Good Morning Everyone!

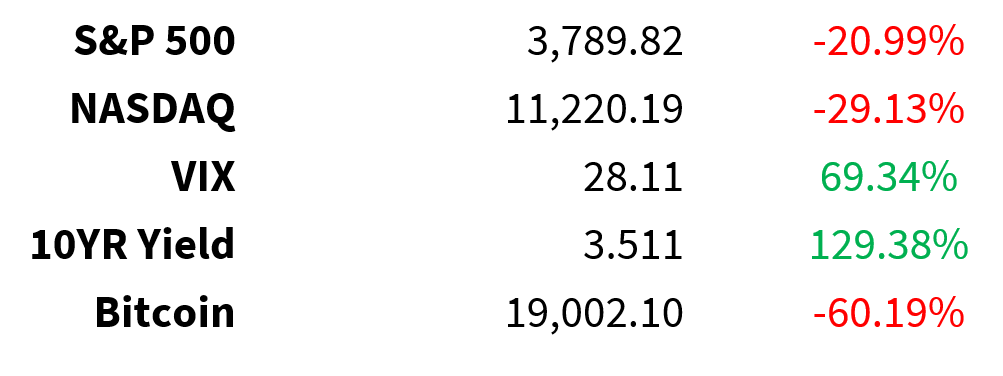

Prices as of 4 pm EST, 9/21/22; % YTD

MARKET UPDATE

Fed lifted interest rates by expected 75bps

-

Third consecutive 75bps hike

-

Powell signaled more to come

-

Comments more hawkish than expected

-

“The chances of a soft landing are likely to diminish to the extent that policy needs to be more restrictive, or restrictive for longer”

-

Current: 3.00-3.25%

-

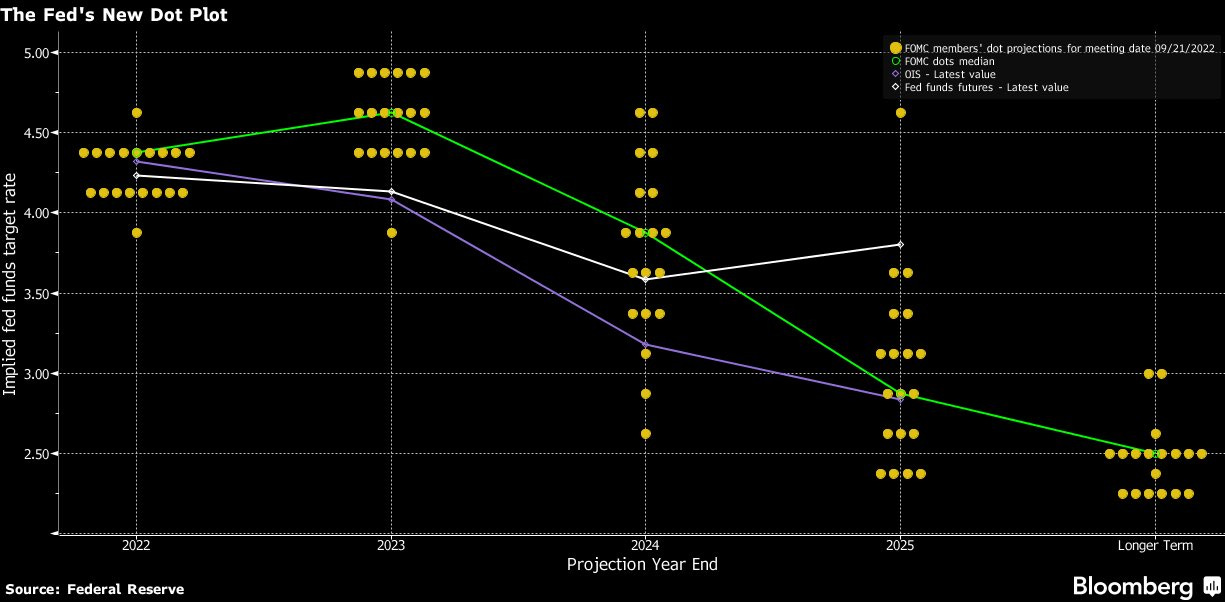

Median forecast has rates hitting 4.4% by end of 2022, 4.6% in 2023

-

75bps in November followed by 50bps in December?

