Home sales in March fell 21% year-over-year. The market is trapped by low inventory because of low mortgages.

No one wants to make a move.

Market

Prices as of 4 pm EST, 4/20/23

Macro

In sharp contrast with this week’s Empire State Manufacturing Index, the Philadelphia Fed’s gauge of regional business activity dropped more than expected in April.

-

The index posted its eighth consecutive reading below zero—indicating a contraction—and its tenth in the past 11 months.

-

Subindexes for new orders are shipments both improved from the previous month but remain in contraction.

-

Prices paid by firms declined for the second straight month while prices received turned negative for the first time since May 2020.

Weekly initial jobless claims rose by 5,000 to 245,000—the highest since November 2021—pointing to a modest softening in the labor market.

-

It was the fifth time in 7 weeks that initial claims have been above 240,000.

-

Continuing claims rose to 22% above their levels from a year ago, above the 20% threshold that has historically marked a recession.

Sales of existing homes in the US fell more than expected in March, dropping 2.4%.

-

It was the 13th decline in sales in the last 14 months.

-

The median selling price for those homes fell by 0.9% from a year earlier to $375,000, marking the biggest drop since January 2012.

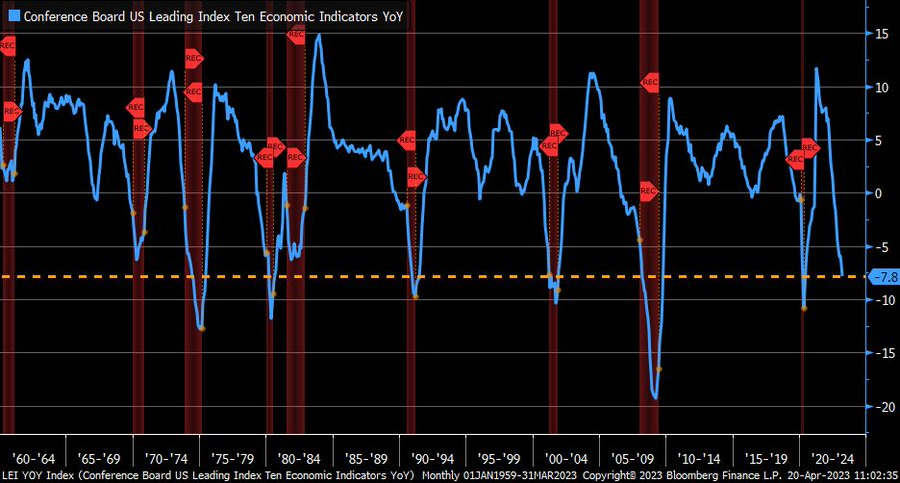

Meanwhile, the Conference Board’s Leading Economic Indicator (LEI) continues to point to a recession ahead.

-

The LEI dropped 1.2% in March to its lowest level since November 2020.

-

On a YoY basis, the index fell 7.8%, a level not seen even during the recessions of the early 70s and early 80s.

@lizannsonders

Stocks

After marking down the price tag for some of its vehicles, Tesla TSLA watched profits compress in Q1.

-

Now, the company is reversing some of those cuts and increasing the price of its Model S and X cars.

-

The models are still cheaper than they were at the end of the first quarter, however.

-

Separately, Ford CEO Jim Farley likened Tesla’s price reduction strategy to that of Henry Ford’s for the Model T, saying the moves could start a price war in the EV market.

BuzzFeed is shutting down its award-winning (wtf?) news division and slashing 15% of its workforce.

-

The digital media group will instead focus on profitable parts of its operations like HuffPost.

-

The company isn’t alone: Vice Media has been trying to unload Vice World News for months, while Insider, Vox Media, and Dow Jones have all laid off staff this year.

