A stock set to report earnings has options pricing in a certain expected move based on the uncertainty surrounding the earnings release. This can lead to elevated premiums (making options more expensive). After earnings, with the uncertainty gone, options reset to price more day-to-day expected moves. That means that further out-the-money Calls or Puts, particularly beyond where the stock actually moves, may see a sharp overnight decline in implied volatility (making them less expensive). In other words, if you’ve used options to trade a view, you may not realize a profit even if you were right on direction.

With options however, there are more ways to trade than just Calls or Puts. Debit spreads can reduce the overall exposure to premium by lowering cost, while giving some protection to declining volatility. Credit Spreads position to actually benefit from declining volatility by being net short premium (selling options and receiving premium rather than buying and paying a premium). Of course, direction is still the most important variable, but smarter positioning can lessen, eliminate, or even benefit from some of the other variables. This said, there are additional risks associated with spreads, including liquidity and assignment, that every investor should also be aware of.

Below we’ll look at some of the expected moves for companies reporting this week, and use NIO as an example to highlight some of the various ways Spreads can be used as an alternative to outright Calls and Puts.

Expected Moves

The expected move is the amount that options traders believe a stock price will move up or down. It can serve as a quick way to see where real-money option traders are pricing the future movement of a stock. That consensus is derived from the price (or implied volatility) of at-the-money options. An easy way to think about it is if the stock moves inside the expected move, options were overpriced, and if the stock moves outside the expected move, options were underpriced.

Knowing this consensus before making a trade can be incredibly powerful, regardless of whether you’re using stock or options to make your trade. Below we’ll see how it might also be as a basis for starting strike selection. Options AI puts the expected move at the center of its trading experience.

Expected Moves

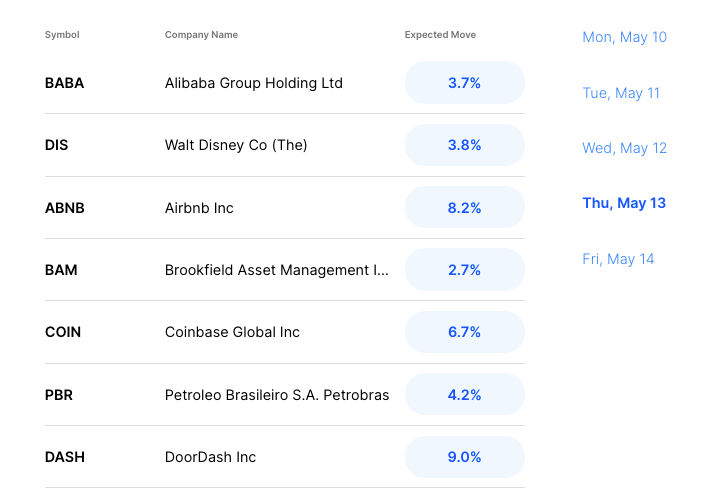

Below are expected moves for a few of the companies reporting today including Alibaba (pre-market), Disney, Airbnb and Coinbase, via the Options AI Earnings Calendar (free to use):

Thursday

Disney (DIS) reports earnings Thursday after the close. Options are pricing an almost 4% expected move in the stock.

