BlackRock, Inc. BLK will release earnings results for its third quarter, before the opening bell on Friday, Oct. 11.

Analysts expect the San Francisco, California-based company to report quarterly earnings at $10.38 per share, down from $10.91 per share in the year-ago period. BlackRock projects to report revenue of $5.01 billion for the quarter, according to data from Benzinga Pro.

On Oct. 1, BlackRock said it completed the acquisition of Global Infrastructure Partners.

BlackRock shares fell 0.1% to close at $955.59 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

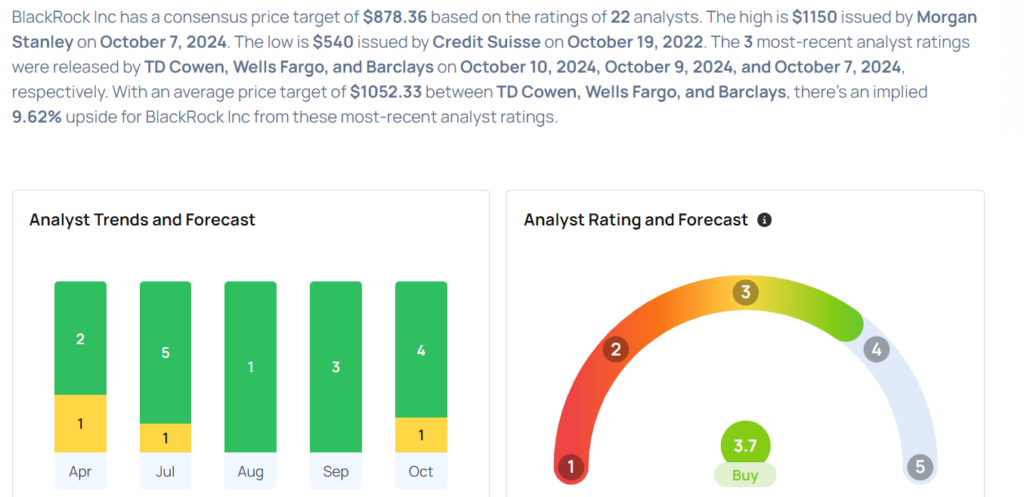

- TD Cowen analyst Bill Katz maintained a Buy rating and boosted the price target from $960 to $1,077 on Oct. 10. This analyst has an accuracy rate of 68%.

- Wells Fargo analyst Michael Brown maintained an Overweight rating and raised the price target from $1,000 to $1,070 on Oct. 9. This analyst has an accuracy rate of 66%.

- Barclays analyst Banjamin Budish maintained an Overweight rating and boosted the price target from $990 to $1,010 on Oct. 7. This analyst has an accuracy rate of 83%.

- Evercore ISI Group analyst Glenn Schorr maintained an Outperform rating and raised the price target from $945 to $995 on Oct. 4. This analyst has an accuracy rate of 72%.

- Goldman Sachs analyst Alexander Blostein maintained a Buy rating and boosted the price target from $960 to $1,040 on Oct. 3. This analyst has an accuracy rate of 73%.

Considering buying BLK stock? Here’s what analysts think:

Read This Next:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.