The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

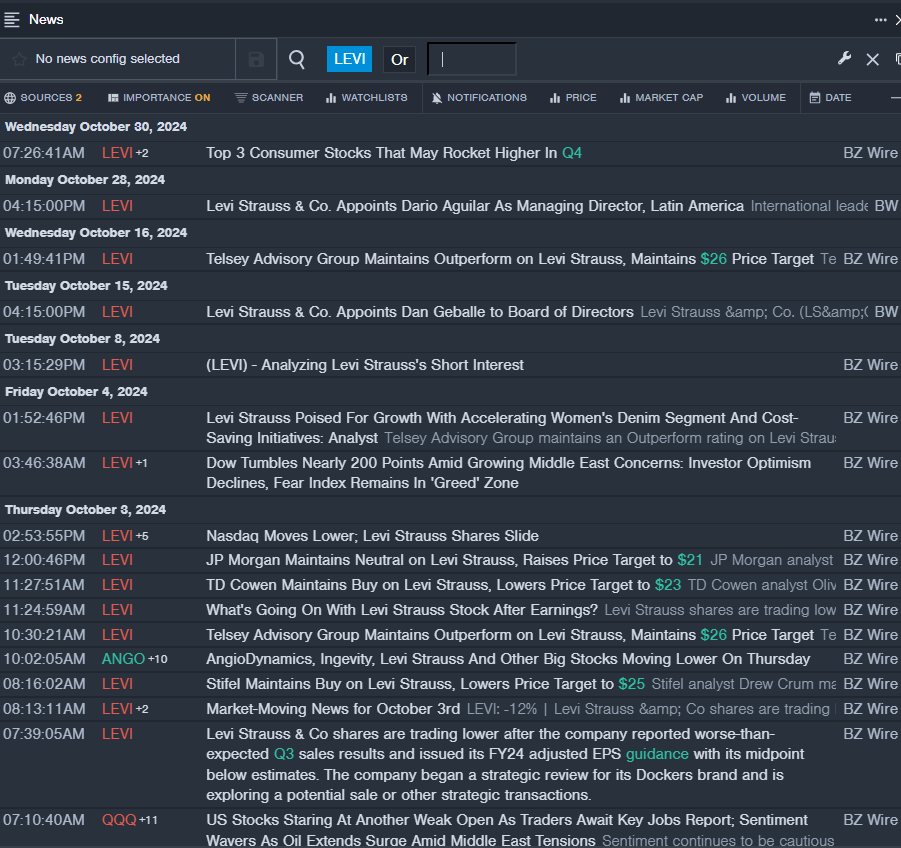

Levi Strauss & Co LEVI

- On Oct. 28, Levi Strauss named Dario Aguilar as Managing Director, Latin America. The company's stock fell around 11% over the past month and has a 52-week low of $13.94.

- RSI Value: 29.52

- LEVI Price Action: Shares of Levi fell 0.7% to close at $16.86 on Tuesday.

- Benzinga Pro's real-time newsfeed alerted to latest LEVI news.

Crocs Inc CROX

- On Oct. 29, Crocs reported third-quarter financial results and lowered its revenue guidance related to the HEYDUDE Brand. The company reported adjusted earnings per share of $3.60 (+11%), beating the street view of $3.10. Quarterly revenues of $1.062 billion (+2%) beat the analyst consensus of $1.05 billion. The company's stock fell around 27% over the past month and has a 52-week low of $77.16.

- RSI Value: 25.13

- CROX Price Action: Shares of Crocs fell 0.9% to close at $101.98 on Tuesday.

- Benzinga Pro’s charting tool helped identify the trend in CROX stock.

