Robinhood Markets, Inc. HOOD has announced a significant milestone in its expansion strategy by entering into an agreement to acquire Bitstamp Ltd., a globally recognized cryptocurrency exchange. The acquisition, valued at approximately $200 million in cash, is set to close in the first half of 2025. It is still subject to regulatory approvals and customary closing conditions.

Founded in 2011, Bitstamp operates in multiple regions, including Luxembourg, the U.K., Slovenia, Singapore and the United States, and holds more than 50 active licenses and registrations globally.

Shares of HOOD have gained 6.5% in response to the announcement.

Accelerating Global Expansion

The acquisition of Bitstamp will propel Robinhood's cryptocurrency division, Robinhood Crypto, into new international markets. Bitstamp's extensive regulatory compliance and global footprint will enable Robinhood to swiftly expand its presence across the EU, the U.K., the United States and Asia.

This strategic move aligns with Robinhood's broader goal to become a comprehensive financial services provider by leveraging Bitstamp's established market position and regulatory approvals.

In March, HOOD launched its trading app in the U.K. Using the Robinhood app, all U.K. customers can access more than 6,000 global companies listed on the U.S. markets. The trading platform offers a wide range of services to U.K. customers, including a 5% interest on uninvested cash, trading outside of market hours, zero trading commission and no foreign exchange fees on trades.

Hence, the deal to acquire Bitstamp is part of its global expansion initiatives.

Entering the Institutional Market

A key highlight of the deal is Robinhood's foray into the institutional market. Bitstamp's reputation for reliable trade execution, deep order books, and industry-leading API connectivity makes it a trusted platform among institutional clients.

By incorporating Bitstamp's services, such as institutional lending, staking and white-label solutions like Bitstamp-as-a-service, Robinhood will enter the institutional space with robust infrastructure and established relationships.

Bitstamp also undergoes regular audits by a global Big Four accounting firm.

Enhancing Competitive Edge

With this impending acquisition, Robinhood positions itself to compete directly with major crypto exchanges like Binance and Coinbase Global, Inc. COIN. Bitstamp's core spot exchange, which features more than 85 tradable assets, coupled with its popularity in Europe and Asia, will significantly enhance Robinhood's crypto offerings.

The deal not only boosts Robinhood's market share but also diversifies its product portfolio, making it more attractive to a broader range of customers.

Expansion & Regulatory Hurdles

Robinhood's push into the global crypto market comes amid ongoing regulatory challenges in the United States. In May, the company received a Wells notice from the U.S. Securities and Exchange Commission ("SEC") concerning the tokens traded on its platform, reflecting the complex regulatory landscape for crypto firms.

The notice came as a result of the violation of registrations as a securities broker and transfer agent. Dan Gallagher, Robinhood's chief legal, compliance and corporate affairs office, said, "We firmly believe that the assets listed on our platform are not securities and we look forward to engaging with the SEC to make clear just how weak any case against Robinhood Crypto would be on both the facts and the law."

Likewise, the SEC had filed a lawsuit against Coinbase in June 2023 on the allegations of operating an unregistered exchange by allowing the sale of certain crypto tokens the agency considers to be investment securities and, hence, part of the SEC's jurisdiction.

Despite these hurdles, Robinhood is committed to maintaining open communication with regulators as it navigates this expansion.

Supporting Top-Line Growth

Cryptocurrency transactions have been a significant driver of Robinhood's financial performance, contributing to a massive first-quarter 2024 earnings beat. Transaction-based revenues related to cryptocurrencies surged 232% year over year to $126 million.

The integration of Bitstamp is expected to further bolster Robinhood's top-line growth by enhancing its crypto trading volume and attracting more institutional clients. This deal underscores Robinhood's belief in the transformative potential of cryptocurrency in reorganizing the financial system.

By leveraging Bitstamp's extensive regulatory compliance, robust infrastructure and established client relationships, Robinhood is well-positioned to enhance its service offerings and maintain its growth trajectory. As cryptocurrency continues to gain traction, this deal will further solidify the company's financial standing and market influence, enabling it to thrive in an increasingly competitive landscape.

Last year, Robinhood acquired X1 Inc., a platform that offers a no-fee credit card with rewards on each purchase. The acquisition, valued at approximately $95 million in cash, expanded its product offerings beyond trading and helped diversify its revenue streams. Further, this March, the company unveiled its first-ever credit card.

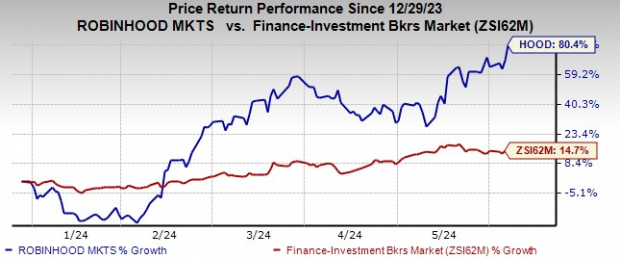

Shares of this Zacks Rank #2 (Buy) company have jumped 80.4% this year, significantly outperforming the industry's growth of 14.7%.

Image Source: Zacks Investment Research

A stock from the same space worth mentioning is Piper Sandler PIPR.

PIPR's earnings estimates for 2024 have been revised 5.8% upward in the past two months. The company's shares have rallied 25.6% over the past six months. At present, Piper Sandler sports a Zacks Rank of 1 (Strong Buy).

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.