-

-

New Dot Plot:

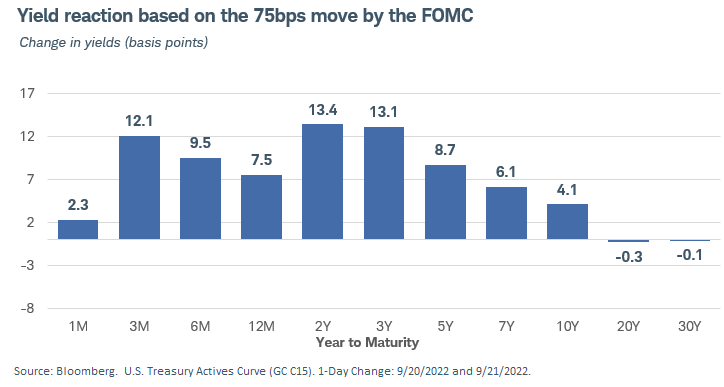

Bond Market reaction

-

Yields on US Treasury bonds jumped on the Fed’s decision

-

Highest yields since

-

US2Y - October 2007 (>4%)

-

US10Y - February 2011

-

US30Y - April 2013

-

-

Yields reaction:

US Q2 Current Account - deficit narrows

-

-$251.1 billion vs. -$260.6 billion expected (prev. -$282.5 billion)

-

Consensus -$260.6 billion

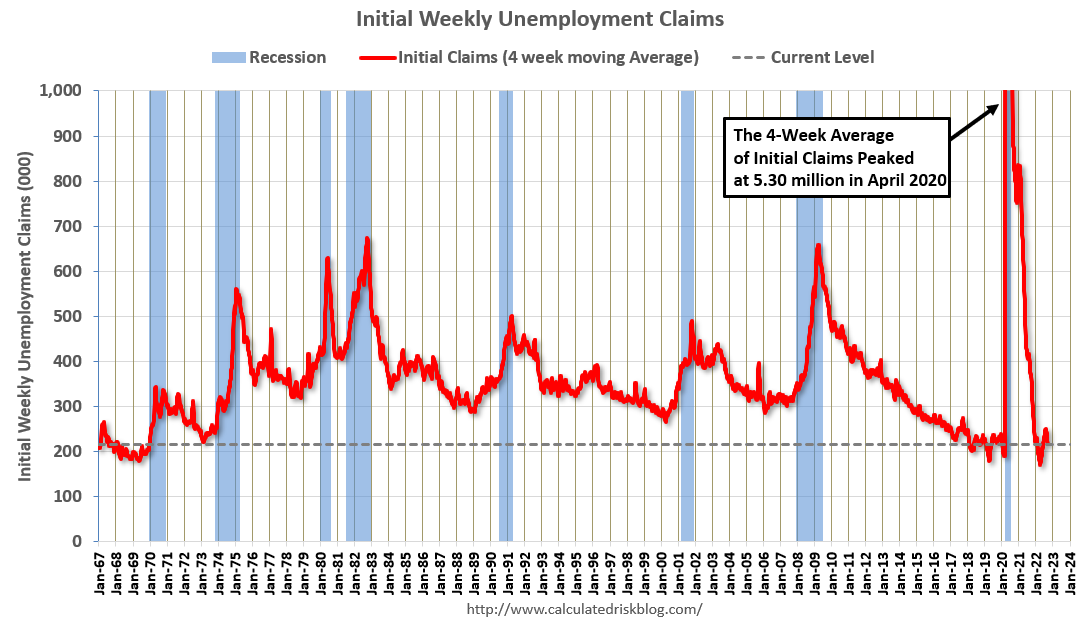

Initial jobless claims - labor market still strong

-

213k vs 218k expected (prev. 208k)

10 am EST - Conference Board Leading Economic Index (LEI)

-

Current data point to already elevated recession risks:

Crude $83

-

Prices dropped on Putin’s mobilization announcement

-

US inventory levels - gasoline and distillate stocks remain below their 5-year ranges:

