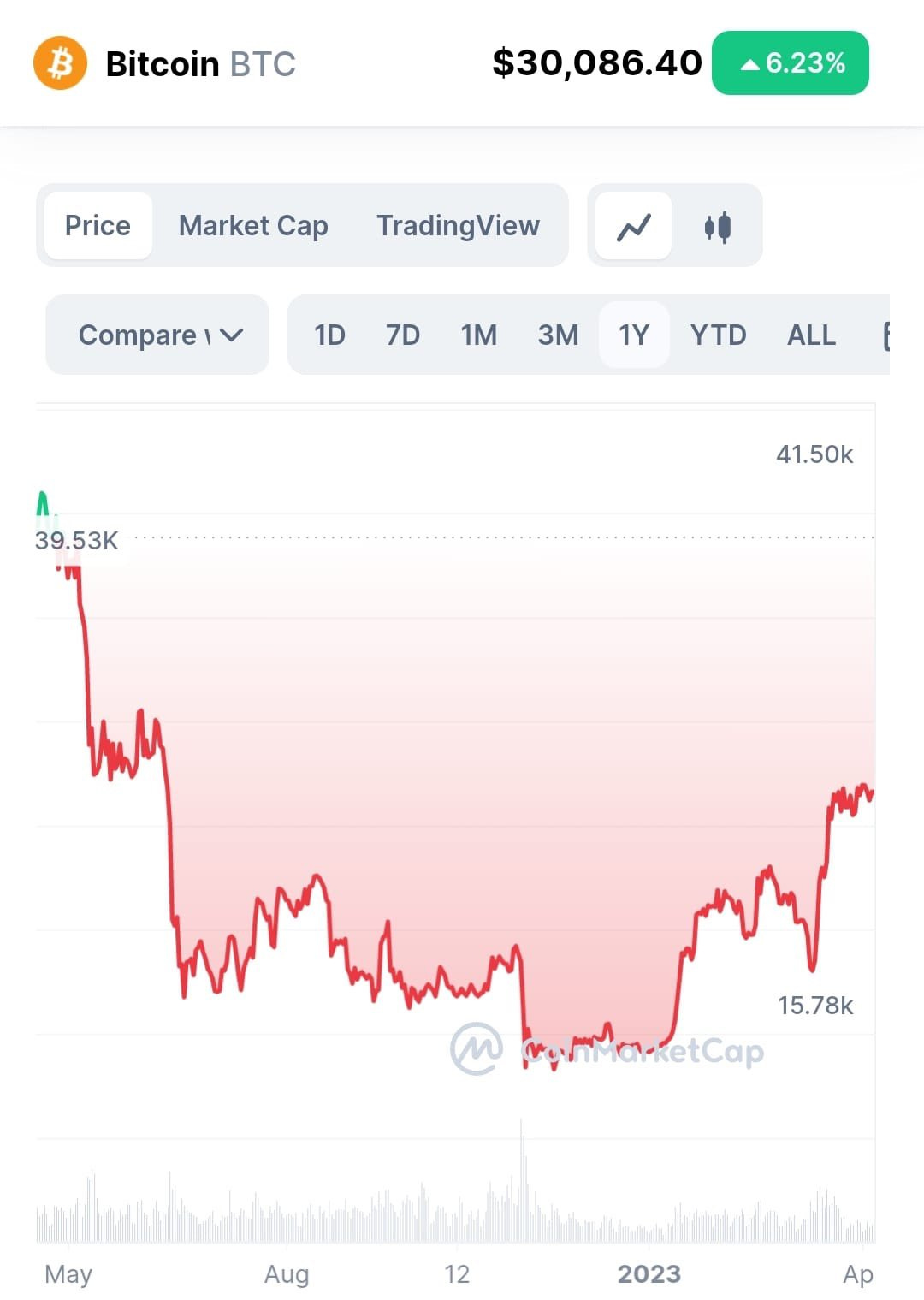

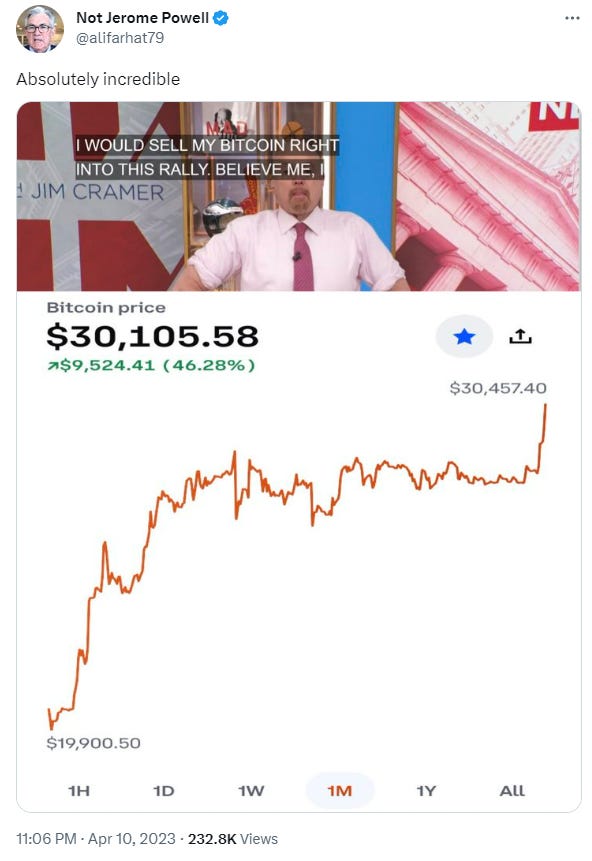

Bitcoin BTC/USD just hit $30,000 for the first time since last June.

Is nature healing?

