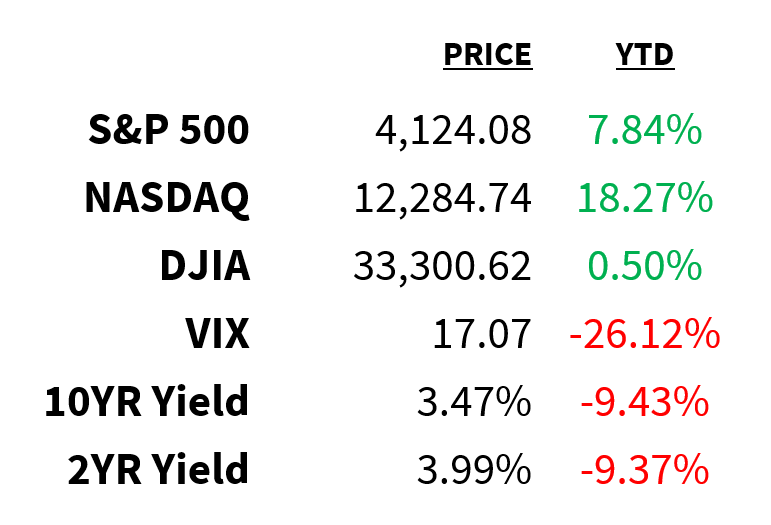

Market

Prices as of 4 pm EST, 5/12/23

Macro

The Group of Seven summit takes place this week in Japan.

-

The US and its allies are expected to issue a joint statement rejecting China's use of economic retaliation in policy disputes.

-

While China likely won’t be mentioned by name, the statement will be directed at Beijing’s increasing use of economic coercion against countries to display its disapproval.

Treasury Secretary Janet Yellen says the US will have to default on “some obligation” if the debt ceiling isn’t raised.

-

By “some obligation”, she means Treasuries or Social Security payments.

-

Yellen is set to update Congress on the proximity of such a scenario within the next 2 weeks.

-

President Biden and House Speaker Kevin McCarthy will meet tomorrow to continue negotiations.

