vehicle quality.

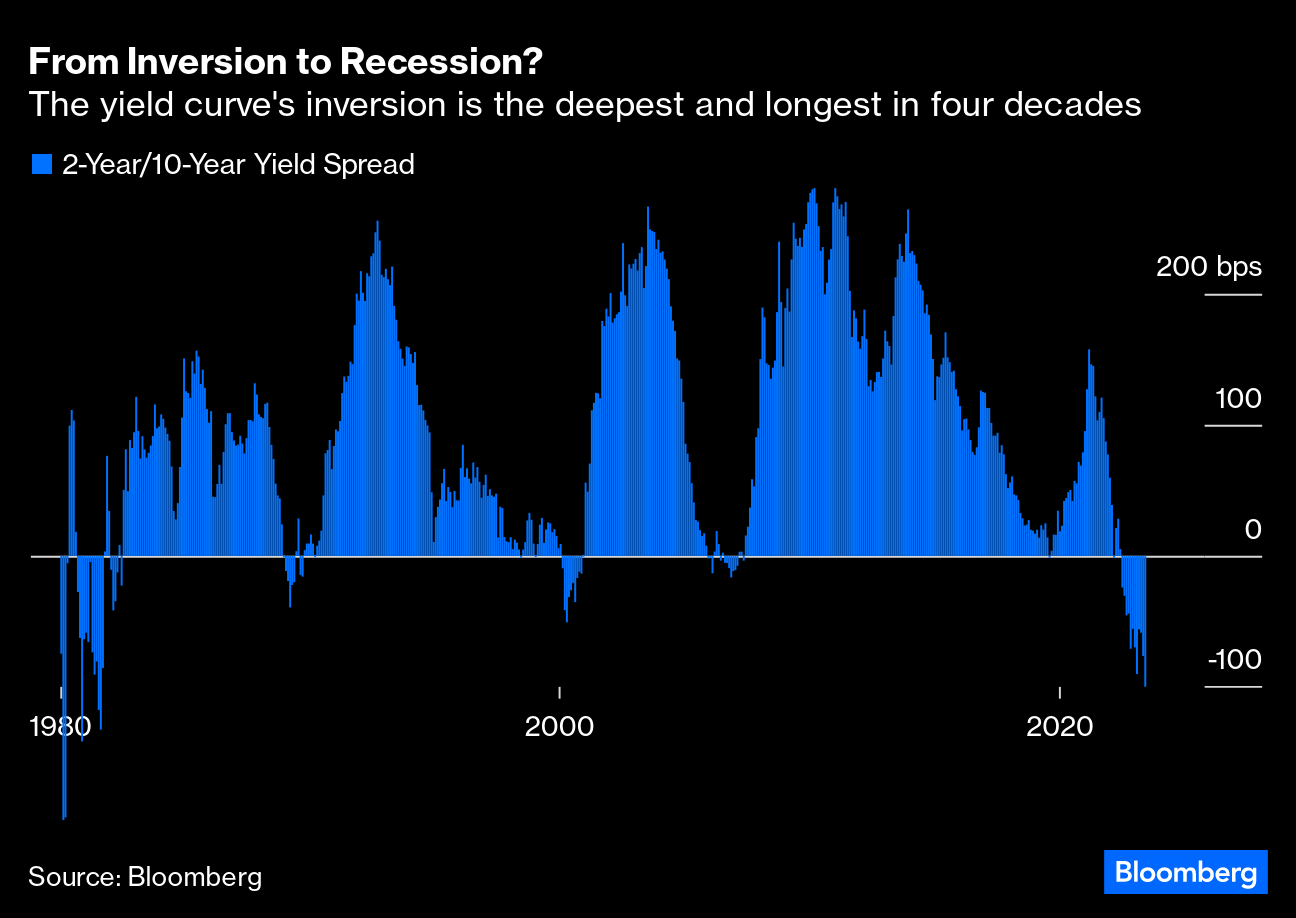

The stock market is saying one thing while the bond market is saying another.

-

The recent rally in equities suggests investors are brushing off the possibility of further rate increases, even as the Fed signals a higher-for-longer environment.

-

Bond investors, meanwhile, are increasingly betting that the Fed’s rate increases will drive the US into a recession with the inversion on the yield curve dropping beyond 100bps for the first time since March.

-

Both can’t be right.

