The Nasdaq 100 closed lower by around 0.5% during Monday's session. Investors, meanwhile, focused on some notable insider trades.

When insiders sell shares, it could be a preplanned sale, or could indicate their concern in the company's prospects or that they view the stock as being overpriced. Insider sales should not be taken as the only indicator for making an investment or trading decision. At best, it can lend conviction to a selling decision.

Below is a look at a few recent notable insider sales. For more, check out Benzinga’s insider transactions platform.

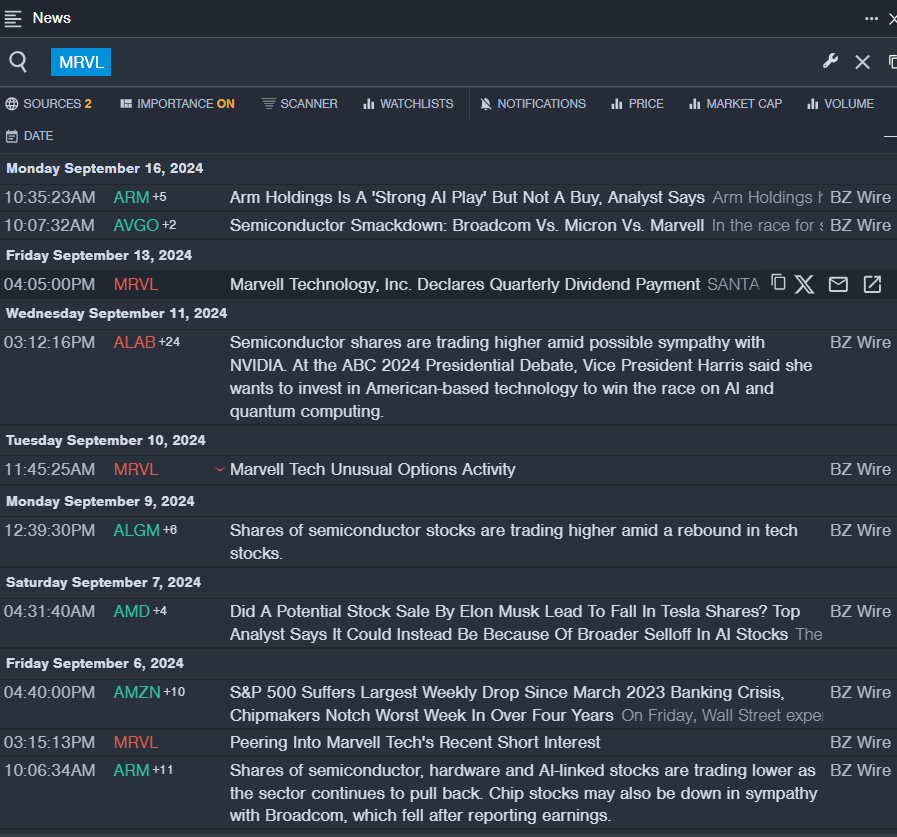

Marvell Technology

- The Trade: Marvell Technology, Inc. MRVL Director Ford Tamer sold a total of 92,000 shares at an average price of $74.16. The insider received around $6.8 million from selling those shares.

- What's Happening: On Sept. 13, Marvell Technology announced a quarterly dividend of 6 cents per share of common stock.

- What Marvell Technology Does: Marvell Technology is a fabless chip designer focused on wired networking, where it has the second-highest market share.

- Benzinga Pro's real-time newsfeed alerted to latest MRVL news.

Northern Trust

- The Trade: Northern Trust Corporation NTRS Director Charles A Tribbett sold a total of 1,855 shares at an average price of $88.12. The insider received around $163,463 from selling those shares.

- What's Happening: On Sept. 10, Northern Trust announced leadership changes.

- What Northern Trust Does: Northern Trust is a leading provider of wealth management, asset servicing, asset management, and banking to corporations, institutions, affluent families, and individuals.

- Benzinga Pro’s charting tool helped identify the trend in NTRS stock.

