As of Oct. 21, 2024, four stocks in the consumer discretionary sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

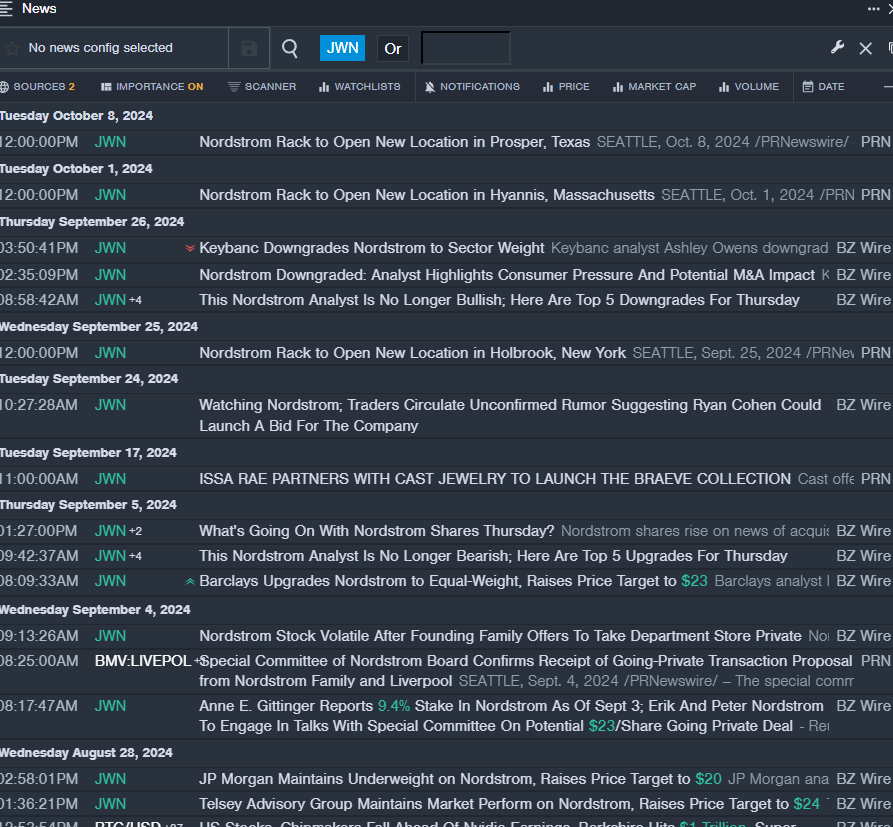

Nordstrom Inc JWN

- On Sept. 26, Keybanc analyst Ashley Owens downgraded Nordstrom from Overweight to Sector Weight. The company's stock gained around 10% over the past five days and has a 52-week high of $24.93.

- RSI Value: 76.29

- JWN Price Action: Shares of Nordstrom gained 0.9% to close at $24.67 on Friday.

- Benzinga Pro's real-time newsfeed alerted to latest JWN news.

Toll Brothers Inc TOL

- On Oct. 2, Oppenheimer analyst Tyler Batory maintained Toll Brothers with an Outperform and raised the price target from $168 to $189. The company's stock gained around 6% over the past five days and has a 52-week high of $160.12.

- RSI Value: 72.41

- TOL Price Action: Shares of Toll Brothers rose 1.9% to close at $159.58 on Friday.

- Benzinga Pro’s charting tool helped identify the trend in TOL stock.