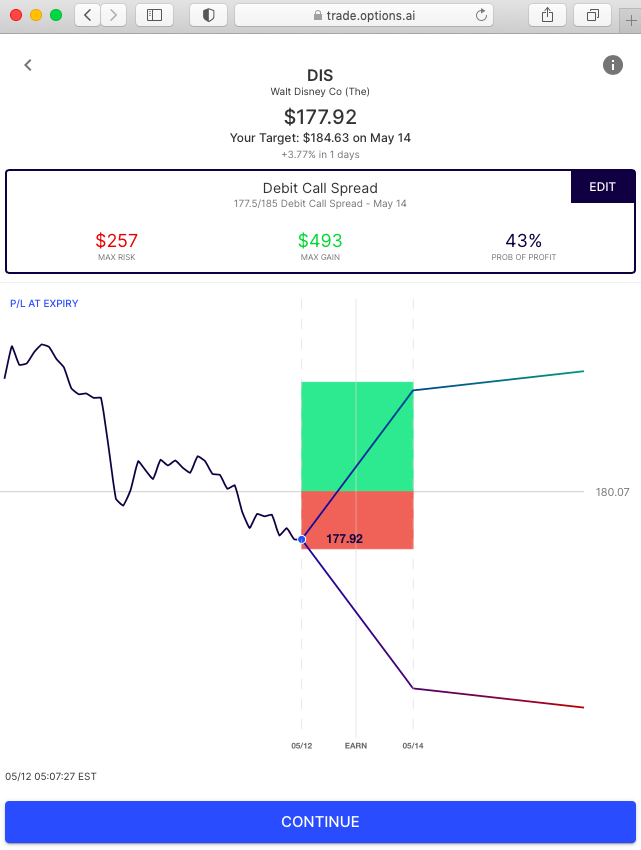

At the time of writing the stock is around $178. The nearly 4% expected move means options are pricing a bullish consensus of around $185 in the stock and a bearish consensus of around $171. Via Options AI:

Below, we’ll explore further how the expected move might be utilized by option traders themselves. Particularly in helping guide strike selection in strategies that seek to reduce costs, or reduce exposure to declining volatility.

Call Alternatives

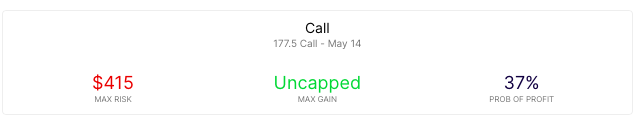

At the time of writing, buying a weekly (May 14th) $177.50 (at-the-money) Call costs about $4.15, or $415 in premium. In order for the Call to be profitable on Friday’s expiration, the stock would need to be above $181.65.

A slightly out-of-the-money Call, the $180 for instance, lowers the cost of a Call slightly, to about $3.00. But buying that Call would need the stock above $183 on Friday’s expiration.

Now, let’s take a scenario where a trader wants to position for a move higher but with a breakeven closer to where the stock is currently trading. One way to do that is to use the 4% expected move to guide strike selection for a Debit Call Spread. One that lowers the breakeven vs outright calls.

Using the Options AI platform, we can generate a trade buying the at-the-money 177.50 call for around 4.15, while simultaneously selling the 185 call around 1.55, creating a 177.50/185 call spread for around 2.60. That lowers the breakeven to roughly 180.10. That’s about 1.50 closer to the current stock price than the 187.50 call outright:

The trader has also reduced their overall exposure to elevated volatility in the options versus an outright call. Less capital is at risk, and a lesser move higher is needed in order to at least breakeven.

Aside from the additional potential risks of option spreads (such as early assignment and liquidity), it is important to note that a spread caps potential profits (if the stock moves beyond $185).

Put Alternatives

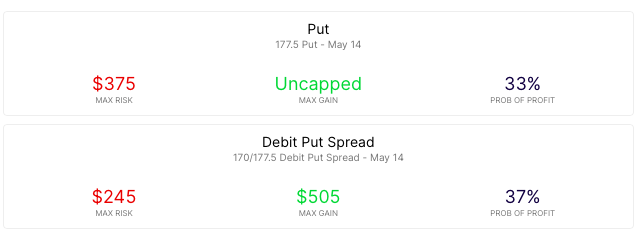

If a trader is interested in positioning for a move lower in the stock, the bearish consensus could also be used for initial trade setup. Again, using the Options AI platform, with May 14th expiry, again lowering the cost of a bearish trade by around $140, and therefore closer to the current stock price. Here’s a direct comparison:

If a trader wants to position for the stock going lower, the magnitude of the move would need to be lower than the breakeven. The Debit Put Spread is able to get that breakeven closer to where the stock is currently trading.

Credit Spreads

Another way for a trader to express a view is by selling premium in the form of a Credit Spread. This trade typically risks more to make less, but instead of requiring the stock to move in the direction of the traders’ view, it is profitable if the stock doesn’t move in the opposite direction. It can be thought of as selling to those that are positioning for a move, upwards or downwards.