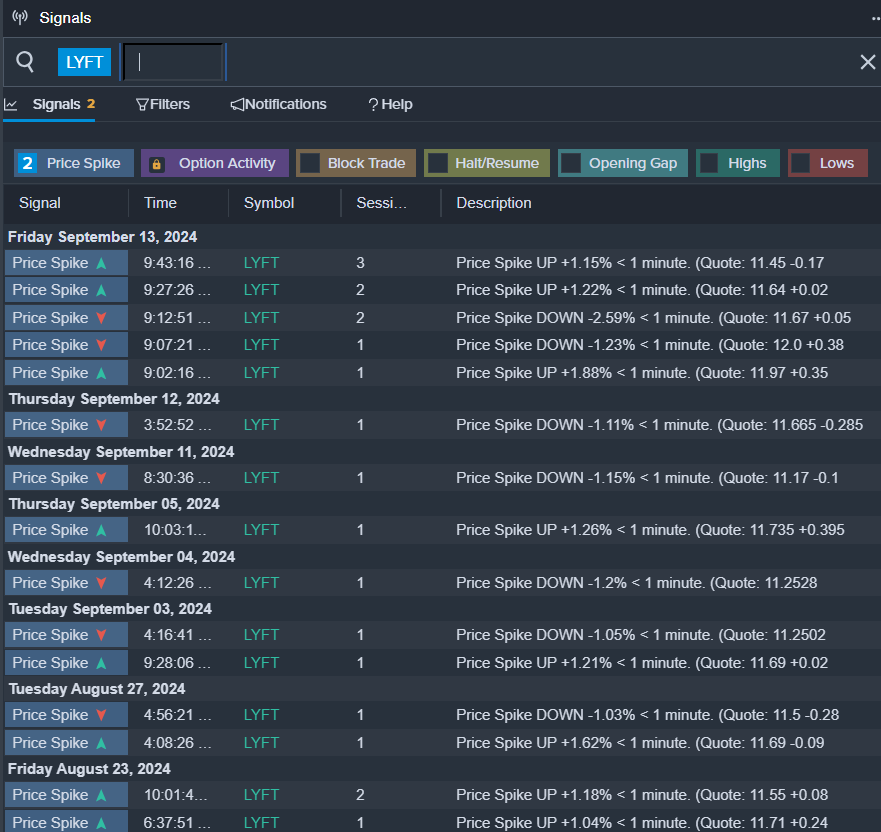

Lyft

- The Trade: Lyft, Inc. LYFT Chief Legal Officer Lindsay Catherine Llewellyn sold a total of 4,243 shares at an average price of $12.00. The insider received around $50,916 from selling those shares.

- What's Happening: On Sept. 5, Cantor Fitzgerald analyst Deepak Mathivanan initiated coverage on Lyft with a Neutral rating and announced a price target of $13..

- What Lyft Does: Lyft is the second-largest ride-sharing service provider in the us and Canada, connecting riders and drivers over the Lyft app.

- Benzinga Pro’s signals feature notified of a potential breakout in LYFT shares.

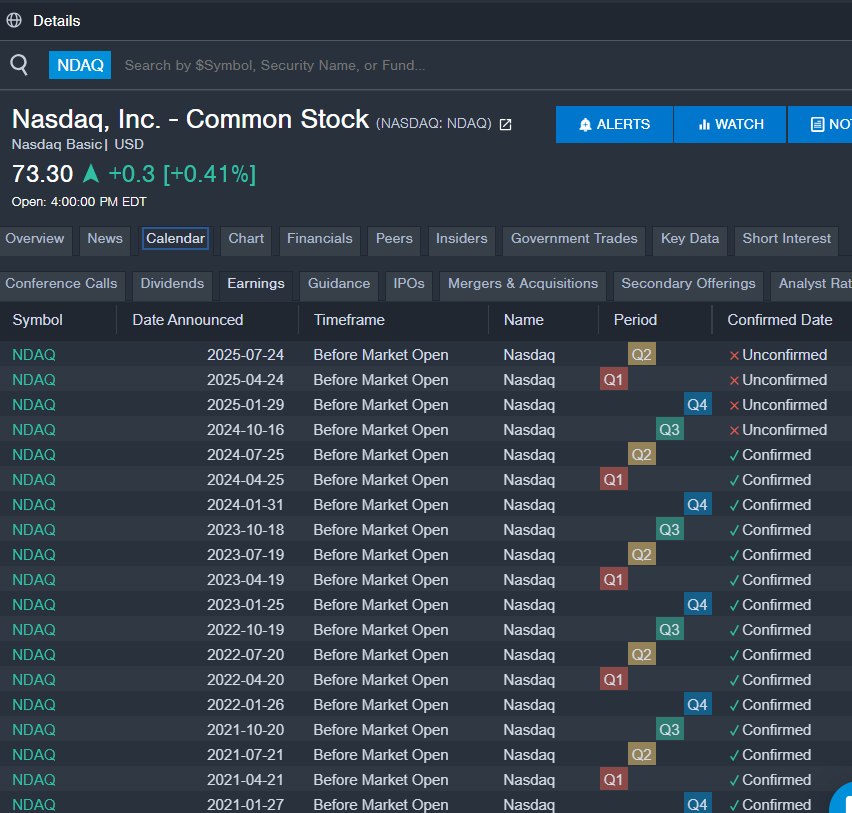

Nasdaq

- The Trade: Nasdaq, Inc. NDAQ Executive Vice President John sold a total of 11,000 shares at an average price of $71.97. The insider received around $791,670 from selling those shares.

- What's Happening: On Sept. 6, Nasdaq announced new leadership and structure for financial crime management technology.

- What Nasdaq Does: Founded in 1971, Nasdaq is primarily known for its equity exchange, but in addition to its market-services business (about 35% of sales), the company sells and distributes market data as well as offers Nasdaq-branded indexes to asset managers and investors through its information-services segment (30%).

- Benzinga Pro's earnings calendar was used to track upcoming NDAQ earnings reports.

Check This Out:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.