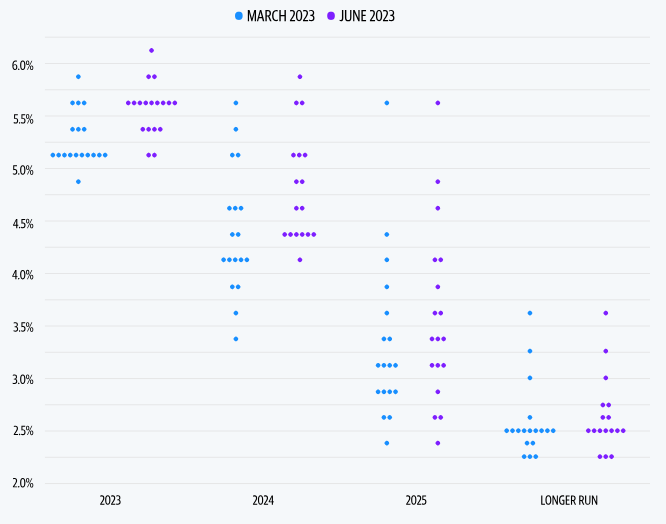

Jerome Powell said the FED’s forecasts have been wrong on inflation the last 2 years. Now he’s saying rate cuts aren’t going to happen for another couple years.

Can we really depend on these projections anymore?