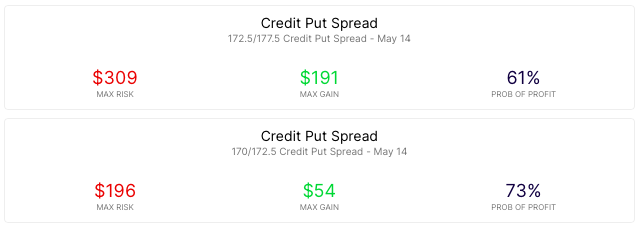

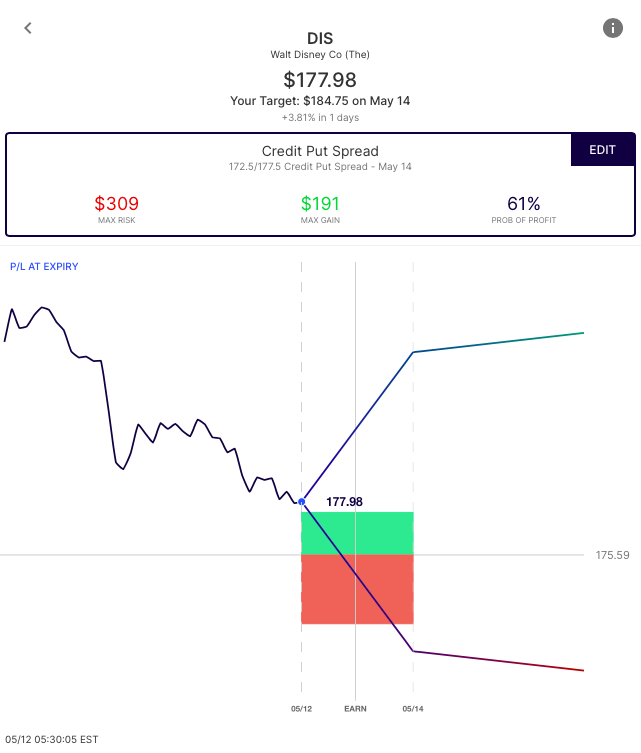

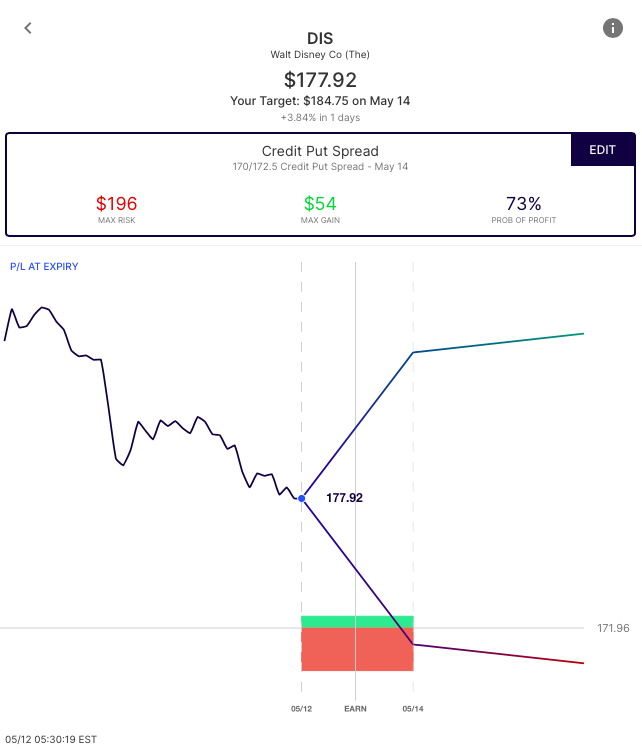

Below are examples of bullish Credit Put spreads based on the expected move, one at-the-money, the other out-of-the-money:

Here are two bullish Credit Put Spreads trades side by side:

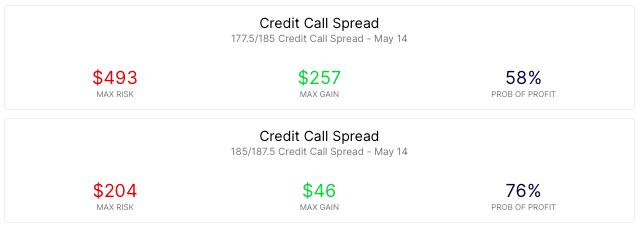

And for those looking to position against the stock going higher, bearish credit call spreads:

Out of the money Credit Put and Call spreads can even be combined to form an Iron Condor, a credit spread that looks to make money if the stock stays within the strikes (in this example, outer strikes based on the expected move):

In this example, the trade sees maximum profit if the stock is anywhere between approximately $178 and $185 on Friday’s expiration. A trader would use this Iron Condor to express a view that options are overpricing a potential move. It is max loss above $187.50 or below $167.50. A move that would mean that options were underpriced.

Options AI puts the expected move at the heart of its trading platform. It allows traders to quickly generate and compare more ways to trade, by entering an informed price target or using the expected move for initial strike selection.

Options AI provides a couple of free tools like an expected move calculator, as well as an earnings calendar with expected moves. More education on expected moves and spread trading can be found at Learn / Options AI.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.