Zinger Key Points

- Bank of America's EPS was $0.94, compared to $0.81 predicted, and sales were $26.39bn, compared to $25.16bn expected.

- Since the start of the bank earnings season, shares of Bank of America and JP Morgan have outperformed rivals.

- Get access to your new suite of high-powered trading tools, including real-time stock ratings, insider trades, and government trading signals.

Bank of America BAC outperforms expectations for the first quarter financial results, delivering a 16% positive surprise in earnings per share ($0.94 vs. $0.80 anticipated) and a 5% positive surprise in revenues ($26.39 billion vs. $25.19 billion).

What you should know about Bank of America's Q1 results:

- Net income rose 15% from $7.1 billion in Q1 2022 to $8.2 billion in Q1 2023.

- Revenue, net of interest expense, rose 13% to $26.3 billion from a year ago. This was Bank of America's second-best quarter ever, in terms of revenue.

- Profits were largely driven by rising net interest income (NII), which increased by $2.9 billion, or 25%, from Q1 2022 to Q1 2023, to $14.4 billion, due to higher interest rates and robust loan growth.

- From a year ago, the average loan and lease balances went up by $64 billion, or 7%, to $1 trillion. This was due to strong growth in business loans and higher credit card balances.

- End-of-period deposit balances eased $20 billion, or 1%, to $1.9 trillion compared to Q4 2022.

- For the consumer banking business, average deposits eased by $30 billion, or 3%, from $1.056 trillion in Q1 2022 to $1.026 trillion in Q1 2023.

- In comparison to Q4 2022 and Q1 2022, EPS climbed by 10.5% and 17.5%, respectively, while sales growth was 7.5% and 13.6%, respectively.

- “Every business segment performed well as we grew client relationships and accounts organically and at a strong pace. Our results demonstrate how our company’s decade-long commitment to responsible growth helped to provide stability in changing economic environments,” said chair and CEO Brian Moynihan.

- Shares of Bank of America were 2% higher in pre-market trading on Tuesday.

Bank of America vs Peers in Q1:

Bank of America announced better-than-expected results in the first quarter of 2023, with an EPS of $0.94, above analyst expectations by 16%.

On the same day, Goldman Sachs GS posted EPS of $8.79, 8% better than the $8.14 predicted by Wall Street, but missed revenues expectations by 4%.

JP Morgan Chase & Co. JPM announced an EPS of $4.10, which was above analysts' expectations by 20%.

Citigroup, Inc. C announced an EPS of $2.19, 33% better than the median analyst projection.

Wells Fargo & Company WFC announced an EPS of 1.23, which topped expectations by 8%.

Stock Reactions:

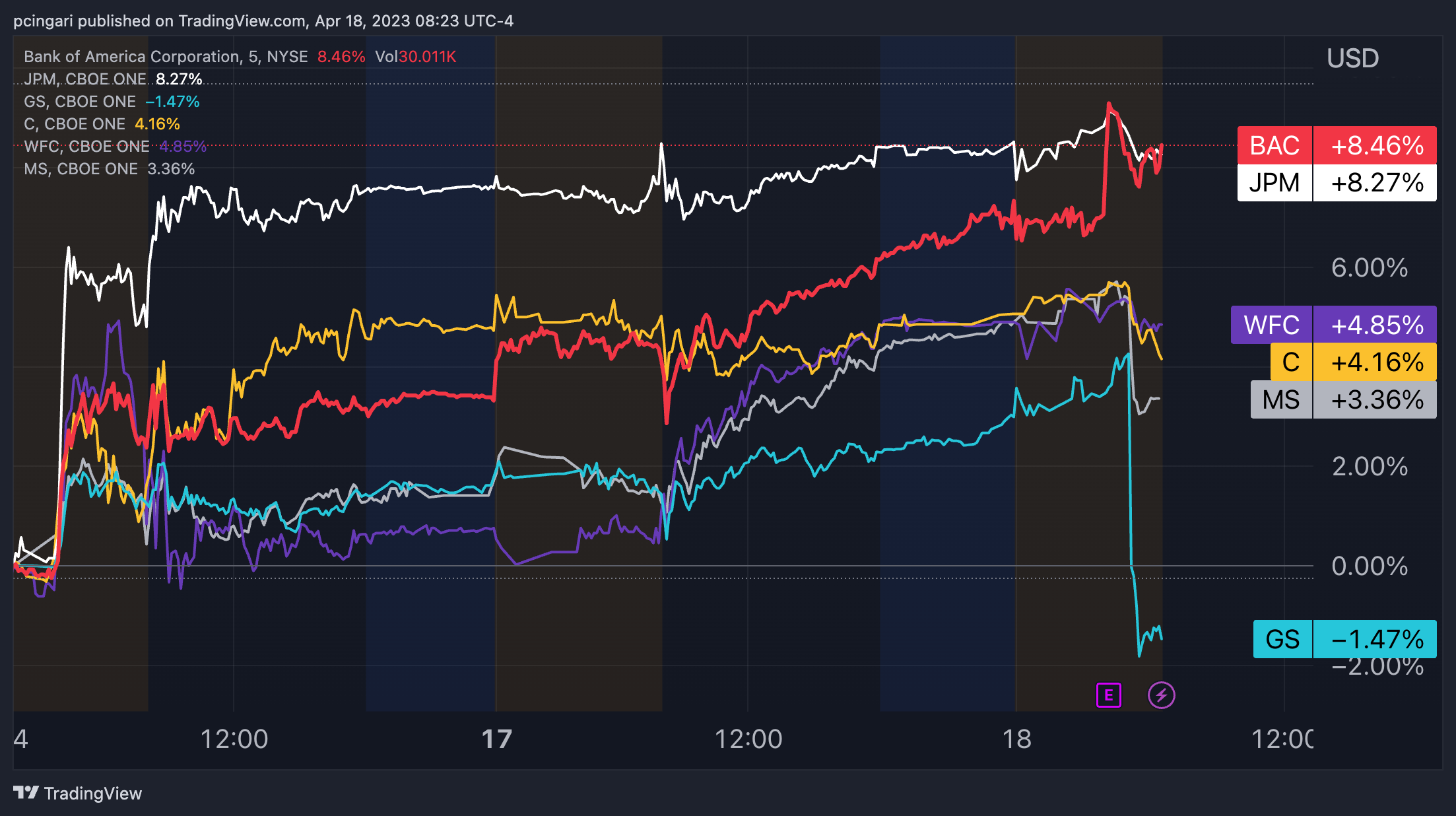

Since the beginning of the earnings season for banks, Bank of America shares have outperformed rivals, rising by 8.5%, while JPMorgan shares rose by 8.2%.

Wells Fargo and Citigroup both increased by 4.85% and 4.2%, respectively. Morgan Stanley gained 3.3%, while Goldman Sachs lost 1.5%, underperforming its rivals.

Now Read: Buckle Up, Tesla Investors: Analyst Spots 2 Red Flags Ahead of Q1 Report

Banks stock performance as of April 18, 2023 (08:24 EDT) – Chart: Tradingview

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.