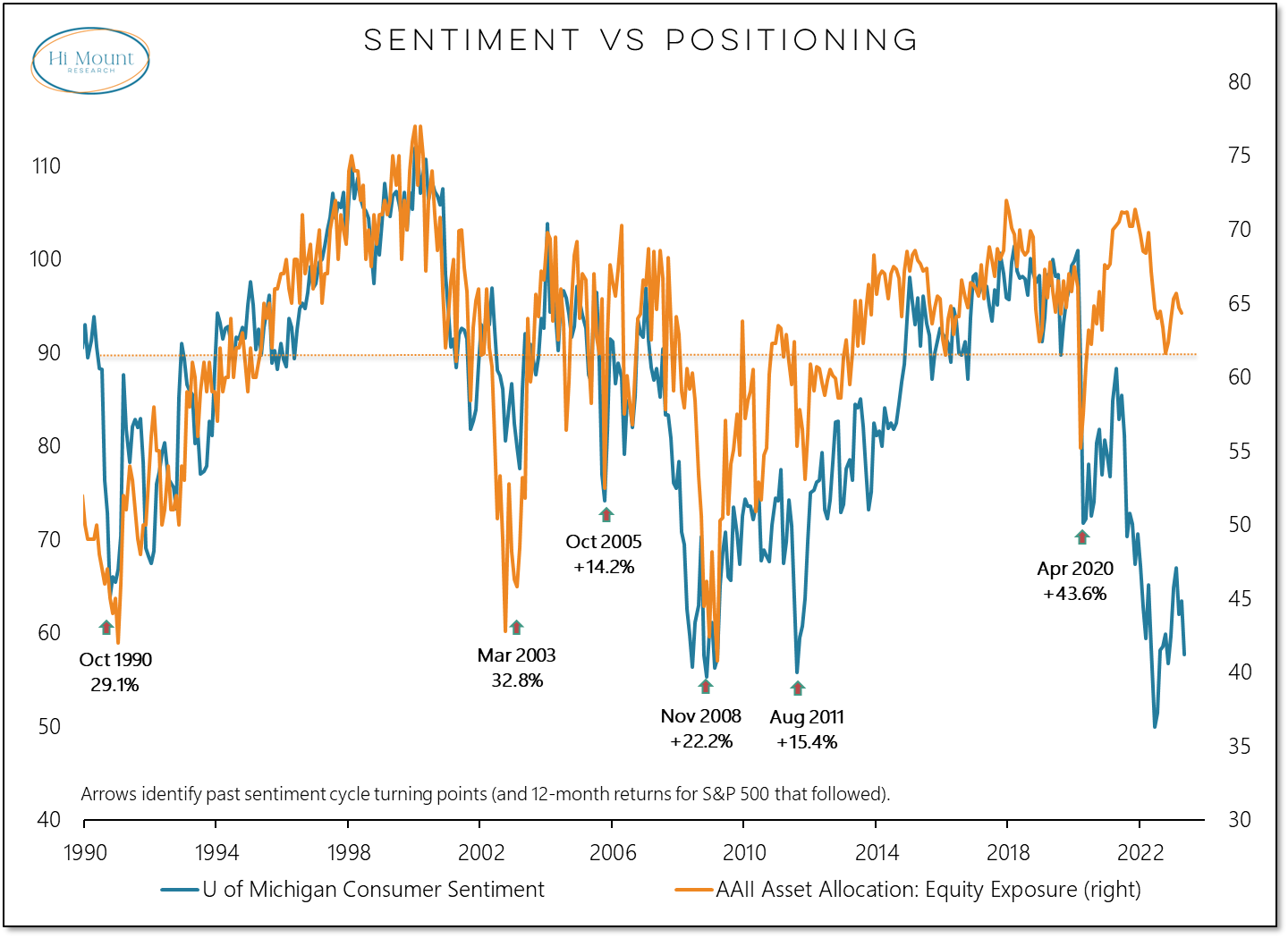

US consumer sentiment tumbled to its lowest in 6 months in May.

-

The drop was driven by concerns over the debt ceiling and its potential to trigger a recession.

-

Long-term inflation expectations also rose to the highest level since 2011, with consumers expecting 3.2% inflation in 5 years.

-

Meanwhile, deteriorating sentiment has done little to provoke a large reduction in equity exposure amongst investors.

Hi Mount Research

Stocks

Investors don’t seem to be fazed by the possibility of a US default.

-

Even in the face of a rise in credit default swaps—which provide insurance against a default—the CBOE Volatility Index (VIX) isn’t budging.

-

At around 17, the VIX remains at levels consistent with complacency.

-

The scenario resembles that of the 2011 debt ceiling impasse which saw a similarly low VIX spike soon after the US received its first credit downgrade.

Institutional pessimism towards US stocks has reached a new low point.

-

Fund managers’ exposure to stocks relative to bonds has been reduced to the lowest levels since 2009.

-

Over the past year, the cohort has yanked $333.9 billion out of US equities.

-

Individual investors have similarly pulled $28 billion from stocks.

-

Meanwhile, money markets have swelled to a record $5.3 trillion.

