The most oversold stocks in the financials sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

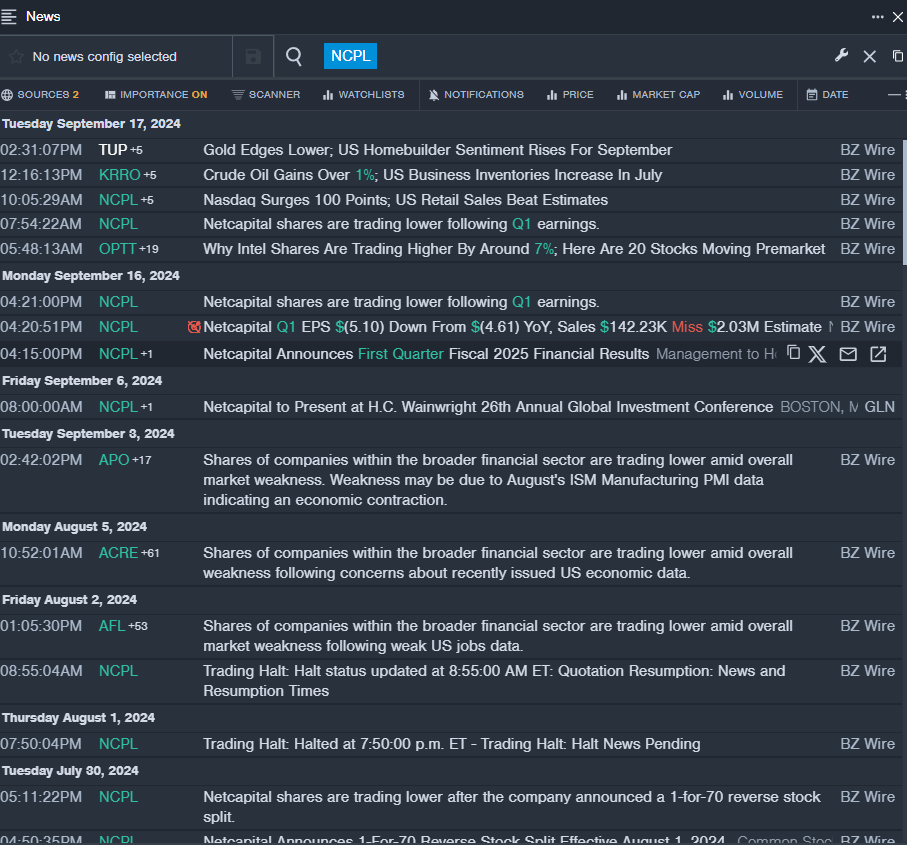

Netcapital Inc NCPL

- On Sept. 16, Netcapital posted a first-quarter loss of $5.10 per share. “This was a challenging quarter for us, driven primarily by a decrease in revenues for services that we provide in exchange for equity securities,” said Martin Kay, CEO of Netcapital Inc. “However, we have taken what we believe are important steps to lay the groundwork for future opportunities.” The company's stock fell around 40% over the past five days and has a 52-week low of $1.54.

- RSI Value: 29.24

- NCPL Price Action: Shares of Netcapital fell 5.2% to close at $1.63 on Thursday.

- Benzinga Pro's real-time newsfeed alerted to latest NCPL news.

Reliance Global Group Inc RELI

- On Sept. 9, Reliance Global Group provided an update on the pending acquisition of Spetner Associates, including a significant reduction in the upfront cash payment required to close the transaction. The company's stock fell around 11% over the past five days. It has a 52-week low of $2.12.

- RSI Value: 27.09

- RELI Price Action: Shares of Reliance Global fell 5.8% to close at $2.45 on Thursday.

- Benzinga Pro’s charting tool helped identify the trend in RELI stock.

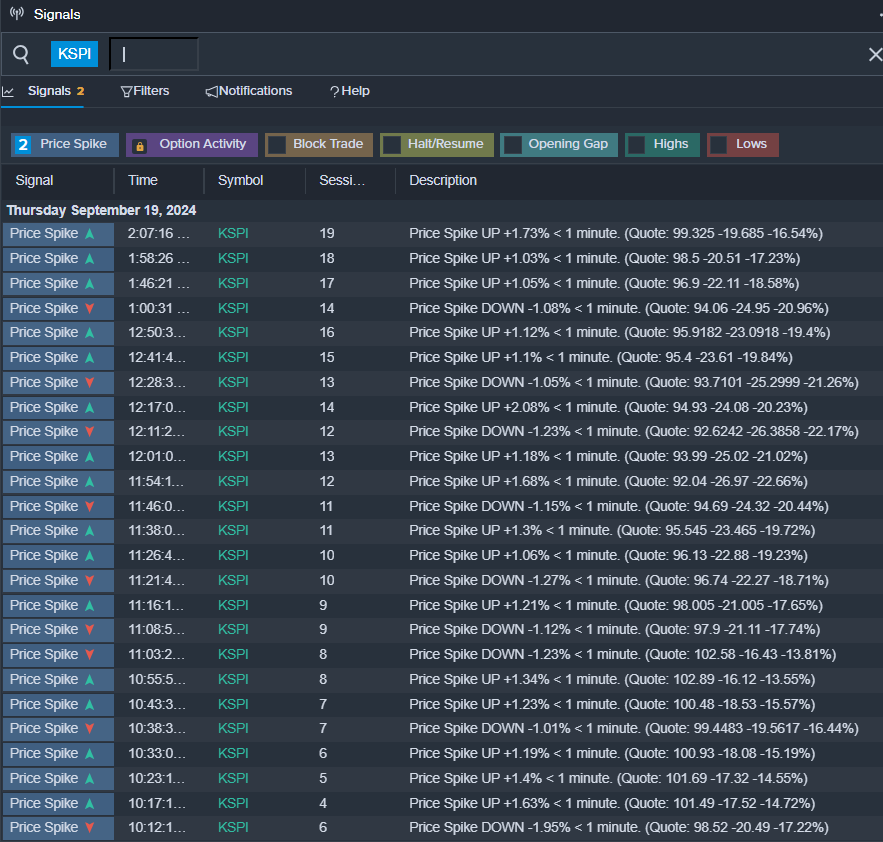

Kaspi.kz AO – ADR KSPI

- On Sept. 19, Culper Research issued a report on the company. The company's shares fell around 21% over the past five days and has a 52-week low of $85.02.

- RSI Value: 18.65

- KSPI Price Action: Shares of Kaspi.kz AO fell 16.1% to close at $99.81 on Thursday.

- Benzinga Pro’s signals feature notified of a potential breakout in KSPI shares.

Read More:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.