A combination of consumer and manufacturing news will be released Tuesday, November 24, 2015, at 10:00 AM ET presenting an opportunity for an Iron Condor strategy using Nadex spreads. The Conference Board Inc., a global research association, will release the US CB Consumer Confidence report based on a survey of 5000 households. Surveyed people rate the current and future economic conditions. The Richmond Manufacturing Index comes out at the same time and gives a level of a composite index telling of business conditions amongst 100 surveyed manufactures.

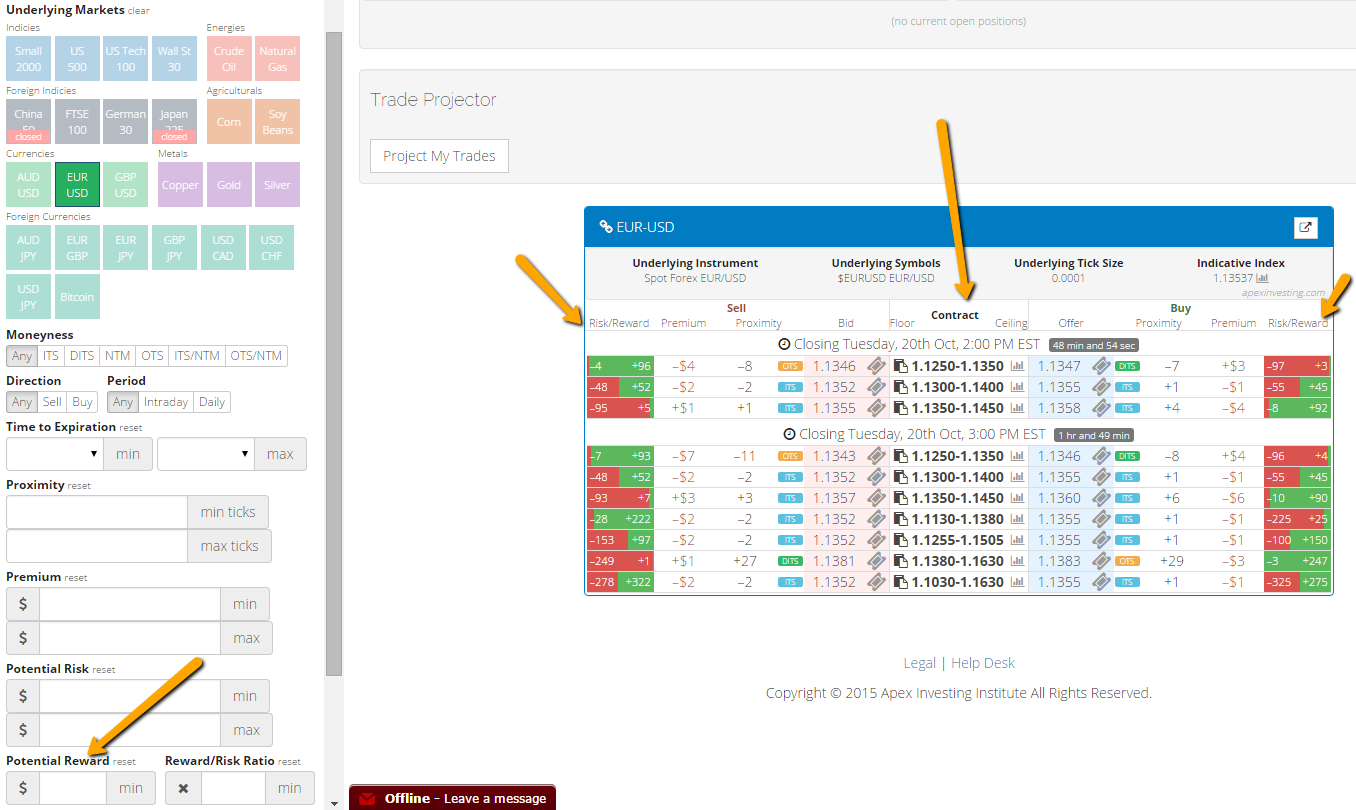

Based on previous reports coming out and past market reaction, it’s been found an Iron Condor is a good strategy to use to trade this event. To set up an Iron Condor, you want to use Nadex spreads and for this trade, you want Nadex EUR/USD spreads. Spreads have a floor or bottom of a range in a market and a ceiling or top of the range. You can sell or buy anywhere in this range. For this trade you want to buy a lower range spread below the market but with the ceiling where the market is trading at the time and sell an upper range spread above the market but with the floor where the market is selling at the time. To find just the right spreads, open the spread scanner at www.apexinvesting.com. Below you can see an example of the spread scanner displaying EUR/USD spreads.

To view a larger image click HERE

You can begin to look and enter your trade as early as 9:00 AM ET for 11:00 AM ET expirations. Your trade should have have a profit potential of $25 or more combined between the spreads. To do that, you want to look in the Risk/Reward columns of the spread scanner. Once you find the spreads with the right ceiling and floor parameters and those spreads have a reward amount of around $12 or more per spread, then you can enter the trade.

It is unknown which direction the market is going to move however, it tends to make a move and then pull back. The Iron Condor can capture profit if the market moves in either direction, if the market stays where it is or stays in a range, and if it moves slightly. If the market moves 25 pips up or down your trade will be at the break even point. If the market moves 50 pips up or down, then you have a 1:1 risk reward ratio. But remember, based on previous reports the market tends to move and then pull back. The market expiring anywhere within the 50 pip range between the breakeven points means your trade will profit.

For more information on Iron Condors or to learn more about how to trade Nadex, visit www.apexinvesting.com Nadex is a US based exchange regulated by the CFTC and can be traded from 49 different countries.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.