During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the real estate sector.

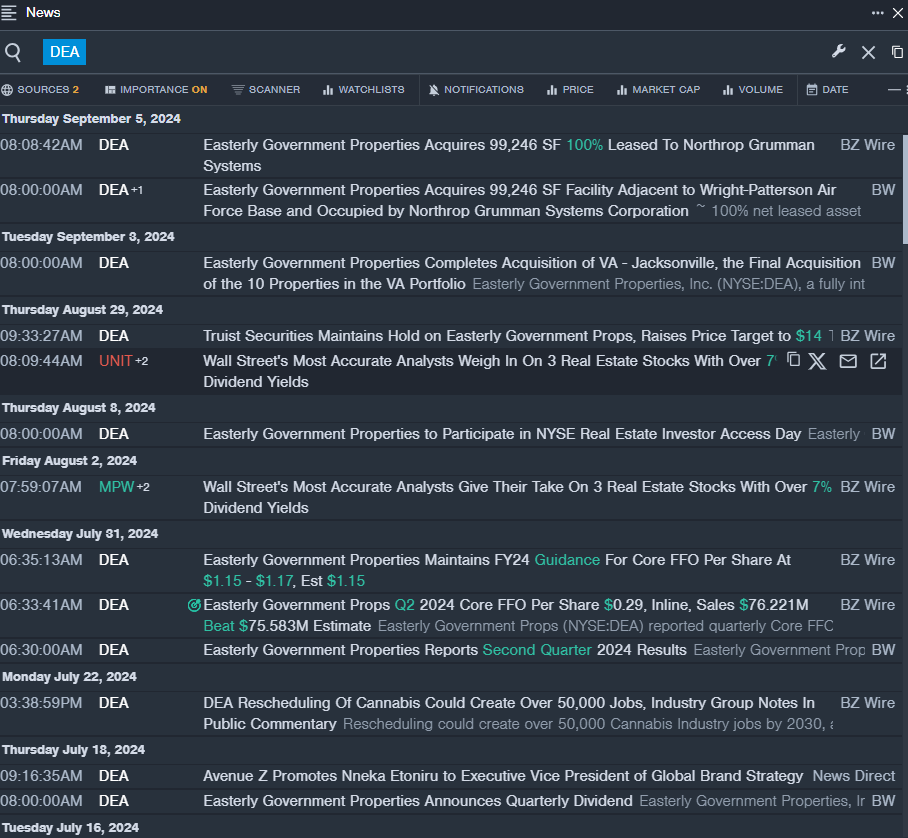

Easterly Government Properties, Inc. DEA

- Dividend Yield: 7.99%

- Truist Securities analyst Michael Lewis maintained a Hold rating and raised the price target from $13 to $14 on Aug. 29. This analyst has an accuracy rate of 70%.

- RBC Capital analyst Michael Carroll downgraded the stock from Sector Perform to Underperform and cut the price target from $15 to $13 on Aug. 16, 2023. This analyst has an accuracy rate of 64%.

- Recent News: On Sept. 5, Easterly Government Properties acquired 99,246 SF 100% leased to Northrop Grumman Systems.

- Benzinga Pro's real-time newsfeed alerted to latest DEA news.

Clipper Realty Inc. CLPR

- Dividend Yield: 7.44%

- Raymond James analyst Buck Horne downgraded the stock from Outperform to Underperform on April 15. This analyst has an accuracy rate of 74%.

- JMP Securities analyst Aaron Hecht downgraded the stock from Market Outperform to Market Perform on April 11. This analyst has an accuracy rate of 63%.

- Recent News: On Aug. 1, Clipper Realty reported better-than-expected second-quarter revenue and FFO results.

- Benzinga Pro’s charting tool helped identify the trend in CLPR stock.

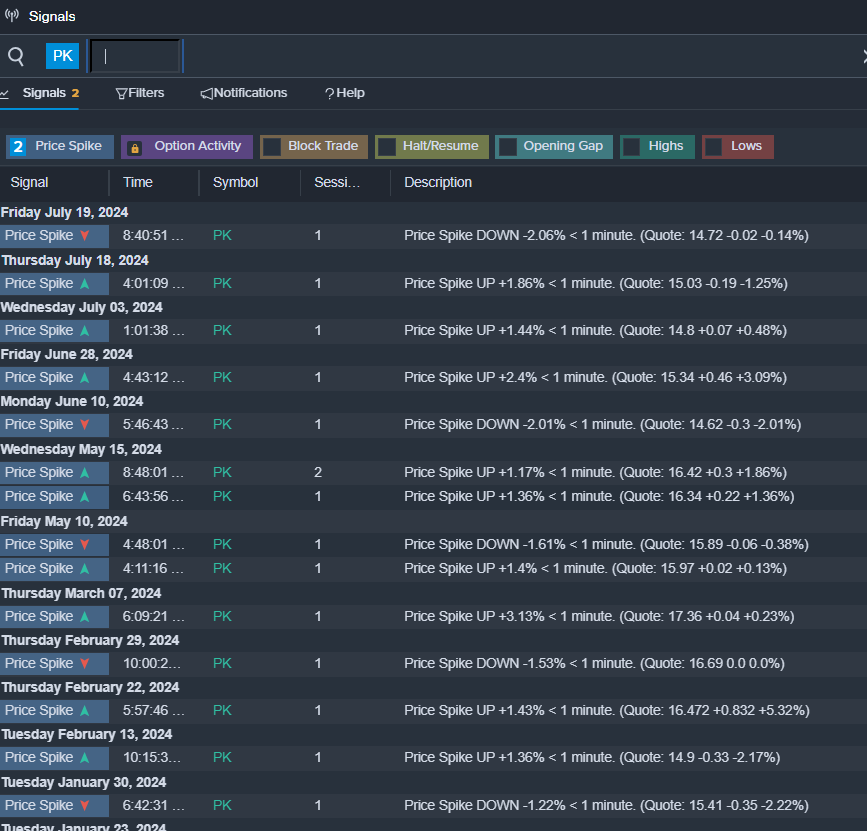

Park Hotels & Resorts Inc. PK

- Dividend Yield: 7.32%

- Truist Securities analyst Patrick Scholes maintained a Buy rating and cut the price target from $20 to $18 on Sept. 4. This analyst has an accuracy rate of 70%.

- UBS analyst Robin Farley maintained a Neutral rating and cut the price target from $18 to $14 on Aug. 16. This analyst has an accuracy rate of 84%.

- Recent News: On July 31, Park Hotels & Resorts posted weak quarterly sales.

- Benzinga Pro’s signals feature notified of a potential breakout in PK shares.

Read More:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.