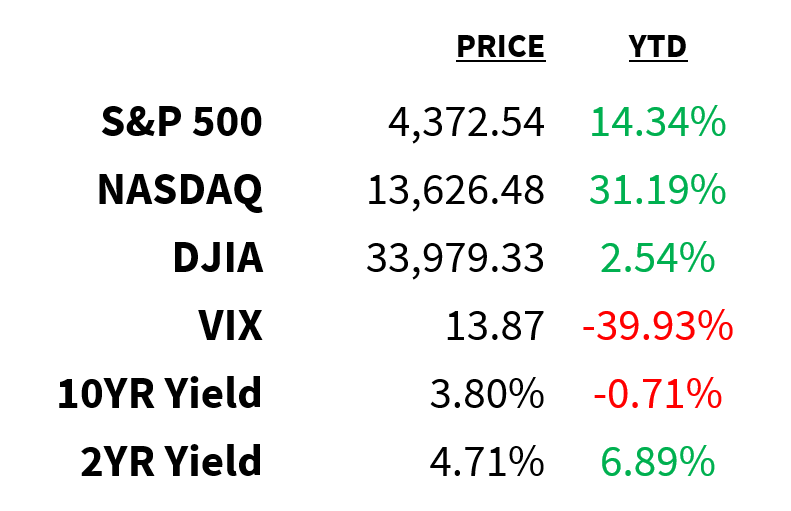

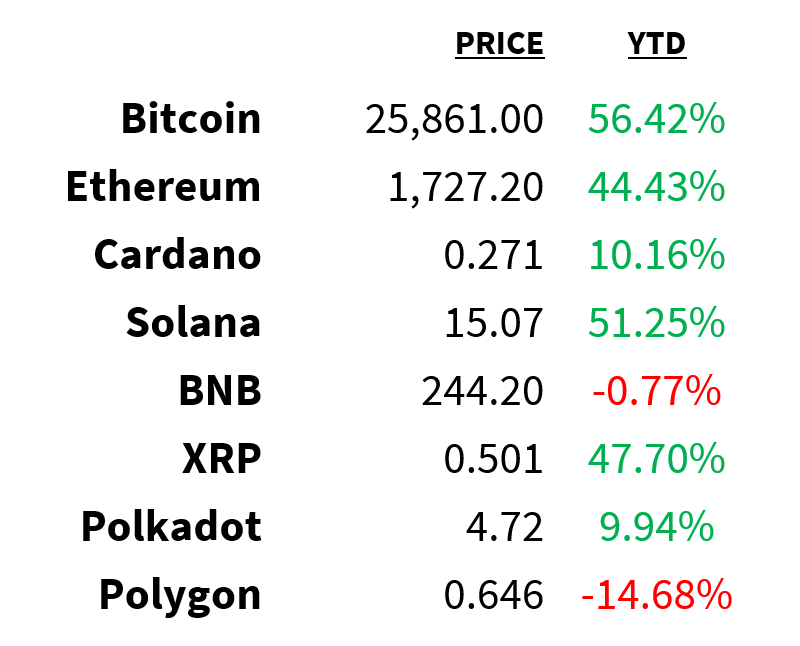

Market

Prices as of 4 pm EST, 6/14/23

Macro

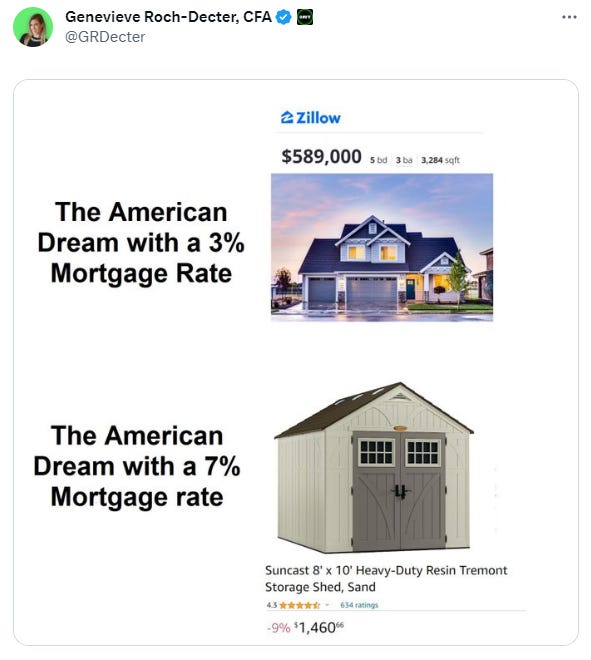

Mortgage demand picked up last week.

-

Applications for mortgages jumped 7.2% in the week ended June 9 marking the first increase in over a month.

-

The rise coincides with a pullback in mortgage rates (to 6.77% from 6.81%) which have now declined for 2 straight weeks.

-

However, with rates still a full percentage point higher than a year ago—and more than double what they were prior to the pandemic—purchase activity is down 27% YoY.

Wholesale prices in the US declined by more than expected in May.

-

Headline PPI dropped 0.3% (vs. +0.2% expected) while core PPI increased 0.2% (in-line).

-

The drop in the former was driven by large decreases in the costs of energy goods (mostly gas prices) and food.

-

On a YoY basis, headline and core PPI are up 1.1% (lowest since December 2020) and 2.8% (lowest since February 2021), respectively.

After 10 consecutive increases, the Fed kept interest rates unchanged in June.

-

The pause (don’t call it a skip), however, was of the hawkish variety as most FOMC members believe further tightening is necessary to bring down inflation.

-

By their forecast, rates will need to rise to 5.6% by the end of the year which implies two more hikes.

-

While markets are coming around to the belief that the Fed will not cut rates this year, they’re not entirely buying the FOMC’s message: Fed Funds futures are pricing in a peak rate of just 5.25-5.50 for 2023.

Yahoo Finance

Stocks

The European Union (EU) has accused Google of abusing its dominance in the advertising tech industry.

-

Charges set out by the European Commission allege the company has leveraged its position to give itself an unfair advantage while charging competitors high fees for its services.

-

The commission’s view is that Google must sell off parts of its adtech business to address the anti-competitive practices.

-

Advertising was responsible for 79% of Google’s total revenue last year.

Elsewhere in the EU, lawmakers voted in favor of stricter rules for artificial intelligence (AI).

-

New draft legislation includes a ban on using AI in biometric surveillance and requires generative AI systems (like ChatGPT) to disclose AI-generated content.

-

It also calls for companies using generative tools to disclose copyrighted material used for training.

-

Additionally, “high-risk applications” would need to undergo fundamental rights and environmental impact assessments.