-

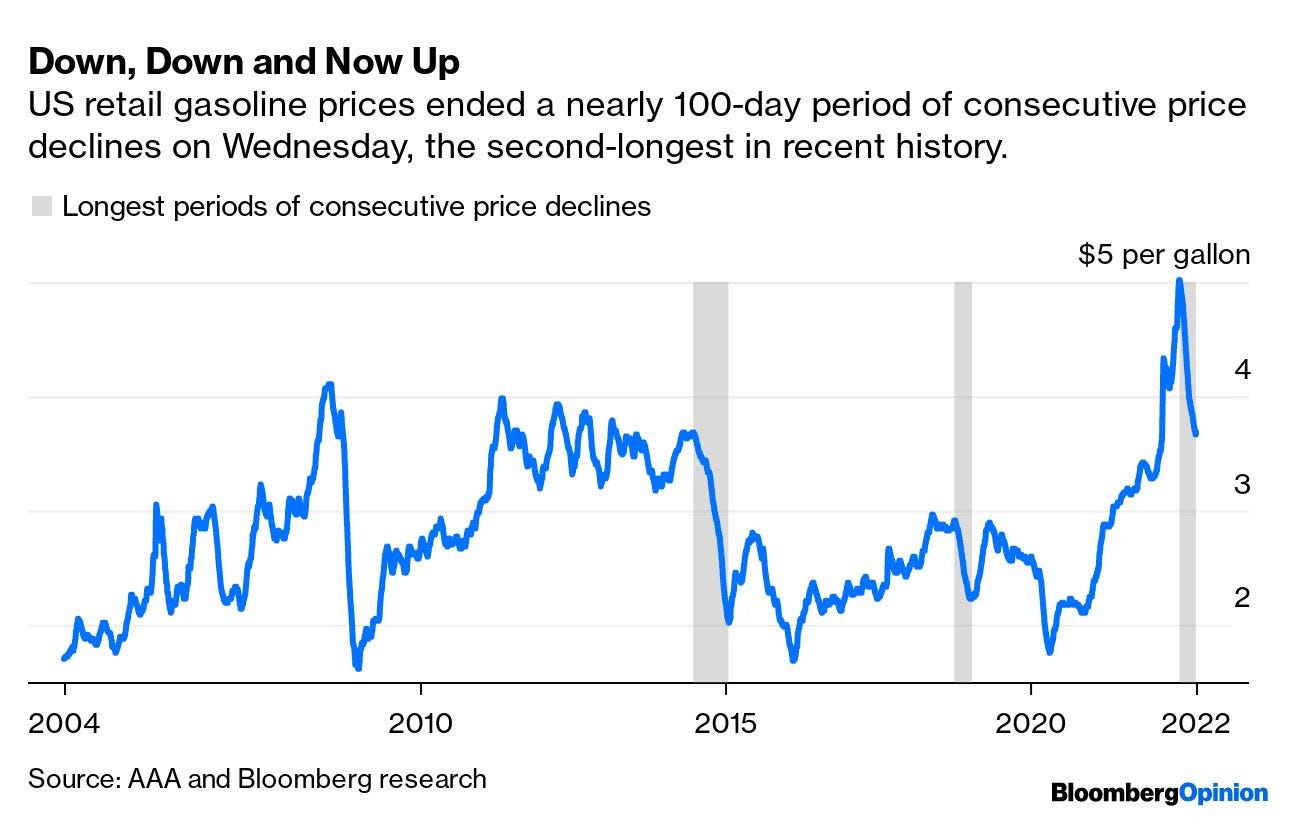

The streak of declining US gasoline prices has ended after 98 days:

Earnings

-

Accenture ACN

-

Darden Restaurants DRI

-

FactSet FDS

-

Manchester United MANU

CRYPTO UPDATE

Stablecoin regulations: US vs. EU

-

In the US, new bill would criminalize creation/issuance of algorithmic stablecoins (think Terra LUNC/USD)

-

Panel could vote as early as this week

-

Some existing stablecoins concerned, uncertain if they fall in this category

-

-

In the EU, new draft of the markets in crypto-assets (MiCA) regulation removes limitations on stablecoins

-

Major win for stablecoin advocates

-

Leaves door open for regulations on DeFi and NFTs

-

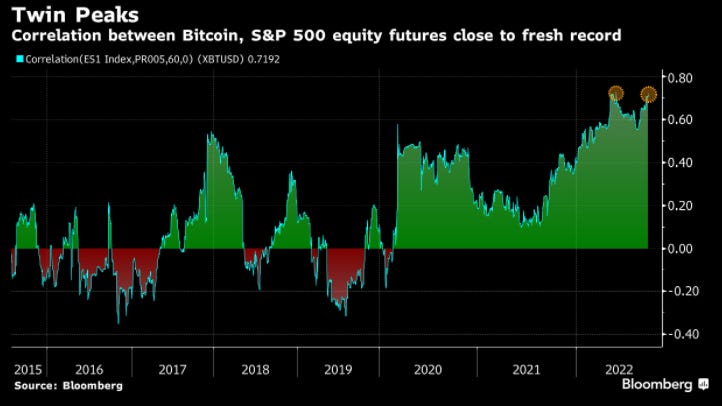

Lockstep: Bitcoin and S&P 500

-

60-day correlation between BTC BTC/USD and S&P 500 futures hit 0.72 this week

-

Just shy of May record

MEME OF THE DAY

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.