Are we inching closer to the elusive “soft landing”? An increasing share of global fund managers sees it as the most likely outcome over the next 12 months:

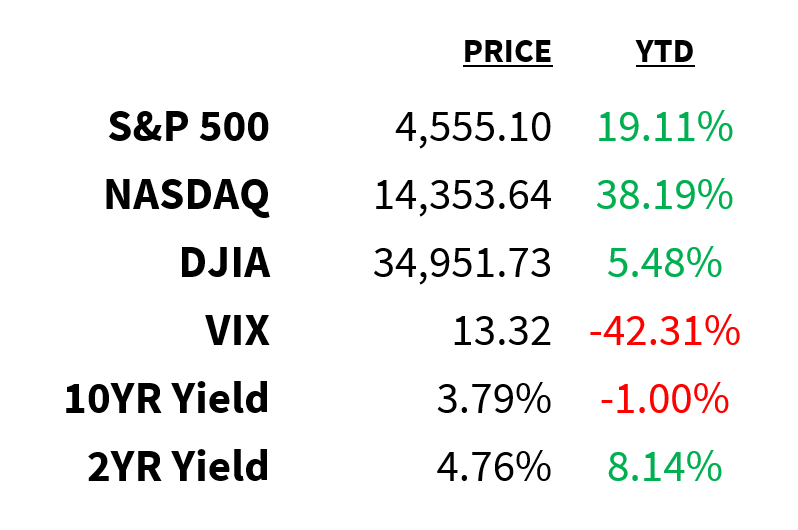

Market

Prices as of 4 pm EST, 7/18/23

Macro

Here are some highlights from BofA’s latest Global Fund Manager Survey:

-

Investors still expect global growth to weaken in the next 12 months.

-

But only 48% predict a recession by the end of Q1 2024.

-

In fact, most (68%) see a soft landing as the most likely outcome over the next year.

-

Sentiment, however, is still stubbornly low.

-

Investors expect the Fed’s first cut will come in Q2 2024.

June’s retail sales report revealed mixed signals about consumer strength.

-

Headline sales missed expectations, rising by 0.2% (vs. 0.5% expected) MoM to 1.5% YoY (vs. 1.6% expected).

-

On the other hand, spending on the core/control group–which excludes food, autos, gas, and building materials and is used to calculate GDP–jumped by 0.6%.

-

Overall, consumer spending softened but flashed resilience in June amid higher prices and borrowing costs.

Homebuilder confidence rose for the 7th consecutive month in July.

-

The NAHB Housing Market Index is at its highest since June 2022.

-

With record-low inventories boosting demand, why wouldn’t it be?

-

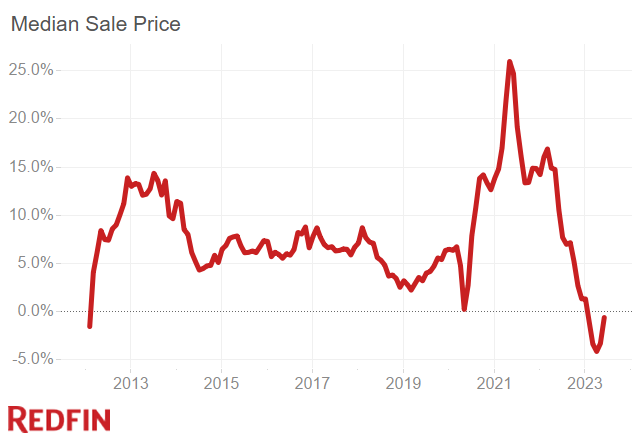

According to Redfin, the total number of homes for sale dropped 15% YoY in June to an all-time low (chart).

-

At the same time, home prices may have bottomed: June’s median sale price decline was the smallest of the past 5 months (chart) and homes are beginning to sell above their list prices.

Redfin

Stocks

Microsoft MSFT shares reached fresh all-time highs after the company announced new generative AI subscriptions for Microsoft 365.

-

The (not cheap) $30-a-month add-on includes AI tools that work with Teams, Word, and Excel.

-

Separately, Microsoft also announced a new partnership with Meta META.

-

As Meta’s preferred partner for Llama 2, Microsoft will make the AI language model software available (for a price) to its Azure customers.

Let’s turn back up on BofA’s Global Fund Manager Survey for some more insights:

-

There’s a massive divergence in sentiment between institutional and retail investors (chart).

-

Equity allocation increased in July but remains net 24% underweight.

-

Bond allocation has been overweight in 7 of the last 8 months and remained so in July despite ticking down.

-

Investors are the most underweight commodities since May 2020.

-

Over the last month, they rotated out of healthcare, Japan, bonds, and tech, and into the US, insurance, staples, EM, and equities.

-

Global profit expectations are the most optimistic since February 2022.

Bank of America

Energy

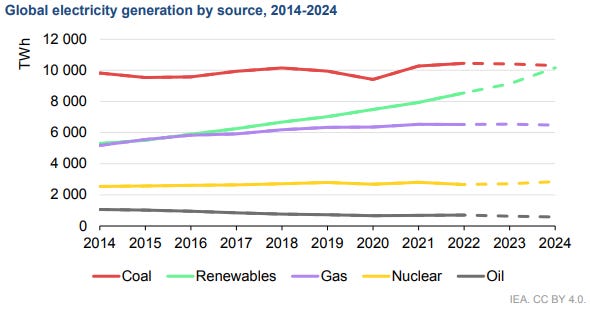

According to a new International Energy Agency (IEA) report, global power demand is poised to grow just under 2% this year.