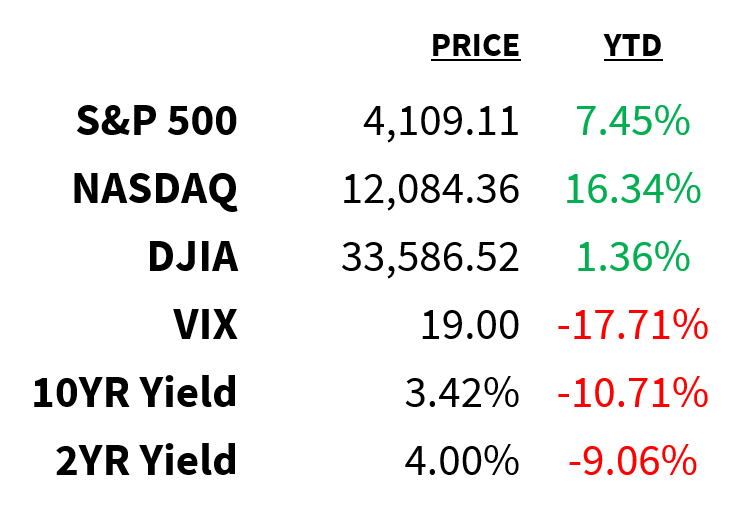

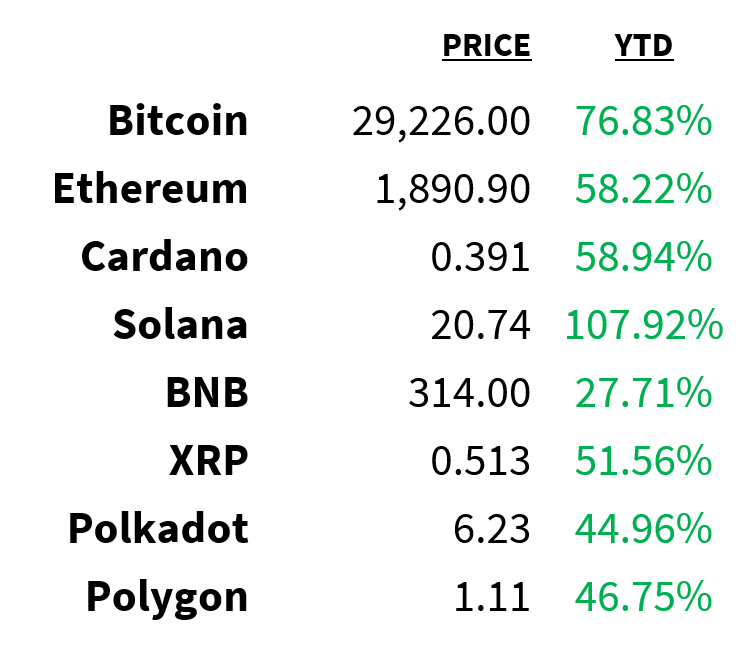

Market

Prices as of 4 pm EST, 4/10/23

Macro

-

China is planning to increase spending on major construction projects by 17% (or +$1.8 trillion) this year. With a focus on infrastructure like transport, energy generation, and industrial parks, the investments will look to further boost an economic recovery led by a rebound in consumer spending following years of pandemic-related (Zero Covid) restrictions.

-

NY Fed President John Williams doesn’t think the central bank’s aggressive monetary policy was behind the issues that led to the demise of March’s bank failures. He also dismissed concerns over the market’s anticipated slowdown in interest rates, noting that participants are just “trying to follow the data”.