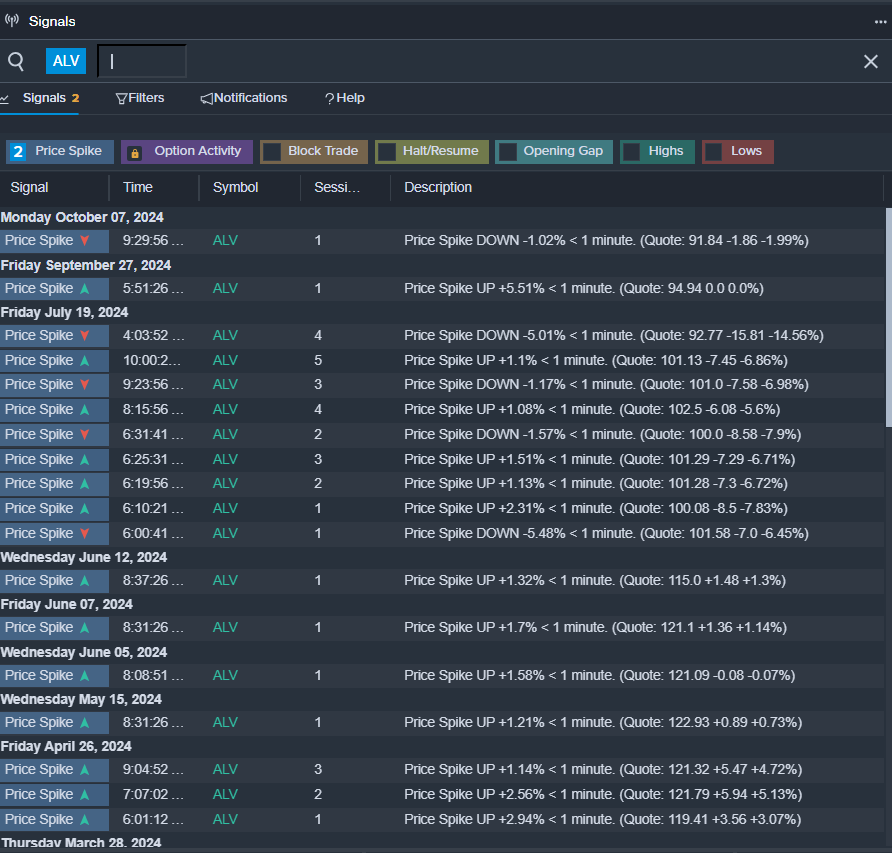

Autoliv Inc ALV

- On Oct. 18, Autoliv reported better-than-expected third-quarter sales results. Mikael Bratt, President & CEO said, "Light vehicle production was weak in the third quarter, declining by close to 5% globally. This was driven by a combination of inventory reductions, especially in the Americas and a high comparison base, especially in China. In this tough environment, Autoliv managed to outgrow LVP by 4pp, enabling almost unchanged sales and operating income. This is despite a $14 million cost item related to a supplier settlement." The company's stock gained around 6% over the past five days and has a 52-week high of $129.38.

- RSI Value: 70.49

- ALV Price Action: Shares of Autoliv gained 6% to close at $99.52 on Friday.

- Benzinga Pro’s signals feature notified of a potential breakout in ALV shares.

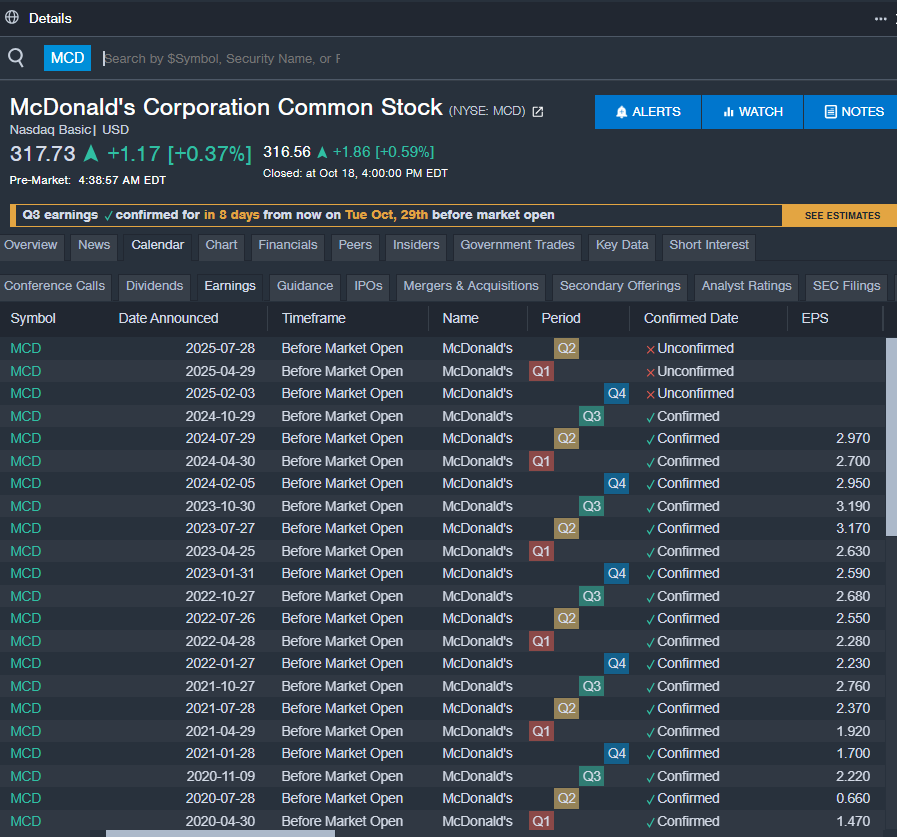

McDonald’s Corp MCD

- On Oct. 16, TD Cowen analyst Andrew Charles maintained McDonald’s with a Hold and raised the price target from $280 to $300. The company's stock jumped around 6% over the past month and has a 52-week high is $317.18.

- RSI Value: 82.85

- MCD Price Action: Shares of McDonald’s gained 0.6% to close at $316.56 on Friday.

- Benzinga Pro's earnings calendar was used to track upcoming MCD earnings reports.

Read More:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.