Zinger Key Points

- U. S. Steel Corp. is trading 28% higher in premarket on news of the acquisition by Nippon Steel Corp.

- The X stock has returned 59.3% to investors outperforming the S&P 500's 23.6% and the materials sector's 17.5% return.

- Get real-time earnings alerts before the market moves and access expert analysis that uncovers hidden opportunities in the post-earnings chaos.

United States Steel Corp‘s X stock is trading over 28% higher in premarket trading on Monday, owing to news around its acquisition by Japan-based Nippon Steel Corp NISTF. The transaction values United States Steel at $14.9 billion.

US Steel Investors Surpass S&P 500 30%

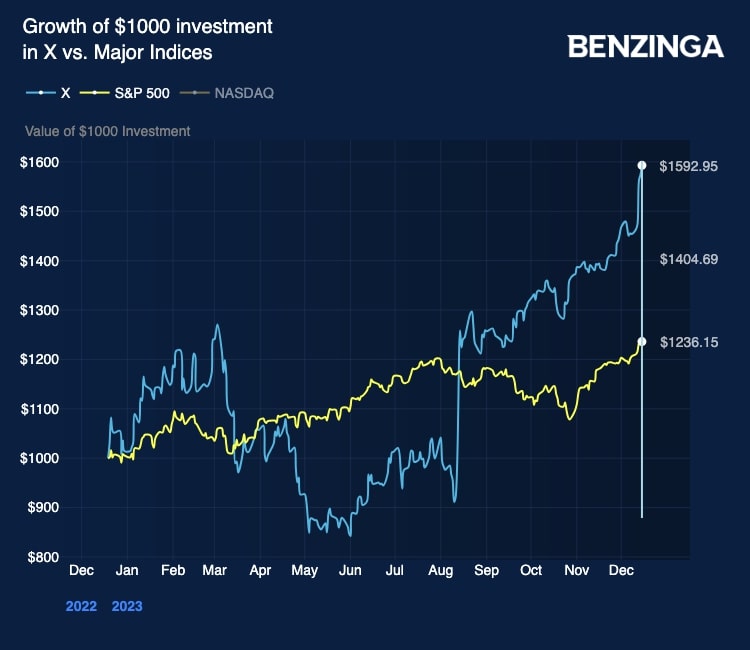

Here’s a chart depicting how a $1000 investment in U.S. Steel and the S&P 500 would have fared over the past year.

A $1000 investment in U. S. Steel stock made a year ago, would now have grown to $1,592.95. That’s a whopping 59.3% return for X stockholders. On the other hand, an equal amount invested in an S&P 500 ETF would have grown to $1,236.15.

The outperformance has been more pronounced since mid-August, when U.S. Steel launched a formal review process, after rejecting rival Cleveland-Cliffs Inc‘s CLF $7.3 billion offer.

Also Read: U.S. Steel’s Operations In Minnesota Generated $1.8B In Economic Impact

Exchange-traded funds that closely track the S&P 500 index, namely the SPDR S&P 500 ETF Trust SPY, the iShares Core S&P 500 ETF IVV and the Vanguard 500 Index Fund ETF VOO are up over 23.6% over the past year.

US Steel Investors Outperform XME By 40%

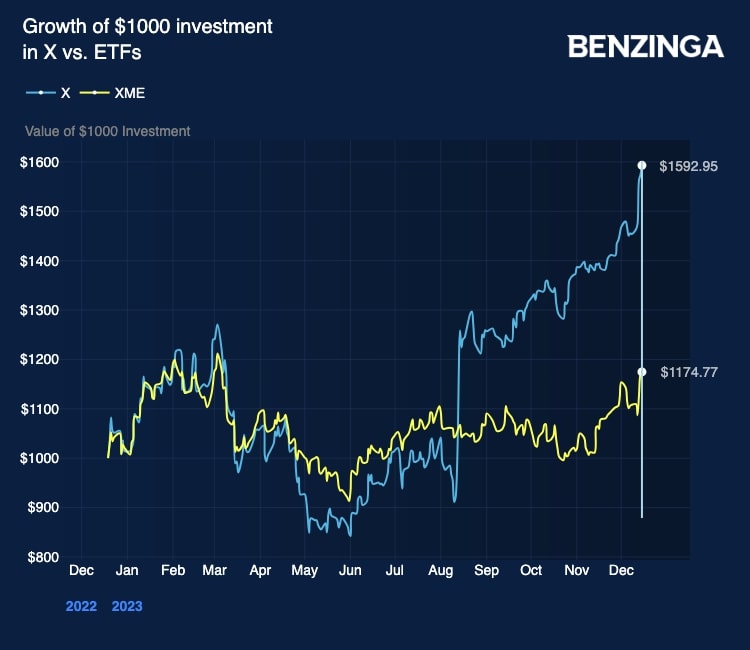

Now, let’s see how U.S. Steel’s stock has fared against the material sector benchmark – SPDR S&P Metals & Mining ETF XME. U.S. Steel commanded 4.81% of the XME ETF portfolio as of Dec. 14.

U.S. Steel stock has outperformed the materials sector benchmark by a good degree as well. While X stock returned 59.3% to investors, XME ETF holders only gained 17.5% over the past 1 year.

U.S. Steel is the fourth largest holding of the XME portfolio, after Alpha Metallurgical Resources Inc AMR, Cleveland-Cliffs and Hecla Mining Co HL.

Related: Why Steel Giant U. S. Steel Shares Are Soaring Today

Photo: Unsplash

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.