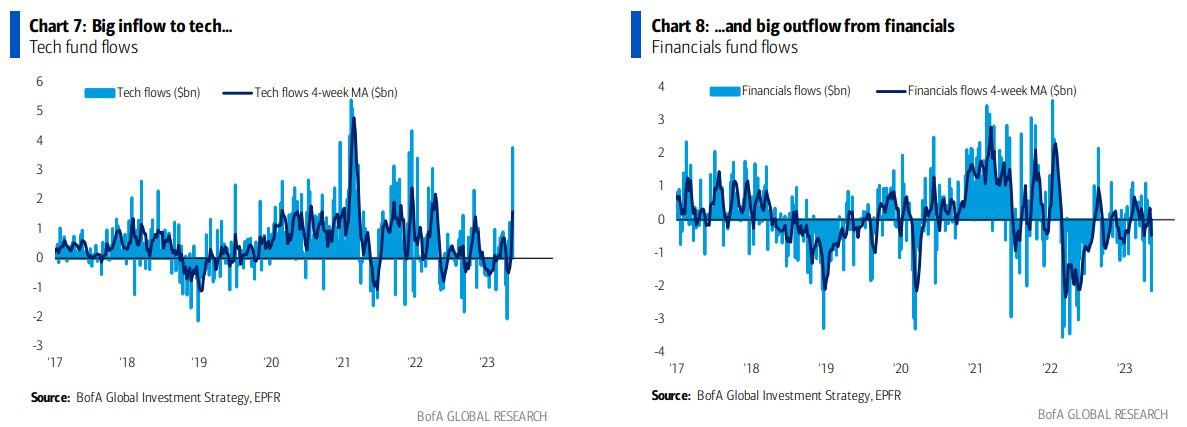

Here’s a look at investor flows for the week ending May 10, courtesy of BofA and EPFR Global data:

-

Tech stocks saw their largest inflow ($3.8 billion) since December 2021.

-

Financials saw their biggest outflow ($2.1 billion) since May 2022.

-

Inflows to cash are slowing ($13.8 billion) while those into Treasuries ($6.3 billion) were the largest in 6 weeks.

-

US and EU equity funds saw $2.7 and $2.2 billion in outflows, respectively.

Energy

The G7 and EU are ramping up the pressure on Russia with the first sanctions on Moscow’s pipeline exports since the invasion of Ukraine.

-

Gas imports on routes where Moscow has cut supplies will be banned, preventing exports to countries like Poland and Germany.

-

The new measures are expected to be announced this week at the Japan summit.

-

Meanwhile, gas futures in Europe are at levels not seen since June 2021.