John Authers

Energy

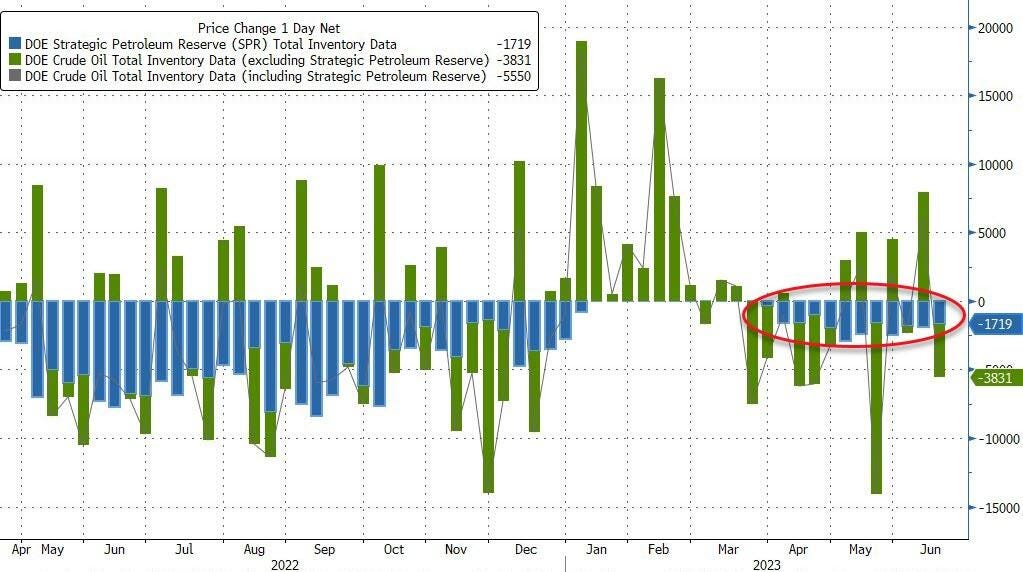

US inventories of crude oil posted a surprise draw last week.

-

The drop in stocks was fueled by strong export demand and lower imports.

-

Together with a 1.7 million drain of the Strategic Petroleum Reserves (the 12th straight draw), overall crude inventories fell by the most in 4 weeks.

-

Oil prices fell, however, with the threat of hawkish central banks outweighing the drop in inventories.

Bloomberg/Zero Hedge

Earnings

Yesterday’s highlights:

Darden Restaurants DRI: $2.58 EPS (vs. 2.54 expected), $2.77 billion in sales (in-line).

-

Net sales rose 6.4% YoY but were dragged down by lower-than-expected same-store sales for Olive Garden.

-

Forecasted for adjusted earnings for FY24 disappointed.

What we’re watching today:

-

Carmax KMX

Top Headlines

-

Office space: Office building values in the US are expected to fall by 35% and are unlikely to recover to their peak values until at least 2040.

-

AI regulation: Current AI models are at risk of violating draft EU rules to govern the technology.

-

AI investment: Amazon Web Services is investing $100 million in a generative AI center to keep up with Microsoft and Google.

-

AI jobs: Generative AI-based job postings in the US rose by 20% in May.

-

Record loan: Ford’s joint venture with Soth Korean battery maker SK On has secured a record $9.2 billion loan from the Department of Energy.

-

TikTok resignation: The social media platform’s COO of 5 years is stepping down to focus on “entrepreneurial passions”.

-

Global trade shift: For the first time in almost 20 years, the US imported more goods from South Korea than China did.

-

Recession risk: US Treasury Secretary Janet Yellen said yesterday she sees diminishing risk of a US recession.

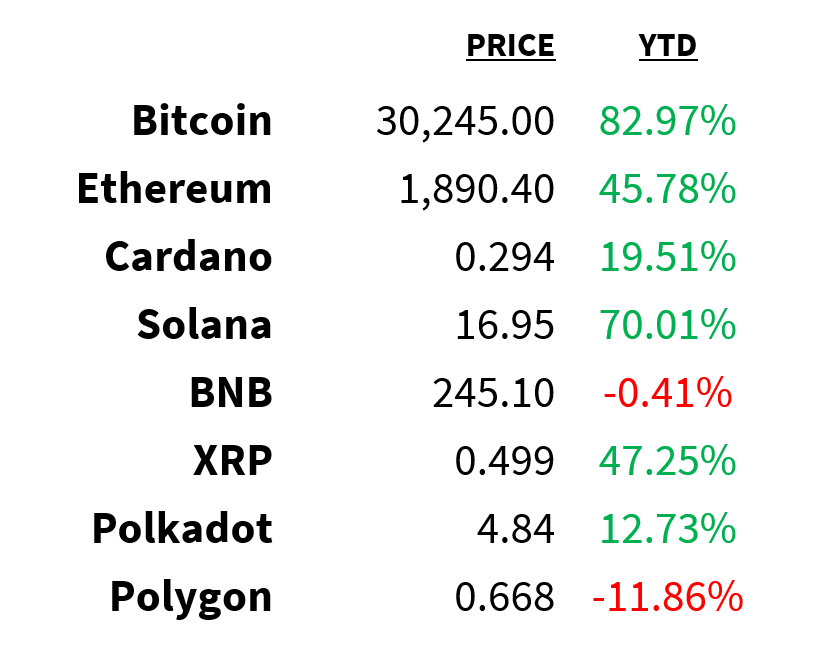

Crypto

Prices as of 4 pm EST, 6/22/23

-

Super-app: Coinbase CEO Brian Armstrong said he envisions the platform becoming a global “super-app”.

-

Deliberate action: Former CFTC Chair Chris Giancarlo said the agency’s move against Coinbase appears to have been “deliberate”.

-

Clawback: FTX is looking to claw back over $700 million from billionaires, celebrities, and politicians.

-

Relinquished: The SEC is postponing collection of a $30 million fine from BlockFi until investors are repaid.

-

Ethereum milestone: The number of staked ETH has more than doubled this year and now totals over $38 billion.

Deals

-

Retail auction: Overstock.com will buy Bed Bath & Beyond’s IP and digital assets for $21.5 million.

-

Smart home: Despite getting the green light from regulators in the UK, Amazon’s $1.6 billion iRobot deal is headed for an EU probe.

-

Gaming: In a court hearing, Microsoft portrayed Sony as the “complainer-in-chief” against its Activision acquisition.

-

Aviation: Bell helicopter and Cessna jet manufacturer Textron is looking to sell its +$1 billion fuel systems unit.

-

Media auction: Fortress Investment Group emerged as the winner for Vice Media with a $350 million bid.

Meme Of The Day

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.