Uranium Energy UEC is expected to report year-over-year improvement in both revenues and earnings in its upcoming third-quarter fiscal 2024 results.

The Zacks Consensus Estimate for revenues is pegged at $21 million, indicating 3.9% growth from the year-ago quarter's actual. The consensus estimate for earnings is 1 cent per share, which indicates a solid improvement from a loss of 2 cents per share reported in the third quarter of fiscal 2023. The estimate has remained unchanged over the past 30 days.

Q2 Performance

In the last reported quarter, Uranium Energy reported declines in both its top and bottom lines. Revenues were $0.12 million, which were down 100% year over year and missed the Zacks Consensus Estimate. Revenues only reflected toll processing services revenues as the company did not sell any of its purchased uranium inventory. Notably, sales of uranium inventory had resulted in revenues of $47.8 million in the year-ago quarter, while revenues from toll processing services were $0.09 million.

Uranium Energy reported second-quarter adjusted earnings per share of 1 cent, which was in line with the Zacks Consensus Estimate. The bottom line marked a 67% plunge from the earnings per share of 3 cents in the year-ago quarter.

UEC's earnings have matched the consensus estimate in two of the trailing four quarters while surpassing on one occasion and missing in one quarter. The company has delivered an average surprise of 33.3% over the trailing four quarters.

Factors to Note

Uranium Energy is primarily engaged in uranium mining and related activities, including exploration, pre-extraction, extraction and processing of uranium projects located in the United States, Canada and the Republic of Paraguay. The company has established the existence of mineralized materials for certain uranium projects, including the Palangana Mine, Christensen Ranch Mine (collectively the ISR Mines), Roughrider and Christie Lake Project. UEC has, however, not yet established proven or probable reserves. Despite commencing uranium extraction at its ISR Mines, it remains in the "Exploration Stage" (as defined by the United States Securities and Exchange Commission) and will continue to remain so until proven or probable reserves have been established.

The Palangana Mine had been Uranium Energy's sole source of revenues from the sales of produced uranium from fiscal 2012 to fiscal 2015. The company has not generated revenues from the sales of produced uranium since fiscal 2016 as it continues per its strategic plan to operate Palangana Mine and Christensen Ranch Mines at a reduced pace. It intends to defer major pre-extraction expenditures and maintain a state of operational readiness in anticipation of a recovery in uranium prices.

The company had earlier stated that it would sell its purchased uranium inventory through the uranium spot market. At the end of the fiscal second quarter, the company held 1,166,000 pounds of purchased uranium concentrate inventory. Uranium spot prices had been above $100 per pound in early February. Spot prices had averaged around $90.60 per pound in the February-April period, 76% higher than year-ago levels.

In the third quarter of fiscal 2023, the company generated revenues of $20 million from sales of purchased uranium inventory while revenues from toll processing services were $0.1 million. The Zacks Consensus Estimate of $21 million for third-quarter fiscal 2024 revenues suggests that the company is likely to have sold some of its purchased uranium inventory to take advantage of the higher prices.

While the company maintains state operational readiness, uranium extraction expenditures continue to be incurred at ISR Mines, which are directly related to regulatory/mine permit compliance, lease maintenance obligations and maintenance of a necessary labor force. The company is expected to have incurred mineral property expenditures primarily consisting of costs relating to permitting, property maintenance, exploration and pre-extraction activities and other non-extraction-related activities on its mineral projects.

What Our Zacks Model Indicates

Our proven model does not conclusively predict an earnings beat for Uranium Energy this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is not the case here.

Earnings ESP: The Earnings ESP for Uranium Energy is 0.00%.

Zacks Rank: UEC currently carries a Zacks Rank of 3.

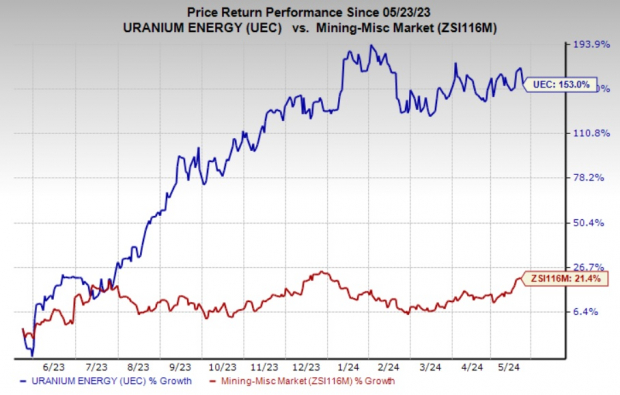

Price Performance

Uranium Energy's shares have appreciated 153% in the past year compared with the industry's 21.4% growth.

Image Source: Zacks Investment Research

Peer Performances

Cameco CCJ reported revenues of $470 million in the first quarter (ended Mar 31, 2024), which were down 8% year over year. Adjusted earnings per share plunged 52% to 10 cents, which missed the Zacks Consensus Estimate of 33 cents.

In the uranium segment, Cameco produced 5.8 million pounds (its share), a 29% increase from the 4.5 million pounds (our share) in the year-ago quarter. Sales volumes were down 25% year over year to 7.3 million pounds. The average realized uranium price rose 27% to $57.57 per pound.

Energy Fuels UUUU reported first-quarter 2024 earnings of 2 cents per share, in line with the Zacks Consensus Estimate. UUUU had reported a loss per share of 1 cent in the year-ago quarter.

Revenues were $25.43 million, which fell short of the consensus estimate of $26 million. This compares with year-ago revenues of $19.61 million. Energy Fuels sold 300,000 pounds of uranium concentrates at a weighted average price of $84.38 per pound for $25.31 million, which resulted in a gross profit of $14.26 million and an average gross margin of 56%.

A Stock Likely to Deliver Earnings Beat

Here is a stock with the right combination of elements to post an earnings beat in its upcoming release.

Abercrombie & Fitch ANF presently has an Earnings ESP of +4.48% and a Zacks Rank of 2.

The company is likely to register growth in the top and bottom lines when it reports first-quarter results on May 29. The Zacks Consensus Estimate for ANF's quarterly revenues is pegged at $948.8 million, which suggests 13.5% growth from the figure reported in the prior-year quarter.

The consensus mark for ANF's quarterly earnings has moved up 6% in the past 30 days to $1.62 per share. The consensus estimate suggests growth of 315% from the year-ago quarter's actual.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.