The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

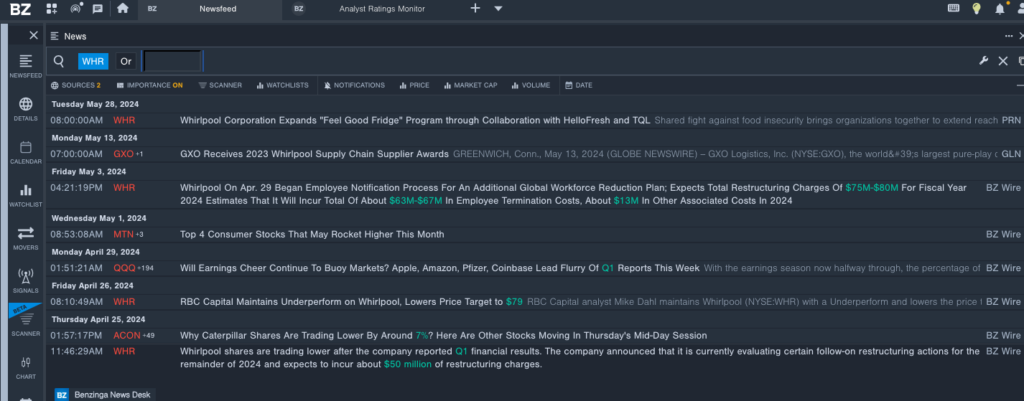

Whirlpool Corporation WHR

- On April 25, Whirlpool reported first-quarter financial results. The company announced that it is currently evaluating certain follow-on restructuring actions for the remainder of 2024 and expects to incur about $50 million of restructuring charges. The company's stock fell around 11% over the past month and has a 52-week low of $84.18.

- RSI Value: 23.29

- WHR Price Action: Shares of Whirlpool fell 2.3% to close at $84.78 on Wednesday.

- Benzinga Pro's real-time newsfeed alerted to latest WHR news.

Chegg, Inc. CHGG

- On April 29, Chegg reported first-quarter financial results and named Nathan Shultz as CEO. “We had a very productive first quarter and successfully rolled out the first of many AI enabled experiences that will strengthen our product-market fit in 2024 and beyond,” said Nathan Schultz, incoming CEO & President. The company's stock fell around 29% over the past month. It has a 52-week low of $3.51.

- RSI Value: 18.08

- CHGG Price Action: Shares of Chegg gained 1.1% to close at $3.67 on Wednesday.

- Benzinga Pro's charting tool helped identify the trend in Chegg's stock.

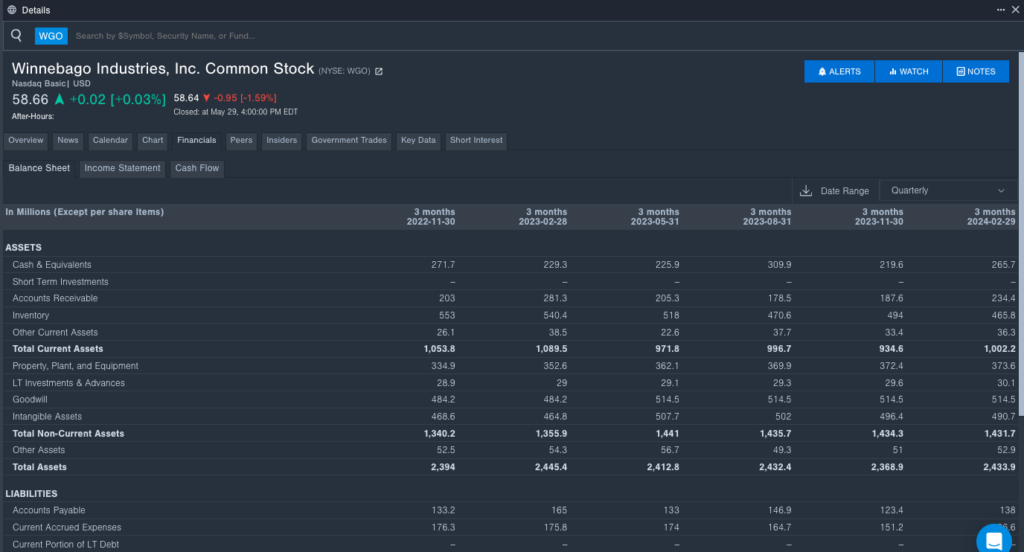

Winnebago Industries, Inc. WGO

- On March 21, Winnebago Industries reported a second-quarter FY24 sales decline of 18.8% year-on-year to $703.60 million, missing the analyst consensus estimate of $706.45 million. President and Chief Executive Officer Michael Happe commented, "Winnebago Industries performed in line with our expectations for the quarter, navigating the effects of ongoing softness in the RV and marine markets." The company's stock fell around 4% over the past five days and has a 52-week low of $55.00.

- RSI Value: 29.86

- WGO Price Action: Shares of Winnebago Industries fell 1.6% to close at $58.64 on Wednesday.

