During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the energy sector.

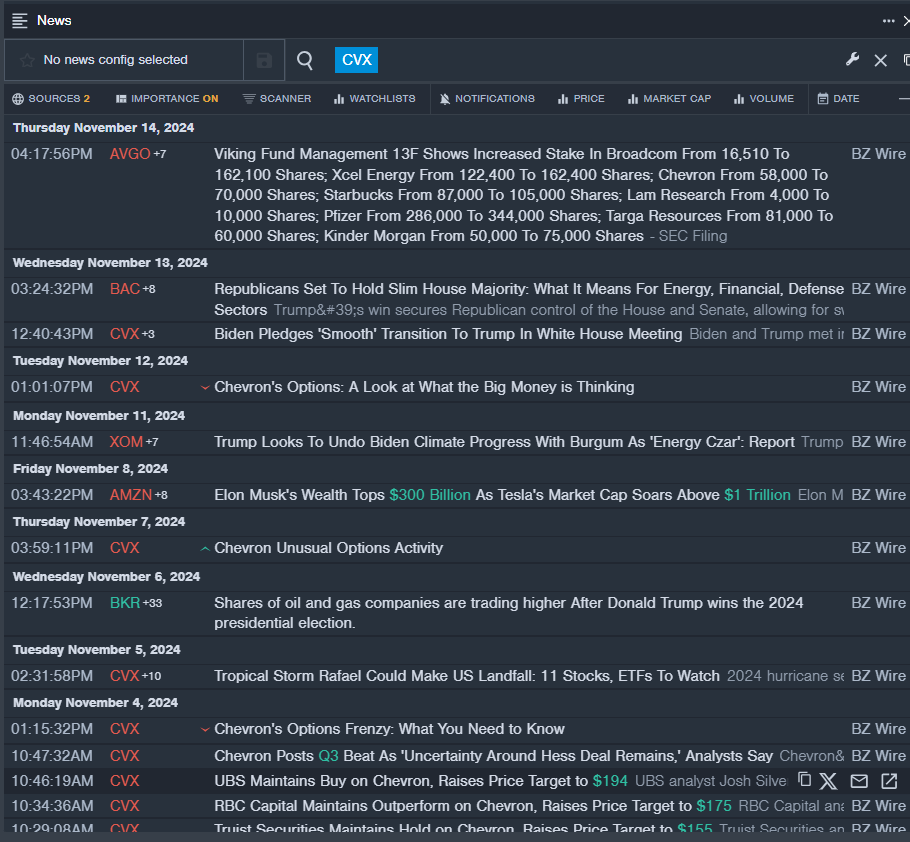

Chevron Corporation CVX

- Dividend Yield: 4.04%

- UBS analyst Josh Silverstein maintained a Buy rating and raised the price target from $192 to $194 on Nov. 4. This analyst has an accuracy rate of 63%.

- Truist Securities analyst Neal Dingmann maintained a Hold rating and boosted the price target from $150 to $155 on Nov. 4. This analyst has an accuracy rate of 72%.

- Recent News: On Nov. 1, the company posted upbeat quarterly earnings.

- Benzinga Pro's real-time newsfeed alerted to latest CVX news

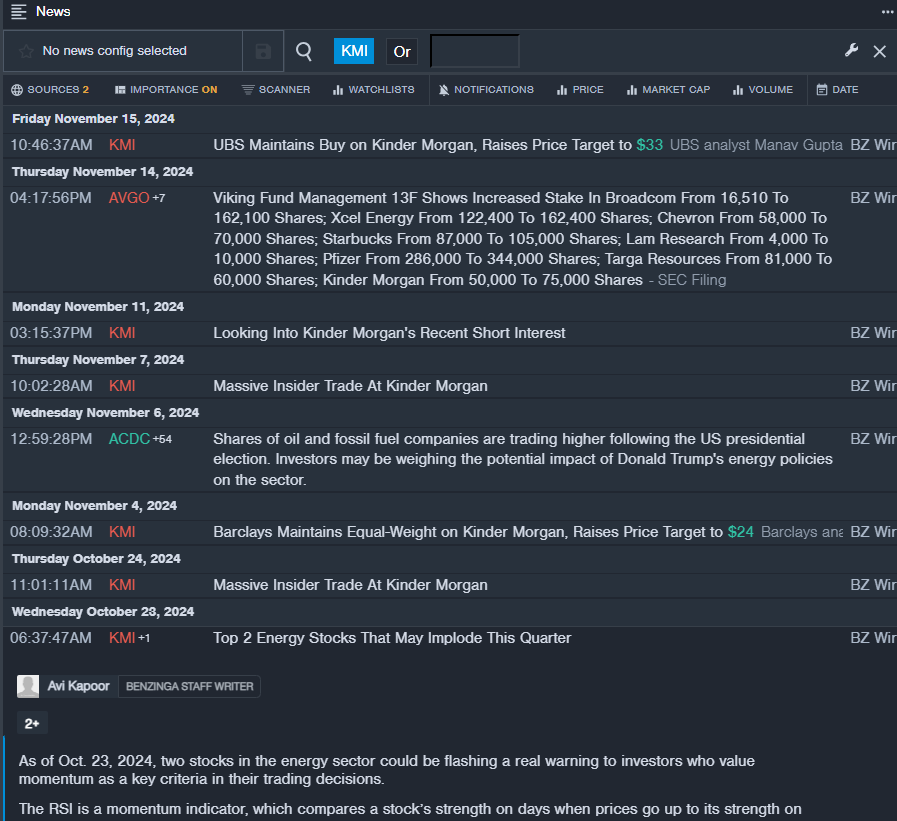

Kinder Morgan, Inc. KMI

- Dividend Yield: 4.14%

- Barclays analyst Theresa Chen maintained an Equal-Weight rating and raised the price target from $22 to $24 on Nov. 4. This analyst has an accuracy rate of 81%.

- Wells Fargo analyst Michael Blum maintained an Overweight rating and increased the price target from $22 to $27 on Oct. 17. This analyst has an accuracy rate of 67%.

- Recent News: On Oct. 16, Kinder Morgan reported third-quarter revenue of $3.699 billion, missing the consensus estimate of $3.975 billion, according to Benzinga Pro.

- Benzinga Pro's real-time newsfeed alerted to latest KMI news

Northern Oil and Gas, Inc. NOG

Dividend Yield: 4.07%

- Piper Sandler analyst Mark Lear maintained a Neutral rating and raised the price target from $40 to $41 on Nov. 18. This analyst has an accuracy rate of 66%.

- Truist Securities analyst Neal Dingmann maintained a Buy rating and boosted the price target from $44 to $51 on Nov. 7. This analyst has an accuracy rate of 72%.

- Recent News: On Nov. 5, Northern Oil & Gas posted better-than-expected quarterly earnings.

- Benzinga Pro’s charting tool helped identify the trend in NOG stock.

Read More:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.