The most oversold stocks in the health care sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

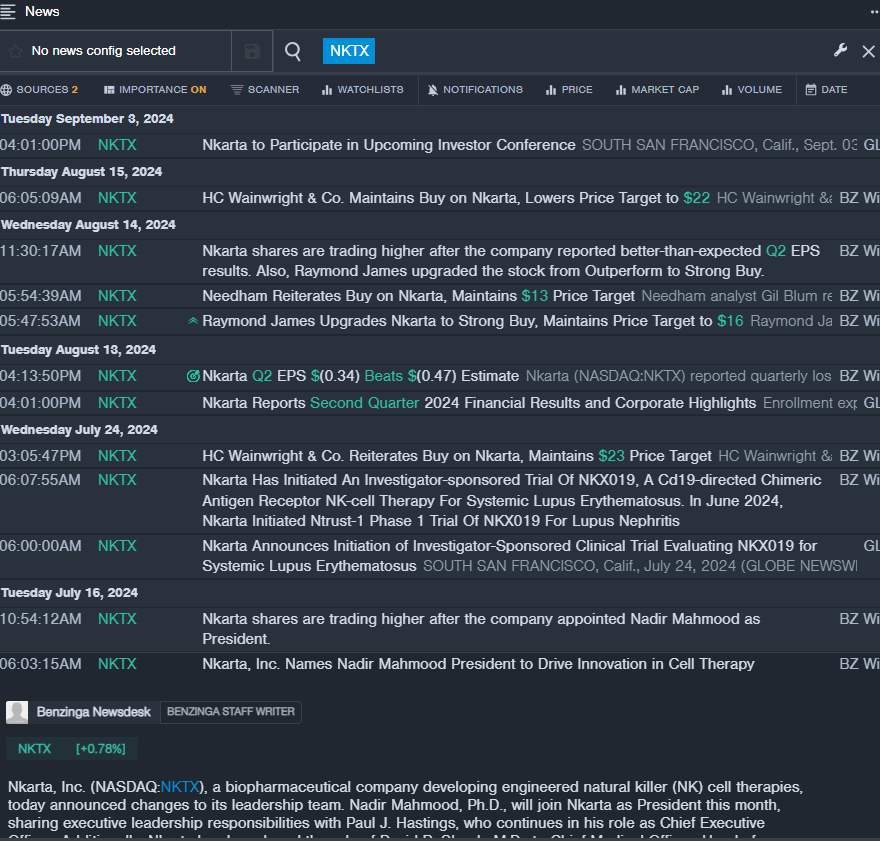

Nkarta Inc NKTX

- On Aug. 13, Nkarta reported better-than-expected second-quarter EPS results. “Patients remain our focus, and early execution on our clinical trials across disease areas is a testament to that commitment,” said Paul J. Hastings, CEO of Nkarta. “NKX019 has the potential to reach people living with a wide range of autoimmune diseases, and we will continue to evaluate ways to maximize our impact in this field. Our cellular engineering enables us to evaluate a reduced toxicity lymphodepletion regimen, to limit hospitalization and patient burden, and spare the complications of other agents.” The company's stock fell around 35% over the past month and has a 52-week low of $1.32.

- RSI Value: 29.34

- NKTX Price Action: Shares of Nkarta fell 2% to close at $3.84 on Monday.

- Benzinga Pro's real-time newsfeed alerted to latest NKTX news.

Moderna Inc MRNA

- On Sept. 30, Moderna said it has dosed the first US participant in Nova 301 Phase 3 trial evaluating the efficacy, safety, and immunogenicity of an investigational norovirus vaccine, mRNA-1403. “Norovirus is a significant public health concern that affects millions of people worldwide each year, leading to severe symptoms and, in some cases, hospitalization,” said Stéphane Bancel, CEO of Moderna. “By advancing our investigational norovirus vaccine into a pivotal Phase 3 trial, we are one step closer to potentially providing a new tool to prevent infection from this highly contagious virus, which places a significant burden on health systems globally.” The company's stock fell around 23% over the past month. It has a 52-week low of $58.33.

- RSI Value: 24.97

- MRNA Price Action: Shares of Moderna fell 2.5% to close at $58.72 on Monday.

- Benzinga Pro’s charting tool helped identify the trend in MRNA stock.

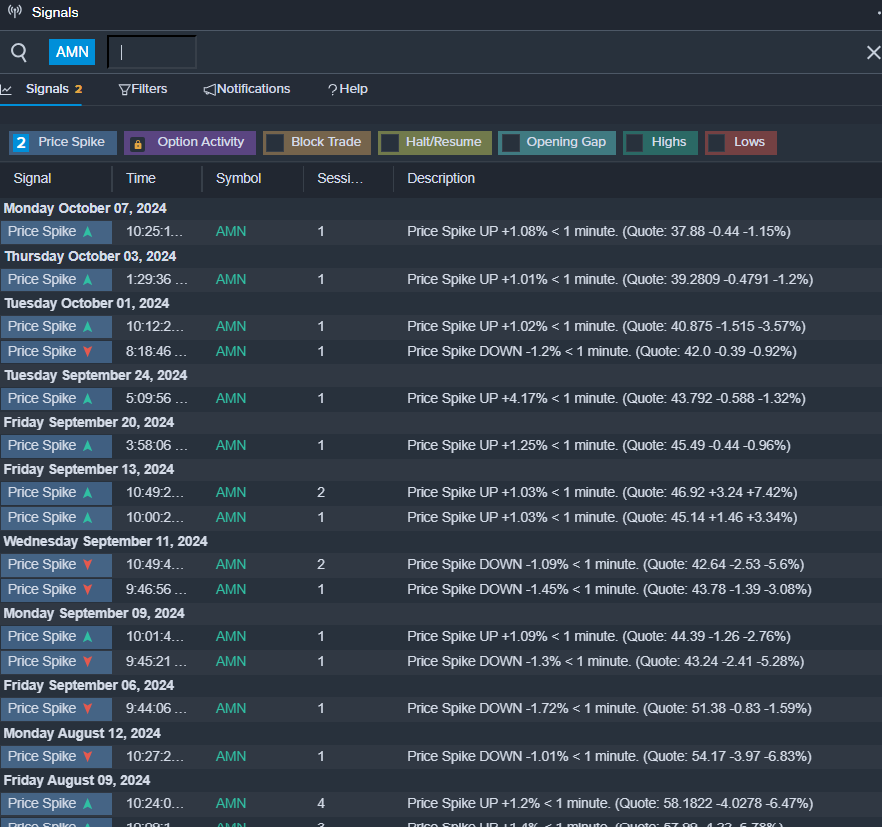

AMN Healthcare Services, Inc. AMN

- On Oct. 7, B of A Securities analyst Kevin Fischbeck downgraded AMN Healthcare Services from Neutral to Underperform and lowered the price target from $65 to $48. The company's shares fell around 15% over the past month and has a 52-week low of $36.50.

- RSI Value: 29.20

- AMN Price Action: Shares of AMN Healthcare gained 0.8% to close at $38.64 on Monday.

- Benzinga Pro’s signals feature notified of a potential breakout in AMN shares.

Read More:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.