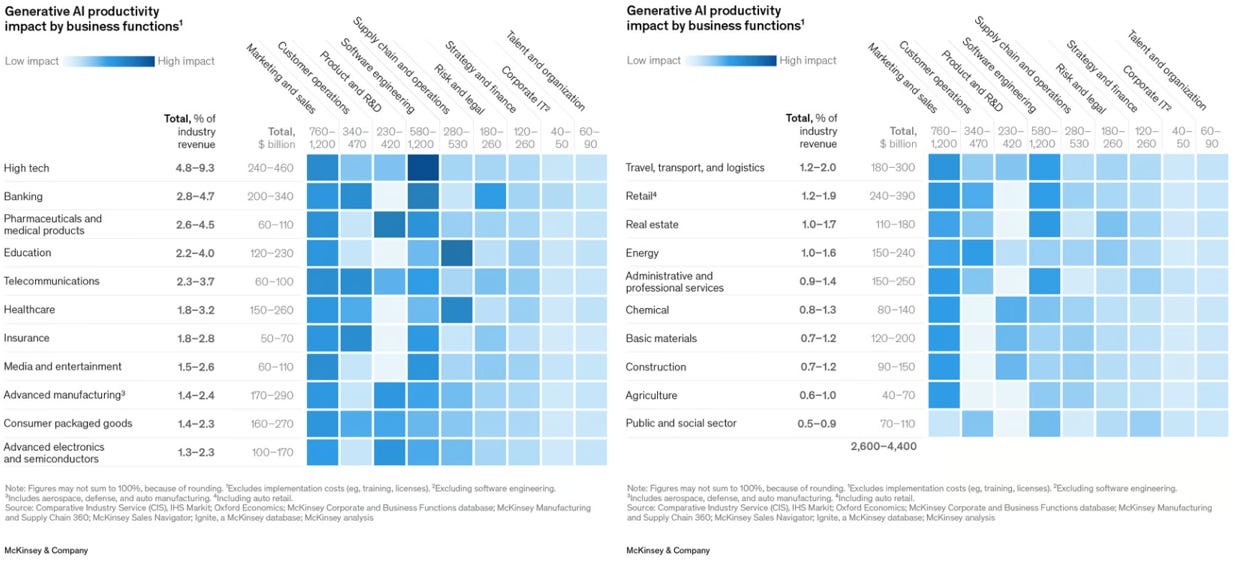

Staying on topic, a new McKinsey report suggests the AI boom could potentially add up to $4.4 trillion–or about 4.4% of output–to the global economy annually.

-

Their research predicts productivity increases could range between 0.1% and 0.6% over the next 20 years, depending on how the tech is adopted and implemented.

-

They estimate current technologies have the potential to absorb 60-70% of employees’ time today.

-

Industries that would benefit most from generative AI include high tech, retail, banking, and pharmaceuticals.

