Itching to Ease & Two Policy Puts

(BN) POWELL: STRONG HIRING BY ITSELF NOT A REASON TO DELAY RATE CUTS

Once again, the Summary of Economic Projections (SEP) offered a market surprise. The increase in median ‘24 growth and core inflation forecasts, combined with no change in the expected year-end policy rate (though the dispersion tightened and nearly changed to 50bp from 75bp), left little doubt the FOMC has a clear bias to ease. Chair Powell’s press conference responses to questions on inflation and the labor market further strengthened the easing bias; similarly hot inflation readings to January and February would delay easing, but likely not prompt a resumption of the hiking cycle. In addition to the bias to look through the early ‘24 hot inflation readings, Powell’s characterization of the risks to the labor market were consistent with our quadrilemma thesis: a jump in the unemployment rate above the FOMC’s 4% ‘24 forecast and wage growth below 4% would result in the Fed easing immediately, while strong nonfarm payroll increases would not result in hikes (see quote above). Although FOMC participants assert they are data dependent, they are willing to look through the January and February hot inflation prints due to faster potential growth, at least through ‘24, in part due to the surge in immigration. What seems clear to us, but was not explicitly discussed, is the third mandate, low and stable interest rates, and facilitating financing the federal government, is a factor in the easing bias.

This brings us to the discussion of the Fed’s balance sheet; market participants heard the FOMC wants to avoid ‘turbulence’ by slowing the pace of QT ‘fairly soon’ as reserves contract from ‘abundant’ to ‘ample’. What was missed, not by the Treasury market that bull steepened on Fed Day, but by equity investors who bid up small caps and banks (perhaps because Chair Powell intentionally obfuscated the Committee’s intent) was the Fed’s goal to shorten the duration of the System Open Market Account (SOMA). To be fair, all Chair Powell said was they were going to make a decision about the maturity of the SOMA, without elaborating on recent comments from KC Fed President Schmid, Governor Waller or his comments in the Monetary Policy report to Congress, that indicated the Fed should increase holdings of bills. We found it notable that Bank of Canada Deputy Governor Gravelle gave a speech on Thursday morning that went into great detail about shortening the duration of their portfolio as they wind down QT in ‘25. Additionally, the Bank of Japan ended negative rate policy and yield curve control earlier in the week, while keeping the JGB portion of QE in place, for now. Central banks pushing back against debt monetization is likely to be limited in scope, as Fed Chair Bill Martin said in the ‘60s, the Fed is independent, within, not of the government. It shouldn’t be lost on anyone that the Fed slowing QT is likely to occur as the Treasury shrinks bills outstanding by $317 billion and increases coupons by $519 billion. The Fed is focused on reserves and are trying to avoid a repeat of the September ‘19 repo rate spike, but the longer run story is removing their suppression of longer maturity real rates and volatility. That said, if another high velocity selloff in longer maturity Treasuries led by real rates similar to the August through October bear steepening develops, the Fed would likely slow QT and put the plan to shorten duration on hold.

In this week’s note we work through a detailed analysis of Fed policy channels and the three mandates, as well as the inflation and economic risks and implications for markets.

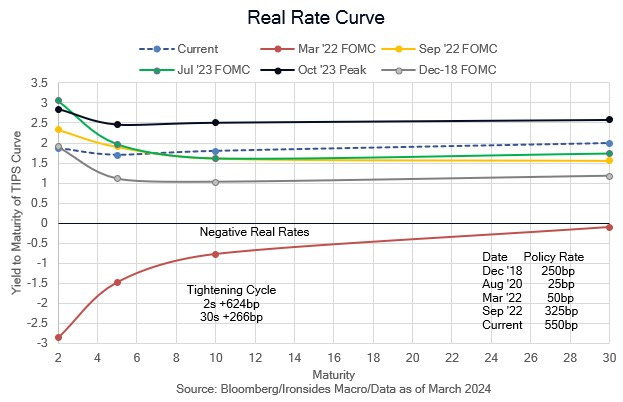

Figure 1: Monetary policy, both rate policy and large-scale asset purchases, works directly through the real rate curve. From the 2-year point of the curve through 30s, real rates are 500bp to 250bp higher when they started the process and above the peak of last cycle with the exception of 2-year TIPS yields.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.