HEICO Corporation HEI is set to release earnings results for its third quarter, after the closing bell on Monday, Aug. 26.

Analysts expect the Hollywood, Florida-based company to report quarterly earnings at 92 cents per share, up from 74 cents per share in the year-ago period. HEICO projects to report quarterly revenue of $995.67 million for the quarter, according to data from Benzinga Pro.

On June 20, HEICO raised its cash dividend from 10 cents to 11 cents per share.

HEICO shares rose 0.6% to close at $246.07 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

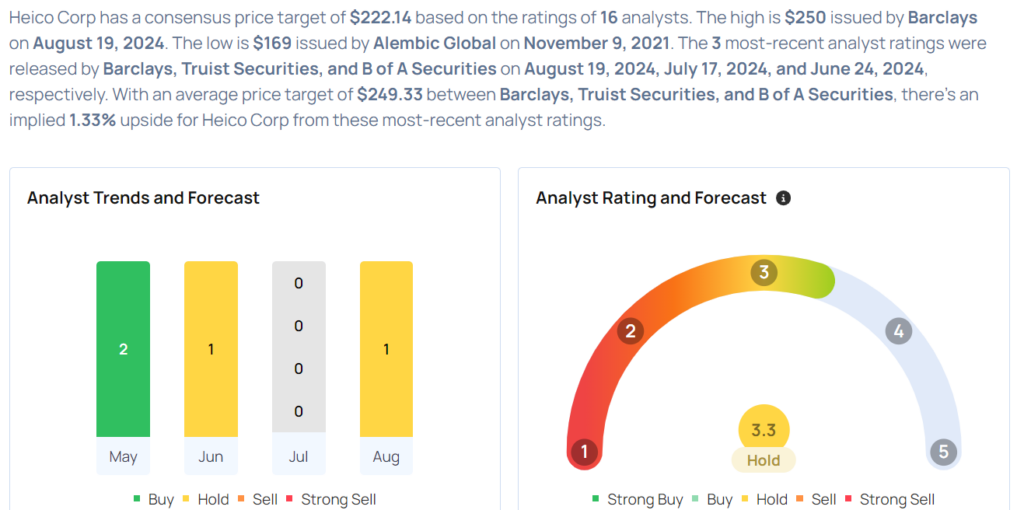

- Barclays analyst David Strauss initiated coverage on the stock with an Equal-Weight rating and a price target of $250 on Aug. 19. This analyst has an accuracy rate of 71%.

- Truist Securities analyst Michael Ciarmoli maintained a Buy rating and raised the price target from $240 to $248 on July 17. This analyst has an accuracy rate of 79%.

- B of A Securities analyst Ronald Epstein maintained a Buy rating and raised the price target from $220 to $250 on June 24. This analyst has an accuracy rate of 63%.

- Benchmark analyst Josh Sulivan maintained a Buy rating and boosted the price target from $185 to $245 on June 14. This analyst gas an accuracy rate of 85%.

- Morgan Stanley analyst Kristine Liwag upgraded the stock from Underweight to Equal-Weight and boosted the price target from $178 to $225 on June 4. This analyst has an accuracy rate of 70%.

Considering buying HEI stock? Here’s what analysts think:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.