-

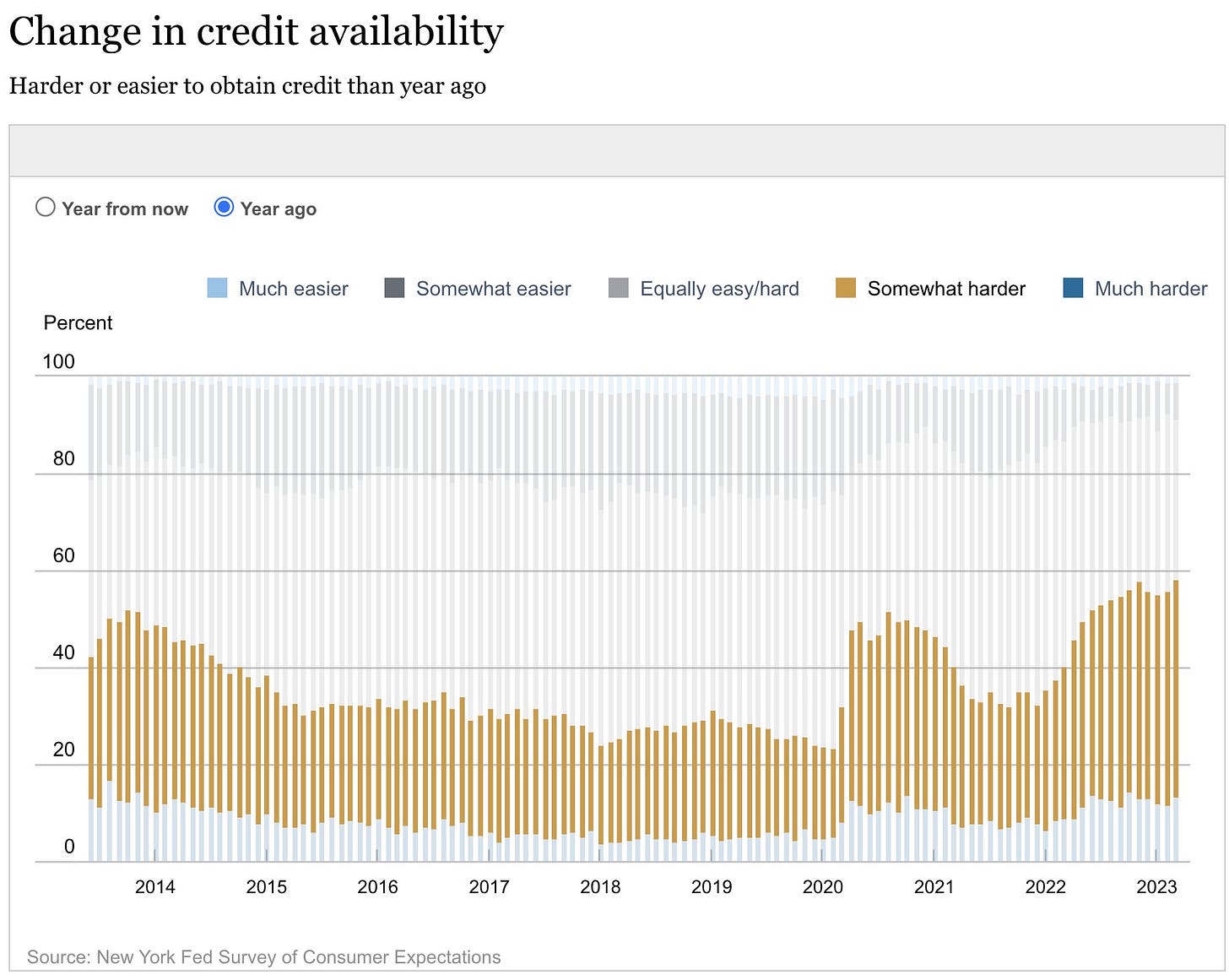

Consumers’ expectations for one-year inflation rose for the first time since October with respondents to a NY Fed survey predicting prices will increase by 4.75%. Meanwhile, the share of households reporting it’s ‘somewhat harder’ to obtain credit moved up to 58.2%, the highest ever in data going back to 2013.

NY Fed

Stocks

-

Chinese regulators proposed new rules for the AI chatbot sector, which caused shares of companies like Baidu and SenseTime to drop. The Cyberspace Administration of China (CAC) has requested feedback on the new guidelines which come after warnings from state media over speculation in stocks linked to the technology.

-

Hedge fund billionaire Paul Singer is warning of “bubble securities” and “bubble asset classes”. The so-called Doomsday Investor thinks overleverage and overvaluations combined with a looming recession will lead to a lengthy period of low returns.

-

Net short positions in S&P e-mini futures among hedge funds hit their most bearish level since November 2011 last week. And tech stocks are in focus. According to Goldman Sachs, notional long selling in the sector was the largest since January 2022 and ranks in the 97th percentile compared to the last 5 years.

Bloomberg

Energy

-

Yesterday, we noted retail investor outflows from oil-related exchange-traded products. Money managers, on the other hand, piled into Brent crude at the fastest clip since 2016 in the week ending April 4.