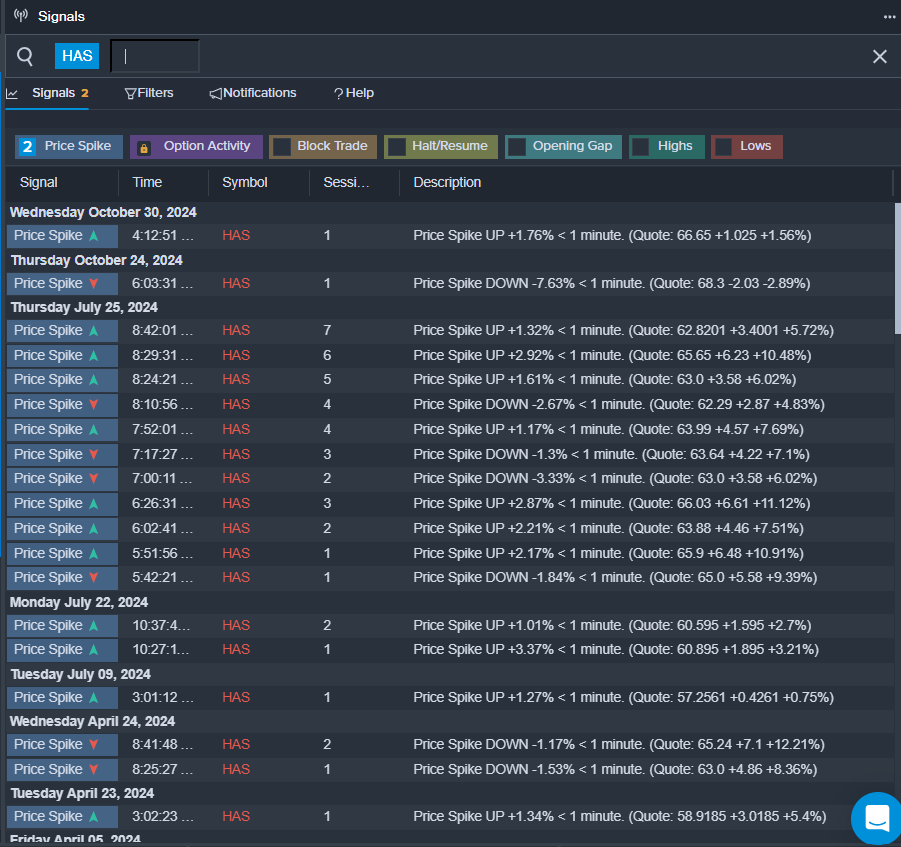

Hasbro Inc HAS

- On Oct. 24, Hasbro reported a third-quarter sales decline of 15% year-on-year to $1.281 billion, marginally missing the analyst consensus estimate of $1.295 billion. “We continue to execute our turnaround efforts and are poised to finish the year with improved profitability, cash flow and operational rigor,” said Gina Goetter, Hasbro’s Chief Financial Officer. The company's stock fell around 11% over the past month and has a 52-week low of $42.70.

- RSI Value: 29.26

- HAS Price Action: Shares of Hasbro fell 1.1% to close at $63.42 on Tuesday.

- Benzinga Pro’s signals feature notified of a potential breakout in HAS shares.

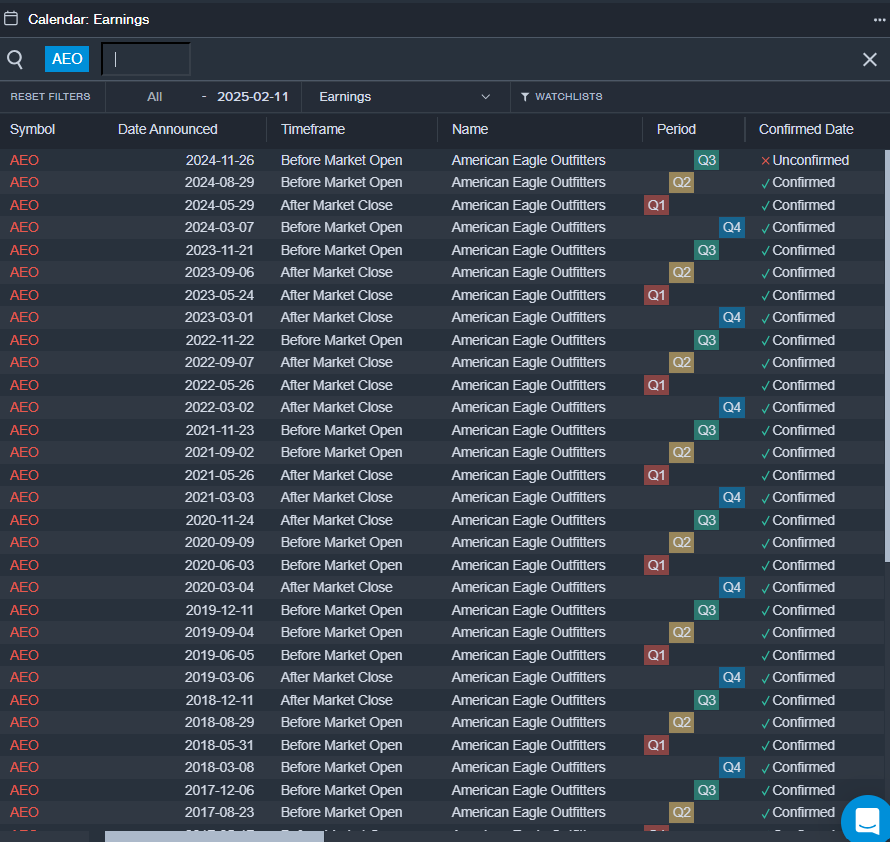

American Eagle Outfitters Inc AEO

- On Nov. 12, Jefferies analyst Corey Tarlowe maintained American Eagle with a Hold and lowered the price target from $22 to $19. The company's shares lost around 13% over the past month. The company's 52-week low is $73.04.

- RSI Value: 15.92

- AEO Price Action: Shares of American Eagle fell 1.5% to close at $17.94 on Tuesday.

- Benzinga Pro's earnings calendar was used to track upcoming AEO earnings reports.

Read More:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.