With a slew of promising semiconductor stocks to choose from, investors may want to avoid Diodes DIOD at the moment which lands a Zacks Rank #5 (Strong Sell) and the Bear of the Day.

This comes as the supplier of high-quality discrete and analog semiconductor products says it's grappling with a slower-than-expected recovery in the consumer, communications, and computing markets.

Growth Concerns

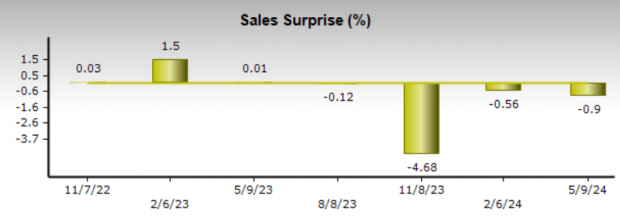

Reporting its first quarter results in early May, Diodes' Q1 sales of $301.97 million missed estimates by -1% and dropped -35% from $467.24 million a year ago. Furthermore, Q1 earnings of $0.28 per share fell -82% from EPS of $1.59 in the comparative quarter despite slightly edging expectations.

Image Source: Zacks Investment Research

Declining Earnings Estimates

Following mixed Q1 results, the earnings outlook for Diodes has begun to slip over the last 30 days with FY24 EPS estimates falling -20% from $2.55 per share to $1.80 a share. More concerning is that FY25 EPS projections have dipped -13% despite a rebound forecasted in Diodes bottom line next year to $4.06 a share although this is down from estimates of $4.67 per share a month ago.

In contrast, many chipmakers have seen a positive trend of earnings estimate revisions including of course Nvidia NVDA and closer peers to Diodes such as Alpha and Omega Semiconductor AOSL, Amkor Technology AMKR, and Silicon Motion Technology SIMO.

Image Source: Zacks Investment Research

The CEO Just Sold Shares

What may also concern investors and dampen the optimism for a rebound in Diodes' bottom line is that CEO and Director Keh Shew Lu sold 13,216 of his DIOD shares for a total of $965,462 on May, 14. Notably, Lu controls over 900,000 shares of the company with 369,992 shares held directly and 599,143 shares held indirectly according to the Form-4 filing with the SEC.

Bottom Line

Given there are so many promising semiconductor companies to invest in, Diodes' stock may not be worth the risk at the moment considering the downward trend of earnings estiamte revisons and insider selling.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.