-

That’s below the 5-year pre-pandemic average of 2.4%.

-

In 2024, however, growth is expected to jump to 3.3% as global economies rebound.

-

The agency predicts that next year—for the first time ever—renewable sources will account for more than 1/3 of the total global power supply:

IEA

Earnings

Yesterday’s highlights:

Bank of America BAC: $0.88 EPS (vs. $0.84 expected), $25.33 billion in sales (vs. $25.05B expected).

-

A 14% jump in net interest income (in-line) drove an 11% gain in total revenue.

-

The bank expects net interest income to expand by 8% for the year.

“We continue to see a healthy U.S. economy that is growing at a slower pace, with a resilient job market.”

- CEO Brian Moynihan

Morgan Stanley MS: $1.24 EPS (vs. $1.15 expected), $13.46 billion in sales (vs. $13.08B expected).

-

The bank’s wealth management business posted record revenue, beating estimates with 16% growth fueled by higher interest income.

-

As with others across the industry, its investment banking division disappointed.

“While we may not be quite at the end of rate increases, I believe we are very, very close to it.”

- CEO James Gorman

What we’re watching today:

-

Tesla TSLA

-

ASML Holding N.V. ASML

-

Netflix NFLX

-

International Business Machines IBM

-

Goldman Sachs GS

-

Elevance Health ELV

-

US Bancorp USB

-

Crown Castle CCI

-

Las Vegas Sands LVS

-

Kinder Morgan KMI

-

Baker Hughes BKR

-

Halliburton HAL

-

Discover Financial DFS

-

Equifax EFX

-

Nasdaq NDAQ

-

M&T Bank MTB

-

Steel Dynamics STLD

-

United Airlines UAL

-

Northern Trust NTRS

-

Citizens Financial CFG

-

Rexford Industrial Realty REXR

-

First Horizon FHN

Top Headlines

-

UK CPI: Inflation in the UK fell more than expected in June, dropping to 7.9%.

-

Stock ban: Two Senators will introduce legislation banning federal executive branch members and lawmakers from owning single stocks.

-

Regional banks: Slowing credit growth and deteriorating credit conditions are in the outlook for US regional banks, according to Apollo.

-

USD weakness: SocGen expects the USD will return to its December 2020 lows.

-

Slowing returns: Bernstein strategists predict US equities will show an annualized total return of 4% over the next decade.

-

Teamsters strike: The Teamsters union is threatening to strike against trucking company Yellow.

-

Pharma suit: Johnson & Johnson joins Merck, Bristol Meyers, and others in suing the US government over the new drug price controls law.

-

PSA: Jim Cramer does not see a recession on the horizon.

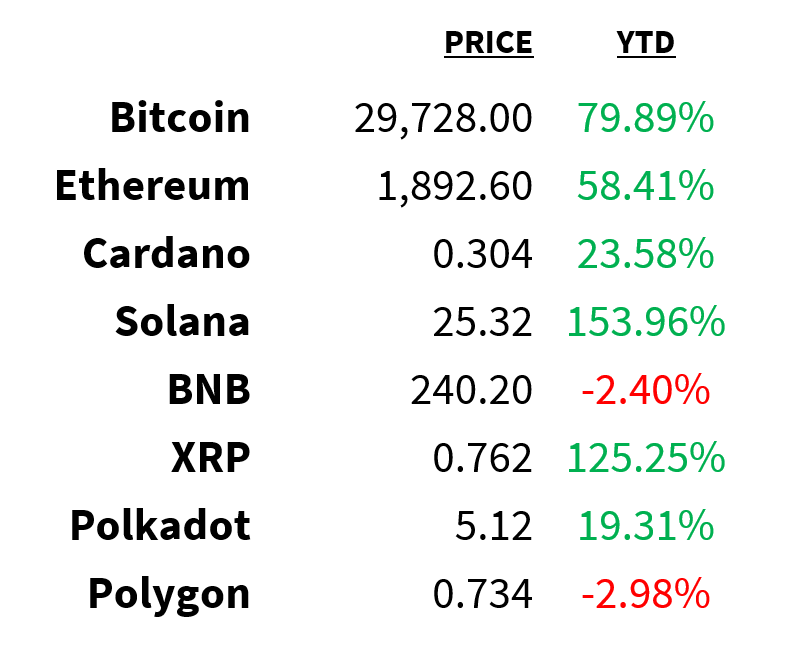

Crypto

Prices as of 4 pm EST, 7/18/23

-

XRP demand: Open interest in XRP futures hit a new YTD record high after climbing above $1.1 billion.

-

Polygon 2.0 roadmap: Polygon MATIC/USD will create a new governance framework aimed at decentralizing control.

-

Crypto flows: Inflows into digital asset investment products over the last 4 weeks were the highest since Q4 2021.

-

French license: SG Force, a Societe Generale division, is the first company to receive a crypto license in France.

-

Crypto nominee: Presidential hopeful RFK Jr. says he would exempt Bitcoin BTC/USD profits from capital gains tax.

Deals

-

Merger rules: The Biden administration is proposing tougher antitrust merger guidelines aimed at private equity and tech.

-

UK OK: Broadcom’s $69 billion acquisition of VMWare has received provisional clearance in the UK.

-

Crowdfunding nightmare: Investors who contributed $63 million for real estate deals through CrowdStreet have watched their funds disappear.

-

Beauty IPO: Oddity Tech raised $424 million in its IPO after pricing shares above the marketed range.

-

PE admin: Private equity firm THL will acquire a majority stake in Standish Management for ~$1.6 billion.

Meme Of The Day

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.