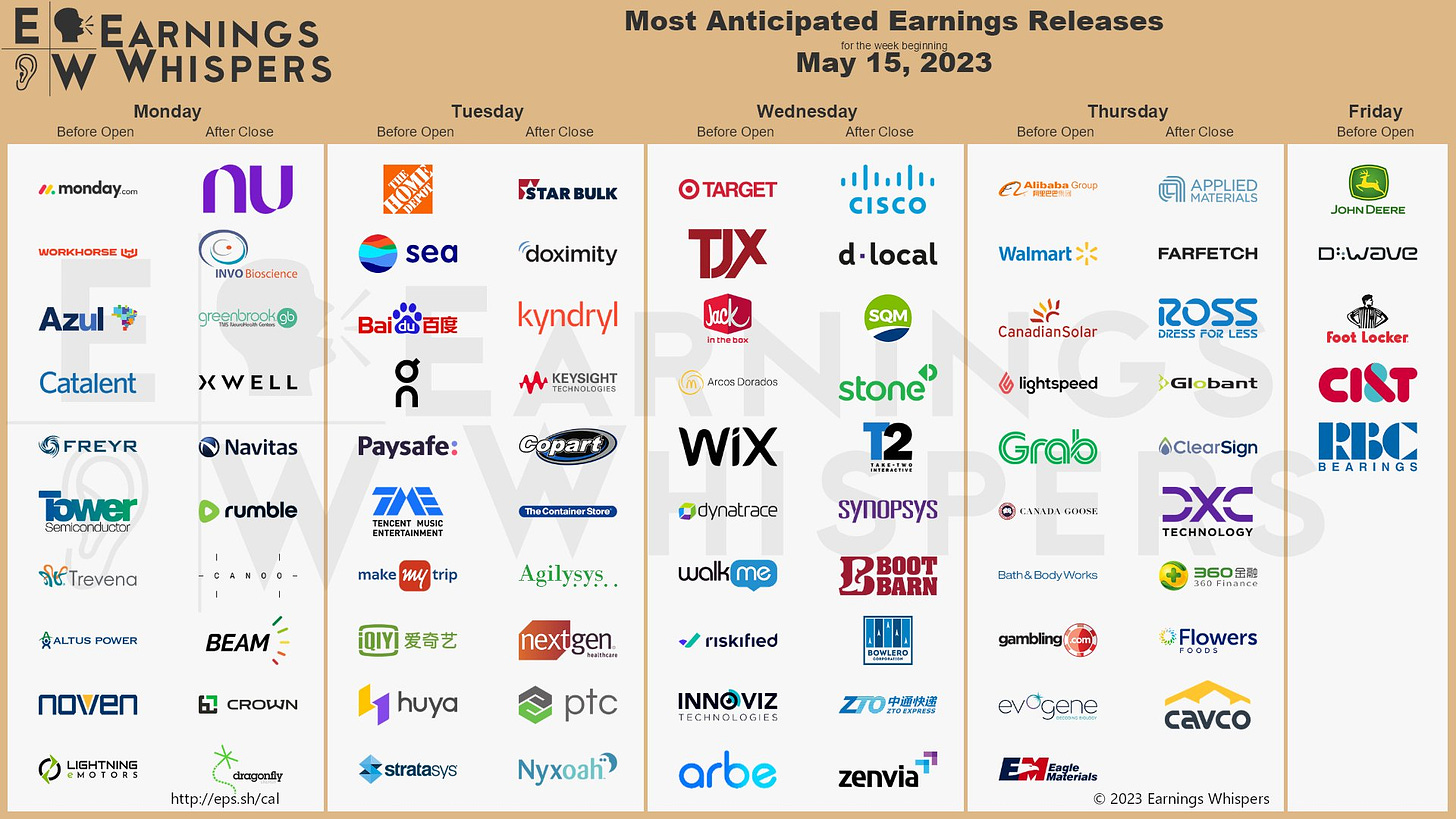

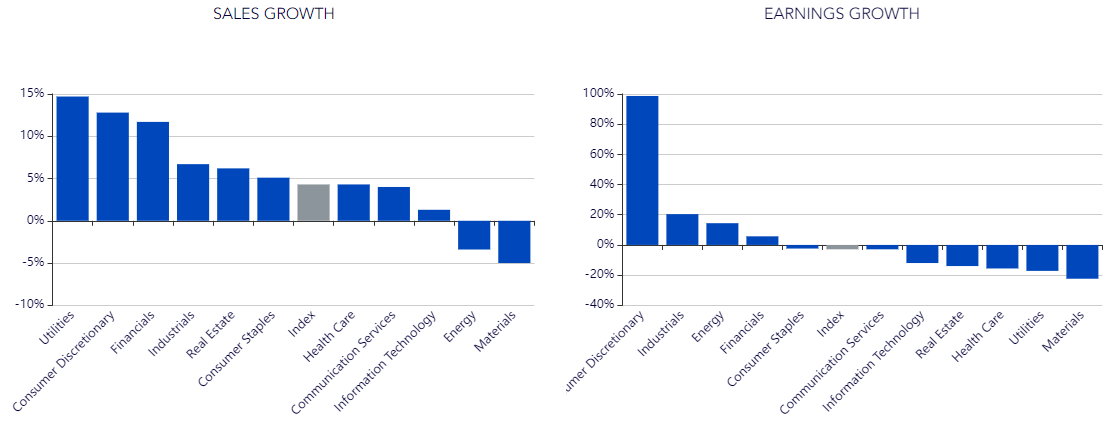

Earnings

92% of the S&P 500 has reported Q1 earnings.

-

78% and 75% of companies have beaten analysts’ estimates on earnings and revenue, respectively.

-

Both figures are better than their 1-, 5-, and 10-year averages.

-

S&P sales and earnings growth total 4.3% and -2.9%, respectively.

Wisdom Tree

What we’re watching today:

-

Nu Holdings NU

-

James Hardie Industries JHX

-

XP Inc XP

-

Catalent CTLT

-

Monday.com MNDY

-

Tower Semiconductor TSEM

-

Rumble RUM

-

TPG Inc TPG

Top Headlines

-

Turkey: The Turkish presidential election is headed to a runoff as President Erdogan failed to secure an outright victory.

