The most oversold stocks in the information technology sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

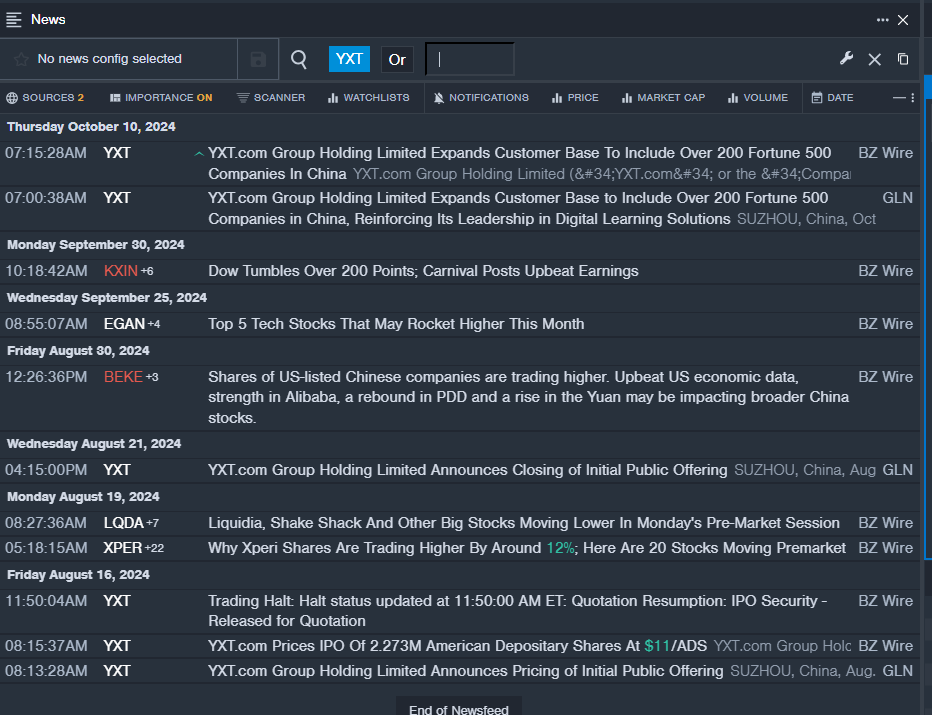

YXT.Com Group Holding Ltd – ADR YXT

- On Oct. 10, YXT.com Group expanded customer base to include over 200 Fortune 500 companies in China. The company's stock fell around 42% over the past month and has a 52-week low of $2.10.

- RSI Value: 29.6347

- YXT Price Action: Shares of YXT.Com fell 6.3% to close at $2.10 on Wednesday.

- Benzinga Pro's real-time newsfeed alerted to latest YXT news.

Verint Systems Inc. VRNT

- On Sept. 25, Needham analyst Joshua Reilly reiterated Verint with a Buy and maintained a $40 price target. The company's stock fell around 6% over the past five days and has a 52-week low of $18.41.

- RSI Value: 21.29

- VRNT Price Action: Shares of Verint fell 0.6% to close at $21.89 on Wednesday.

- Benzinga Pro’s charting tool helped identify the trend in VRNT stock.

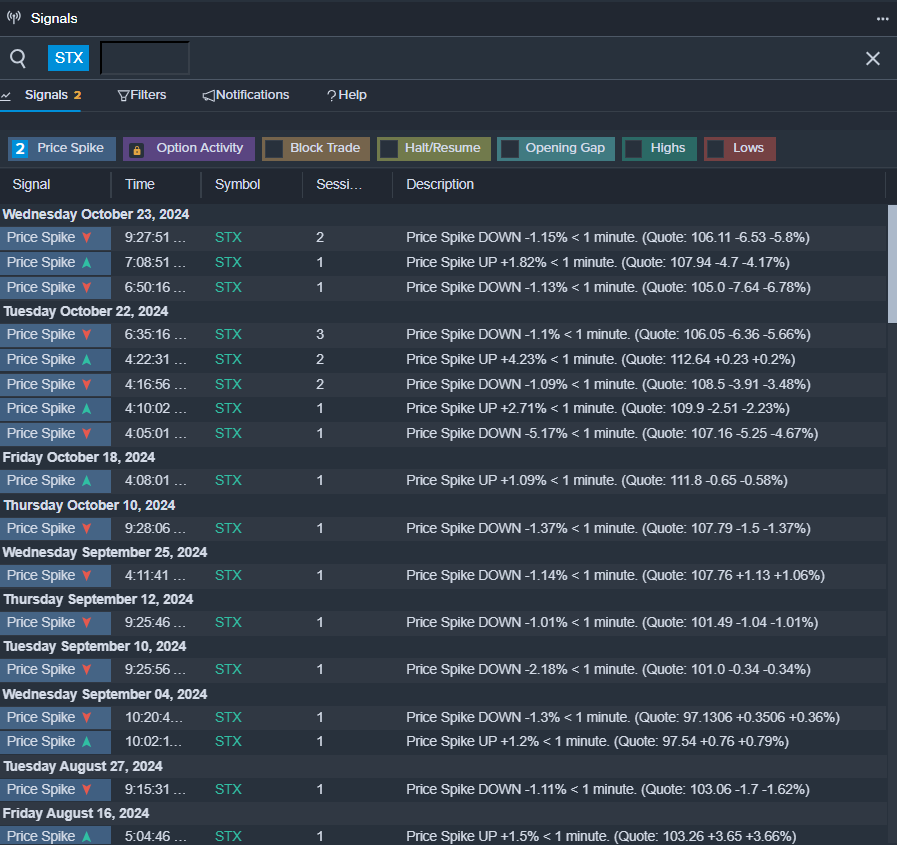

Seagate Technology Holdings PLC STX

- On Oct. 22, the company reported first-quarter revenue of $2.17 billion, beating the consensus of $2.119 billion. Adjusted gross margin rose to 33.3% from 19.8% a year ago quarter. Adjusted operating margin escalated to 20.4% from 2.8% in the prior-year quarter. Adjusted EPS of $1.58 beat the consensus of $1.46. The company's shares fell around 8% over the past five days and has a 52-week low of $64.12.

- RSI Value: 27.97

- STX Price Action: Shares of Seagate fell 8.1% to close at $103.52 on Wednesday.

- Benzinga Pro’s signals feature notified of a potential breakout in STX shares.

Read More:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.