The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

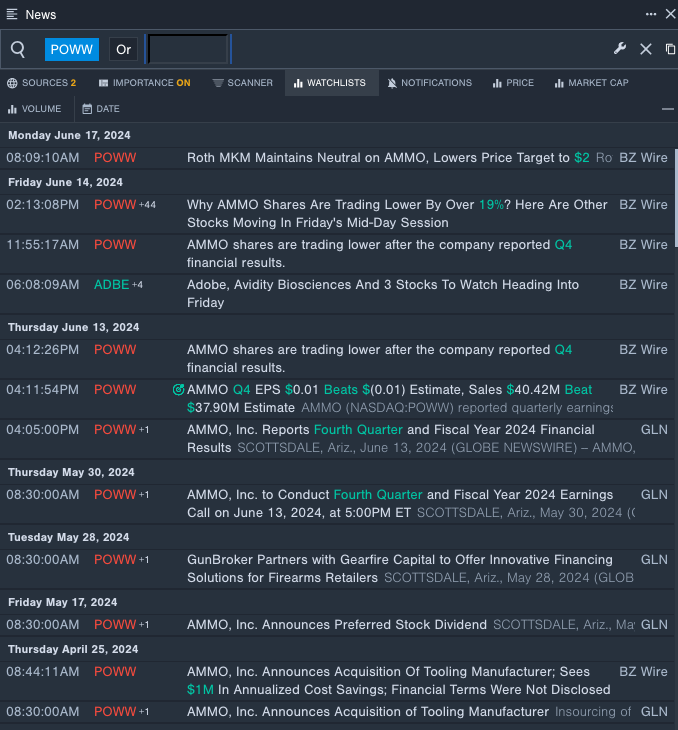

Ammo Inc POWW

- On June 13, AMMO posted a profit for the first quarter. Jared Smith, AMMO’s CEO, commented “Sales increased sequentially despite a slower market environment. We continued to make progress this quarter and ended the fiscal year with a strong pipeline of rifle ammunition and casing sales while accelerating our buildout of GunBroker’s capabilities. This is most evident as we start to deliver on our ZRO Delta contract, while continuing the advancement in financing, cross selling, and carting of accessories that will take place with GunBroker in Fiscal 2025.” The company's stock fell around 38% over the past month and has a 52-week low of $1.60.

- RSI Value: 29.16

- POWW Price Action: Shares of Ammo gained 1.8% to close at $1.68 on Friday.

- Benzinga Pro's real-time newsfeed alerted to latest POWW's news.

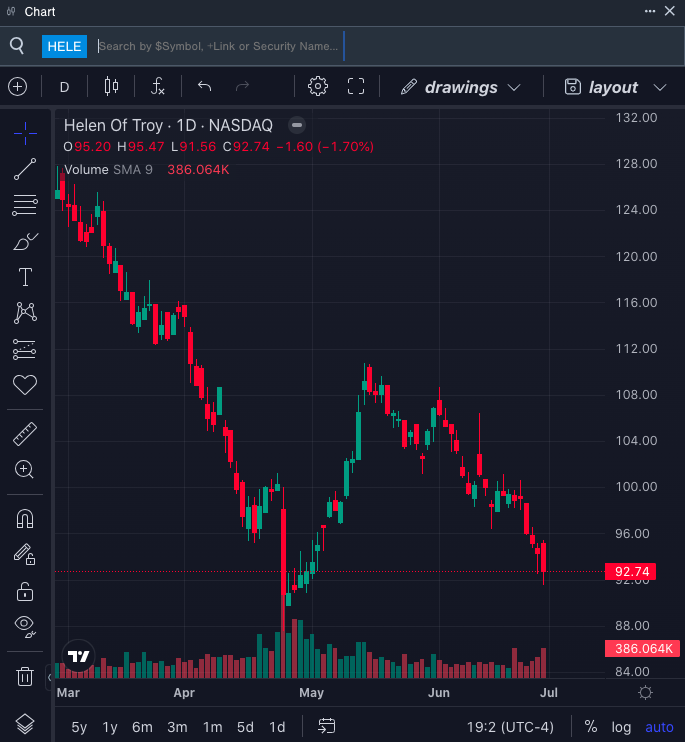

Helen of Troy Limited HELE

- Helen of Troy is scheduled to release its first quarter fiscal 2025 results before the opening bell on Tuesday, July 9. The company's stock fell around 13% over the past month. It has a 52-week low of $87.50.

- RSI Value: 28.92

- HELE Price Action: Shares of Helen of Troy fell 1.7% to close at $92.74 on Friday.

- Benzinga Pro's charting tool helped identify the trend in HELE's stock.

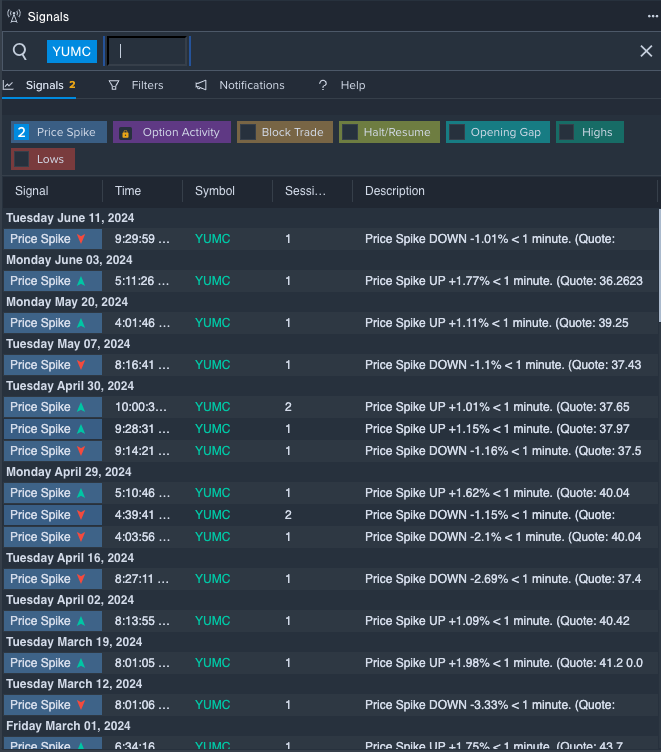

Yum China Holdings Inc YUMC

- On April 29, Yum China reported mixed first-quarter financial results. Joey Wat, CEO of Yum China, commented, “We achieved solid sales growth in the first quarter with total revenues hitting an all-time high. Our core operating profit grew modestly from last year’s high base and EPS was up double digits excluding foreign currency.” The company's stock fell around 18% over the past month and has a 52-week low of $30.76.

- RSI Value: 22.38

- YUMC Price Action: Shares of Yum China fell 1.5% to close at $30.84 on Friday.

- Benzinga Pro's signals feature notified of a potential breakout in Yum China's shares.

Check This Out: Wall Street’s Most Accurate Analysts Give Their Take On 3 Health Care Stocks With Over 3% Dividend Yields

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.