-

IRS: The White House is exploring the creation of a free government-run alternative tax-prep option to TurboTax and H&R Block.

-

Bear call: Morgan Stanley’s Mike Wilson sees the debt ceiling debate sparking sharp price swings in US stocks.

-

CEO pay: Two out of three S&P 500 CEOs were compensated less last year than they were initially awarded.

-

Chapter 11: Vice Media filed for bankruptcy after failing to find buyers for its assets.

-

China boost: The recovery in China is boosting sales for many US companies operating in the country.

-

EU forecasts: The European Commission lifted its inflation and growth predictions for this year and next.

-

Pound bears: Hedge funds have become the most bearish on the British pound since 2021.

Week Ahead

-

Monday: NY Empire State manufacturing, net long-term TIC flows

-

Tuesday: Retail sales, industrial & manufacturing production, business inventories, NAHB housing market index

-

Wednesday: Building permits, housing starts

-

Thursday: Initial jobless claims, Philly Fed manufacturing, existing home sales, CB leading index

-

Friday: Powell speech

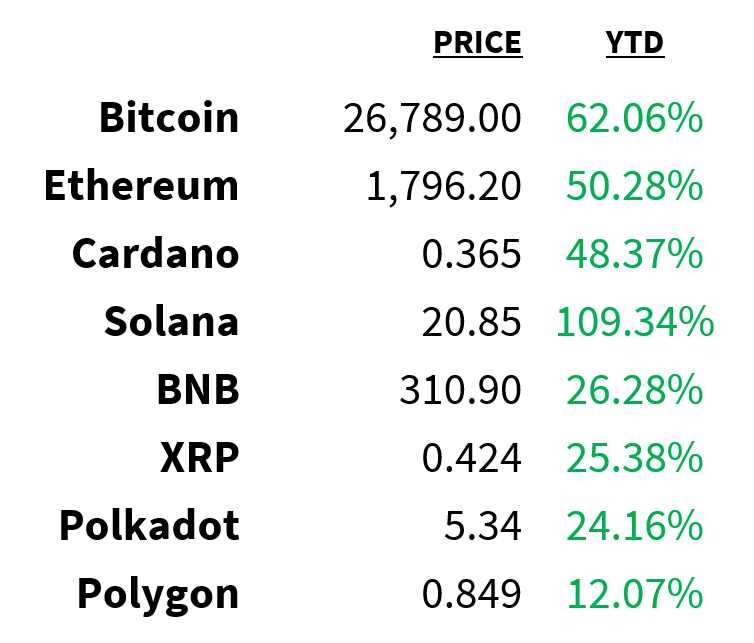

Crypto

Prices as of 4 pm EST, 5/12/23

-

DOJ scrutiny: The US Department of Justice is promising to crack down on digital platforms involved in illicit activities.

-

Walk talk: Crypto firms are threatening to leave the US in response to the SEC’s crackdown on the industry.

-

Eyeballs: Sam Altman (of OpenAI) is closing in on $100 million in funding for startup Worldcoin to create iris-scanning technology.

-

Staking: Surging demand for staking ether has led to wait times of over a month for a 5% annualized yield.

-

Stacking sats: The number of Bitcoin addresses holding 1 BTC or more has reached 1 million.

Deals

-

Exit strategy: Tiger Global is looking to sell a significant portion of its private company holdings in the secondary market.

-

Mining consolidation: Newcrest’s board has unanimously backed a $19 billion takeover by US mining giant Newmont.

-

Pipeline megamerger: Oneok has agreed to acquire Magellan Midstream Partners for $14 billion.

-

Sports betting: Fanatics will buy US operations from PointsBet for around $150 million.

-

Content is king: Alibaba’s e-commerce division will make “huge” investments in its Taobao shopping app with a focus on content creation.

Meme Of The Day

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.