-

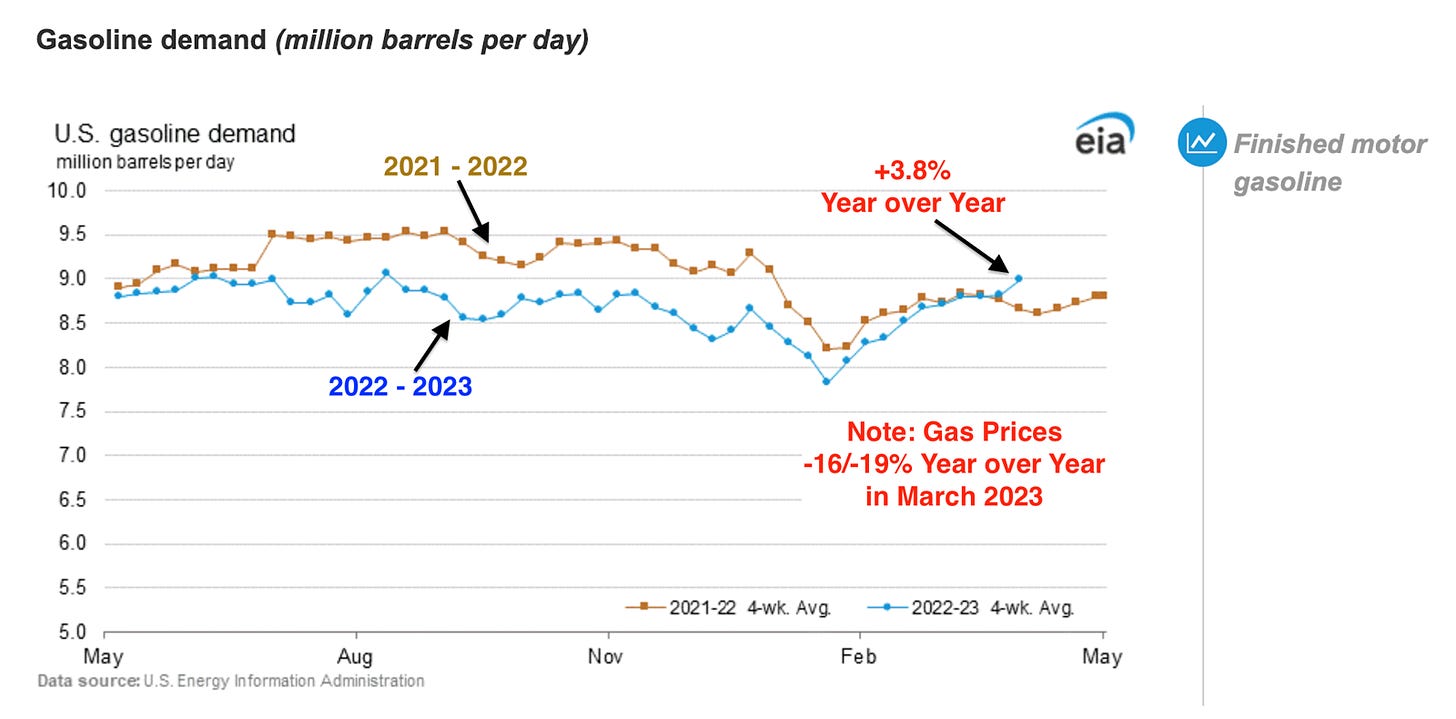

Prices for commodities that power homes and fuel cars have come down in recent months, even as crude enjoys its longest streak of weekly gains (3) all year. The drop in prices has driven gasoline demand higher on a year-over-year basis for the first time in nearly a year.

EIA/Data Trek Research

Earnings

-

Albertsons ACI

-

Carmax KMX

-

Uxin Limited UXIN

News

-

Congress trades: Two US lawmakers made trades in bank stocks last month even as they worked on government efforts to address the sector’s turmoil.

-

Crisis subduing: In an early sign that bank troubles are easing, the Federal Home Loan Bank system issued significantly less debt in the last week of March.

-

Diesel: Prices for retail diesel have dropped below the level they were at when Russia invaded Ukraine.

-

PC shipments: A 40.5% year-over-year decline in Apple’s worldwide computer shipments in Q1 dropped its global market share to 7.2% from 8.6%.

-

Bank deposits: Despite gaining new customers following the collapse of Silicon Valley Bank, the country’s “Big Four” lenders are expected to report a deposit flight of nearly $100 million in Q1.

Crypto

Prices as of 4 pm EST, 4/10/23

-

BTC 30k: Now up over 80% YTD, Bitcoin rose above $30,000 for the first time since June 2022.

-

Winkelvi: After failing to secure funding from external investors, the Winklevoss twins have loaned $100 million to their crypto exchange, Gemini GMNI/USD.

-

Fund flows: Net flows for digital asset investment products entered positive territory for the year after funds saw inflows of $57 million last week.

-

The SHIB: Shiba Inu SHIB/USD developers plan to partially open SHIB: The Metaverse by the end of 2023.

-

MSTR: Between March 24 and April 4, Michael Saylor’s MicroStrategy purchased ~$29 million worth of Bitcoin, taking its total holdings to around $4.17 billion.

Deals

-

Communications: KKR will buy a 30% stake in financial communications group FGS Global in a deal that values the company at ~$1.4 billion.

-

Wound up: Europe’s largest SPAC, Pegasus Europe, will be wound up after failing to find a suitable target in the financial services sector.

-

Data centres: Brookfield Infrastructure has agreed to acquire French data centre firm Data4 from AXA IM for an undisclosed amount.

-

Mining: Newmont Corp has sweetened its bid for Newcrest Mining to $19.5 billion in a deal that would create the world’s largest gold miner.

-

Corporate raiders: With 83 campaigns launched globally, active investors had their busiest quarter ever in Q1.

Meme Of The Day

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.