McKinsey

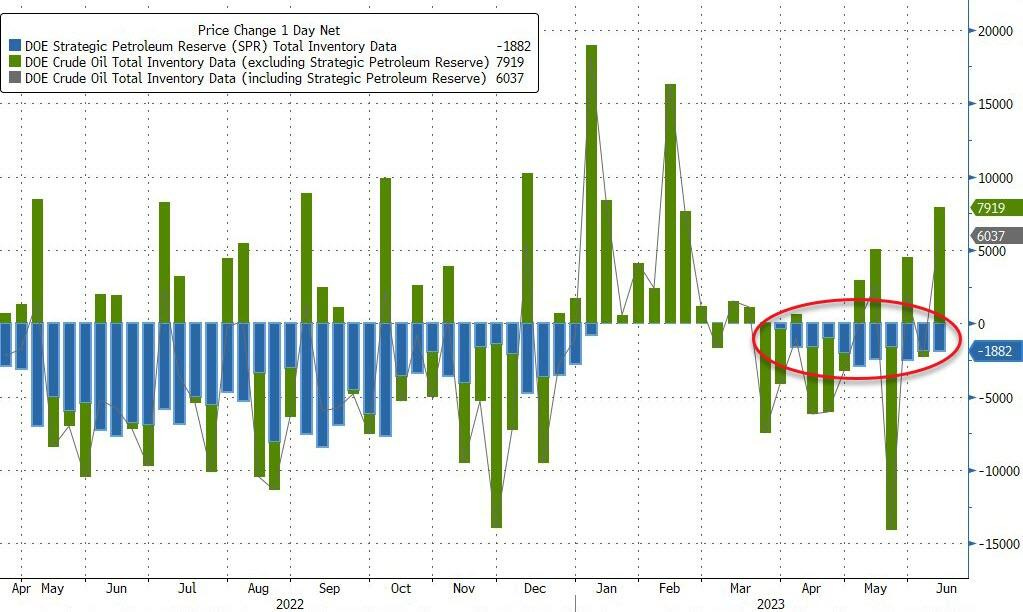

Energy

US crude inventories rose unexpectedly last week, rising by nearly 8 million barrels.

-

Analysts were expecting a 510,000 barrel draw.

-

Strategic Petroleum Reserves, meanwhile, were drained (by 1.9 million barrels) for the 11th straight week.

-

The draw comes after reports the White House is seeking to buy 12 million barrels to refill reserves this year.

Zero Hedge

Earnings

Yesterday’s highlights:

Lennar Corp LEN: $3.01 EPS (vs. $2.33 expected), $8.05 billion in sales (vs. $7.22B expected).

-

The homebuilder raised its forecast for home deliveries in 2023 to 68,000-70,000 from previous guidance between 62,000-66,000.

-

It also expects gross margins to increase from the current quarter’s 22.5% to between 23.5% and 24% in Q3.

What we’re watching today:

-

Adobe ADBE

-

Kroger KR

-

Jabil JBL

-

John Wiley & Sons WLY

Top Headlines

-

Semiconductor spying: US chipmaker Applied Materials is accusing a Chinese rival of a 14-month espionage campaign.

-

Twitter faces the music: Twitter is being accused of copyright infringement by music publishers in a $250 million lawsuit.

-

Super app: ByteDance has plans to create an “everything app” to rival WeChat.

-

Consumers cut back: A new CNBC and Morning Consult survey revealed 92% of Americans are pulling back on spending.

-

Corporate debt: Interest costs at US companies increased by 22% YoY in Q1.

-

Hydrogen electricity: New US and EU government policies are boosting investor confidence in hydrogen projects.

-

Canadian housing: Mortgage growth in Canada dropped to a 20-year low in Q1 thanks to rising rates.

-

US-Iran: The Biden administration has resumed talks with Iran to secure the release of American prisoners and address the country’s nuclear plans.

-

Crypto

Prices as of 4 pm EST, 6/14/23

-

Cyprus pullback: Binance is looking to deregister its Cyprus unit as a crypto service provider to focus on its larger European businesses.

-

Market share: Binance.US’ market share in the US fell to just 2.7%, the lowest since December 2020.

-

Advisers’ takes: Here’s what wealth management pros think about the SEC’s crackdown on crypto.

-

USDT: Tether’s USDT/USD stablecoin is under pressure as liquidity platforms like Curve and Uniswap see an influx of USDT sellers.

-

BTC vs. TradFi: Bitcoin’s unpredictable correlation with traditional finance has inverted.

Deals

-

UK mobile: Vodafone and CK Hutchison have agreed on a $19 billion merger to create the largest mobile operator in the UK.

-

Restaurant IPO: With shares expected to begin trading today, Cava has priced its IPO offering at $22 per share, a ~$2.45 billion valuation.

-

Chinese IPOs: Investment banks are backing out of potential listing in China as international investors sour on the country’s IPO market.

-

Bid rejected: SoftwareOne’s board unanimously rejected Bain Capital’s $3.2 billion takeover offer as too low.

-

LNG stake: TotalEnergies has acquired a 17.5% stake in LNG developer NextDecade for $219 million.

Meme Of The Day

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.