Production in the UK is made up of manufacturing, mining, and utilities. With 80% from the manufacturing side, it makes the news release on Manufacturing Production a leading indicator for economic health. Manufacturing has to respond quickly to business conditions and it can be a good read of consumer activity. For these reasons, traders watch the release making it a good opportunity for trading. The two reports, Manufacturing Production and Industrial Production, will come out Wednesday, May 11, 2016, at 4:30 AM ET. Being so early in the morning, it could be difficult to trade unless one has a strategy taking that into consideration.

For example, the Iron Condor strategy using day trading options like Nadex GBP/USD spreads, allows for an entry the night before on Tuesday, May 10, 2016, at 11:00 PM ET. Being an option, spreads have expiration times. This strategy uses the 7:00 AM ET expirations.

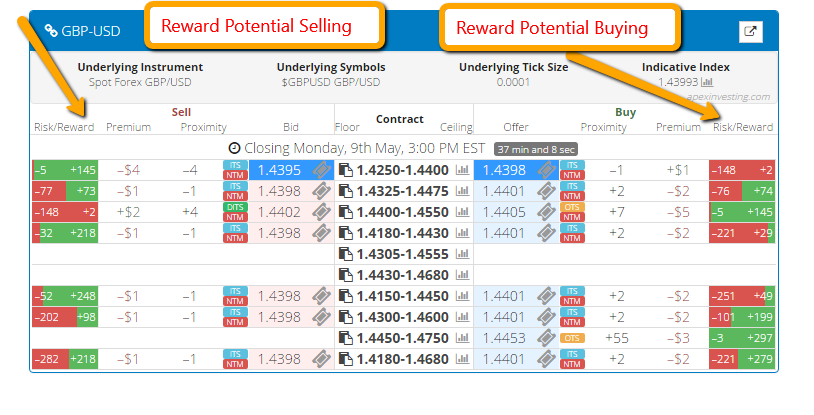

One spread is bought below the market and one spread is sold above the market. The ceiling of the bought spread should meet the floor of the sold spread and be where the market is trading at the time of entry. For this trade opportunity, a $35 or more profit potential is ideal, which is around $17 or more on each spread. See below for an example of how to find reward potential for spreads.

To view a larger image click HERE.

The image above is showing spreads available for 3:00 PM ET expiration. On the left, are green bars showing potential reward for selling the spread and the right shows the potential reward for buying the spread. With a profit potential of $35 or more and having bought below the market and sold above the market, it is anticipated the market will either stay in a range, make a move and pull back or remain where it is until expiration.

For max profit, the market would either stay or return to between the two spreads at expiration. The breakeven points are approximately 35 pips above and 35 pips below where the market started. The 1:1 risk reward ratio points are approximately 70 pips above and 70 below where the market started. It is at that those points to place stop limit orders. For more profit, additional contracts can be traded, as long as there is the same number of contracts on each side.

Free education and more details are available at www.apexinvesting.com.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.