Zinger Key Points

- Institutional investors shift focus to Bitcoin, holding 50% of assets, amid positive market sentiment and regulatory developments.

- Altcoin interest dwindles among institutions, with holdings consistently declining and only showing a brief uptick in May.

- Get access to your new suite of high-powered trading tools, including real-time stock ratings, insider trades, and government trading signals.

Institutional investors are wary of altcoins and prefer holding Bitcoin BTC/USD and Ethereum ETH/USD.

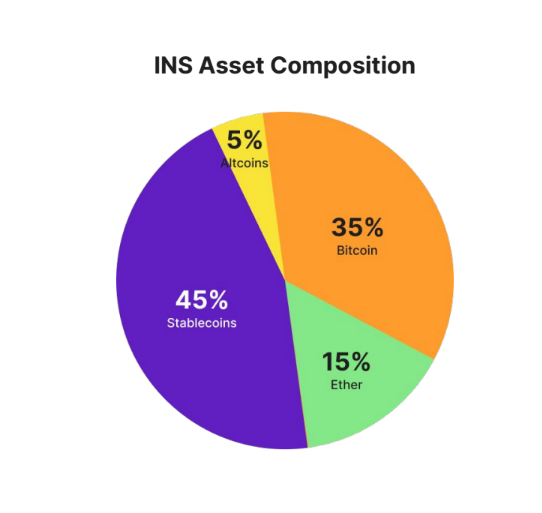

According to crypto exchange Bybit, Institutional Investors (INS) increased their Bitcoin holdings during the first three quarters of 2023.

In September alone, a staggering 50% of INS's asset portfolio was allocated to Bitcoin.

This shift aligns with the positive market sentiment towards Bitcoin, spurred by favorable lawsuit outcomes and the anticipation of the SEC's potential approval of a spot BTC ETF. It also sharply contrasts with the asset allocation strategies of other traders, particularly retail investors.

Ether ETH/USD, meanwhile, has seen a decline in interest since the Shapella update earlier this year.

Despite a stable price post-update, Ether holdings have consistently fallen across most trader categories.

However, an unusual surge in Ether holdings was noted among INS traders from September, possibly reflecting a broader optimistic sentiment towards cryptocurrencies.

Stablecoins: The report also sheds light on the stablecoin holding patterns of different trader categories. Retail traders have consistently shown a higher percentage of stablecoin holdings, influenced by their leverage practices.

In contrast, institutional investors have demonstrated a strategic deployment of their stablecoin reserves into Bitcoin and Ether, particularly noticeable in September.

This trend suggests a growing confidence among institutional players in the market's positive trajectory.

Caution: Institutional-investor interest in altcoins has generally been subdued.

Both normal users and VIPs initially increased their holdings in other tokens during the first half of the year, but this trend reversed in the latter months, dropping to levels even lower than those recorded in December.

In light of these shifting trends and the overall downbeat market sentiment, Bybit's research underscores the importance of optimized asset allocation strategies.

Read Next: Binance Tips Off 'VIP' Traders About $4B Settlement With The US Government: Report

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.