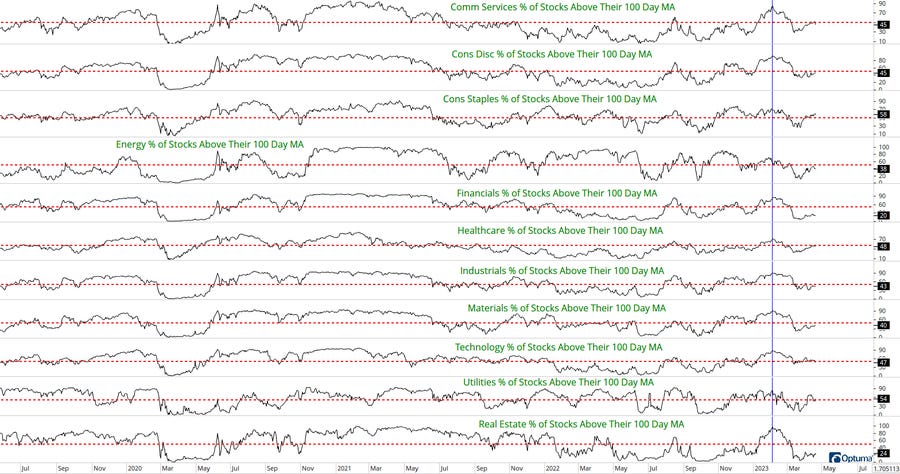

Relative to the Nasdaq, stocks in the S&P 500 are seeing stronger short-term breadth.

-

Close to 80% of the latter’s large caps are above their 20-day moving average as compared to 55% for the former.

-

On the other hand—with the exception of staples—100-day moving average breadth for all sectors is well below levels seen in February.

@the_chart_life

Energy

Gaps were made to be filled.

-

Oil prices are sitting just above the level they were at when OPEC+ shocked markets with surprise production cuts.

-

Driving the losses are economic uncertainty and fears of a recession which would weigh on demand.

Bloomberg

Earnings

Here are some of yesterday’s highlights:

-

American Express AXP: $2.40 EPS (vs. $2.66 expected), $14.28 billion in sales (vs. $13.98B expected).

-

Despite record quarterly revenue, Amex missed on earnings as it prepares for potential customer defaults in a weakening economy.

-

-

AT&T T: $0.60 EPS (vs. $0.59 expected), $30.14 billion in sales (vs. $30.27B expected).

-

The stock closed down more than 10% as subscriber growth failed to offset a miss on revenue.

-

-

DR Horton DHI: $2.73 EPS (vs. $1.93 expected), $7.97 billion in sales (vs. $6.45B expected).

-

Shares rose by more than 5% as concerns about limited supply and affordability weren’t enough to discourage investors.

-

What we’re watching today:

-

Procter & Gamble PG

-

SAP SE SAP

-

HCA Healthcare HCA

-

Schlumberger SLB

-

Freeport-McMoRan FCX

-

Regions Financial RF

Top Headlines

-

Loophole: The Fed is considering closing an exemption that allows some midsize banks to mask losses on securities they hold.

-

Labor talk: Fewer and fewer companies are talking about labor shortages.

-

Checkmarks: Twitter has stripped legacy accounts of their blue checkmark status.

-

Friendly fire: A Russian fighter jet accidentally dropped a bomb on Belgorod–a Russian city.

-

Starship: Minutes after liftoff, SpaceX’s Starship rocket exploded mid-flight due to an engine failure.

-

AI race: Alphabet will try to gain ground on Microsoft and OpenAI by merging its DeepMind and Google Brain AI research units.

-

US-China: Janet Yellen says any efforts to decouple the US economy from China would be “disastrous”.

-

Hiring plans: Following its latest round of layoffs, Mark Zuckerberg says Meta will slow down hiring.

Crypto

Prices as of 4 pm EST, 4/21/23

-

USDT: Tether USDT/USD increased its stablecoin market dominance by minting one billion USDT tokens on the Ethereum network last night.

-

Offshoring: Gemini became the second major US crypto exchange (after Coinbase) to announce plans to expand abroad.

-

MiCA: The EU Parliament voted yesterday to approve the long-awaited Markets in Crypto Assets Regulation.

-

ETH supply: Ethereum’s ETH/USD supply of native coins has been reduced by 100,000 since The Merge.

-

Web3 VC: Venture capital funding for web3 startups dropped 82% YoY to its lowest since Q4 2020.

Deals

-

Battery tech: China’s U Power saw shares surge 620% in the biggest US IPO pop of the year.

-

Fast food: Carlyle is looking for fresh backers for its investment in McDondald’s China operations.

-

Infrastructure: Saudi Telecom will buy a portfolio of tower assets from United Group for $1.3 billion.

-

MLB: The Oakland A’s plan to become the first MLB team to relocate since 2005 after acquiring land for a new stadium in Las Vegas

-

Tokyo IPO: Rakuten Bank becomes Japan’s biggest IPO since 2018 after a 38% surge in its debut.

Meme Of The Day

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.