Zinger Key Points

- NYCB top execs buy stock to boost confidence: shares up 7%

- Private equity buying distressed commercial property assets

- Markets are swinging wildly, but for Matt Maley, it's just another opportunity to trade. His clear, simple trade alerts have helped members lock in gains as high as 100% and 450%. Now, you can get his next trade signal—completely free.

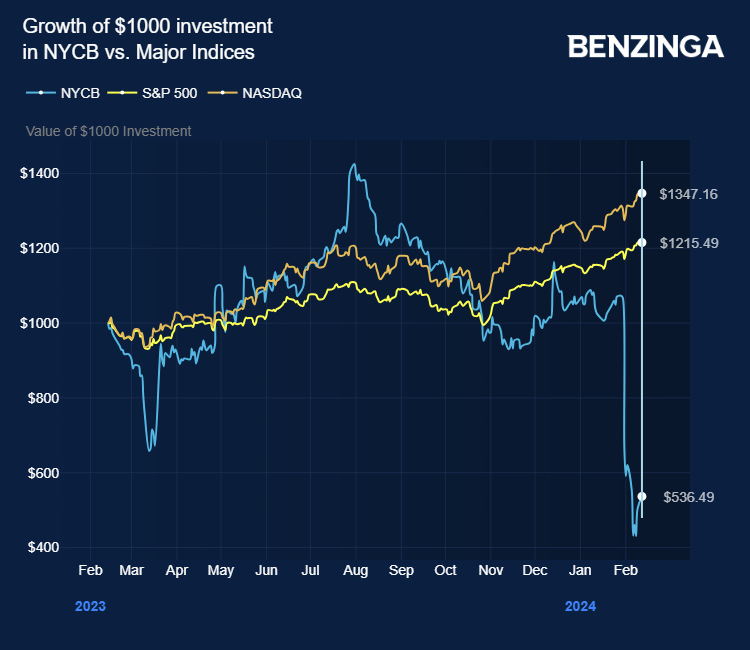

New York Community Bancorp NYCB shares climbed on Monday after executives said they were buying stock.

What Happened: NYCB is enjoying some respite as shares rallied 7% Monday, adding to gains notched up on Friday when company executives disclosed they had bought stock in the bank.

Regulatory filings with the U.S. Securities and Exchange Commission indicated they had purchased around $850,000 of stock.

Last week, NYCB shares tumbled 38% as the lender’s exposure to the sector forced it to increase its reserves. The development underscored stresses in the commercial real estate (CRE) market.

The company also said it was looking into some of its loans in its CRE portfolio.

Overall, the banking industry holds around $2.7 trillion in commercial property debt. With interest rates still at decades highs, it’s becoming more difficult for owners and developers to service.

“Already in play is nearly US$900 billion in loans set to mature over the next two years in the United States,” said Jeffrey Smith, lead analyst on Deloitte’s 2024 commercial real estate outlook.

He added: “These mortgage maturities could also face difficulties in refinancing in the current lending environment of high borrowing costs and risk-averse lenders.”

Also Read: New York Community Bancorp Plummets To 26-Year Lows On Commercial Real Estate Fears

Why It Matters: The turmoil within CRE may have longer to play out. Last week, Federal Reserve governor Adriana Kugler said the central bank was keeping an eye on the sector as a source of potential financial stress.

Alternative investment firms, however, are unfazed. They’re now buying up distressed CRE assets, or offering property developers and owners loans as banks mitigate risk.

Ares Management ARES, for example, announced in December that it had raised $3.3 billion of real estate secondaries capital. The firm “seeks to acquire seasoned assets at attractive discounts to market value to build highly diversified portfolios for its investors.”

By the second quarter of 2023, global real estate funds operated by private equity companies had amassed $544 billion in cash to deploy — a record level, according to The Wall Street Journal, citing data from Preqin.

Regional Banks Exposed

Regional banks are more exposed to CRE sector than the majors. After all, they have smaller balance sheets. Also, the potential collapse of one could trigger depositors to make runs on others causing a domino effect.

However, NYCB maintained it was well enough capitalized to withstand stresses in the property sector.

Investors have been wary of the sector so far in 2024. The SPDR S&P Regional Banking ETF KRE, an exchange trade fund which tracks the sub sector on the S&P 500, is down nearly 7% since the start of the year.

Its largest holdings, Citizens Financial Group CFG, Truist Financial Corp TFC and Regions Financial Corp RF are all down so far this year.

Now Read: ‘The Greatest Real Estate Crisis Since The Financial Crisis’

Image: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.