- Benzinga Pro's financials section was used to monitor Winnebago's performance.

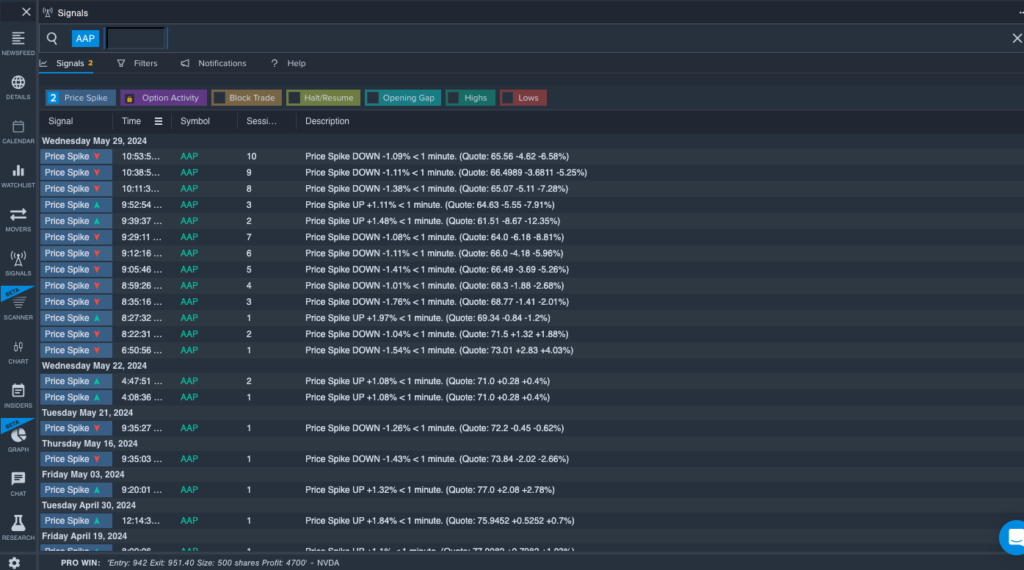

Advance Auto Parts, Inc. AAP

- On May 29, the company reported first-quarter earnings per share of 67 cents, beating the street view of 64 cents. Net sales totaled $3.406 billion in the first quarter of 2024, a 0.3% decrease from the prior year’s first quarter. The company's shares lost around 11% over the past five days. The company's 52-week low is $47.73.

- RSI Value: 24.02

- AAP Price Action: Shares of Advance Auto Parts fell 11% to close at $62.48 on Wednesday.

- Benzinga Pro's signals feature notified of a potential breakout in Advance Auto Parts shares.

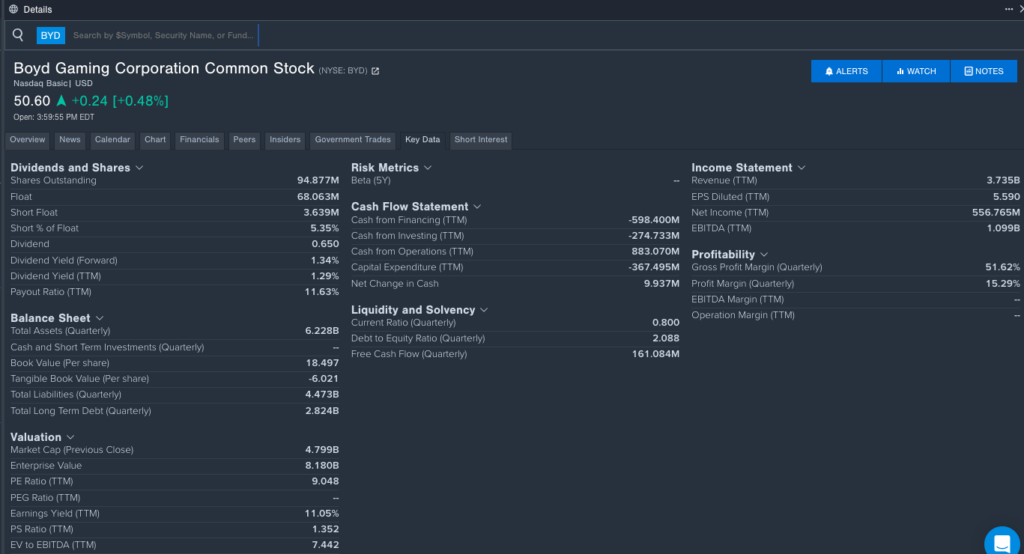

Boyd Gaming Corporation BYD

- On May 13, Boyd Gaming announced an additional $500 million share repurchase authorization. The company's shares fell around 8% over the past five days. The company has a 52-week low of $49.34.

- RSI Value: 26.03

- BYD Price Action: Shares of Boyd Gaming rose 0.4% to close at $50.58 on Wednesday.

- Key Data for Boyd Gaming was monitored using Benzinga Pro.

Read More: Dollar General, Salesforce And 3 Stocks To Watch Heading Into Thursday

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.