Two scheduled news events will be released on Thursday: Canadian Building Permits at 8:30 a.m. ET and Ivey School of Business Purchasing Manager’s Index at 10:00 a.m. ET. Both events have a history of getting the USD/CAD to react and pull back, offering Iron Condor trade opportunities.

Canadian Building Permits

For this news event, trade two Nadex USD/CAD spreads. One could buy the lower spread below the market with the ceiling of wherever the market is at that point, and sell the upper spread above the market and with the floor where the market is. This trade can be entered as early as 8:00 a.m. ET for the two-hour 10:00 a.m. ET expiry spreads.

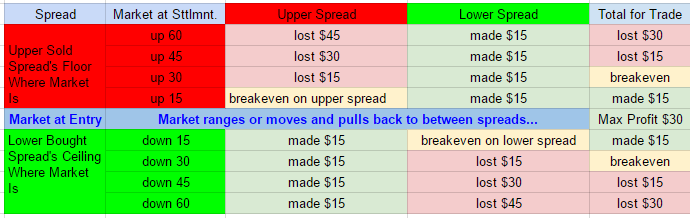

Profit potential for this trade is at least $30 combined, or around $15 or more from each spread. Based on this profit potential, the breakeven points are where the market would hit 30 pips above and below. Stops should be set where the market would be at 60 pips above and below for a 1:1 risk reward ratio. The max profit point is when the market pulls back and is right between the spreads at settlement. Some profit is made when the market settles between the breakeven points. See the below image for profit results based on where the market settles.

Ivey School of Business Purchasing Manager’s Index

An iron condor trade can also be used to trade this number. With entry at 10:00 a.m. ET, go for Nadex USD/CAD spreads with the 12:00 p.m. ET expirations. One could buy the lower spread below the market with the ceiling of where the market is trading, and sell the upper spread above the market but with the floor where the market is trading. The profit potential for this trade is $25 or more combined between the spreads.

You could also place stops where the market would move 50 pips up and down. The breakeven for this trade is where the market hits 25 pips up or down. When the market settles anywhere between the breakeven points, the trade will make some profit, with max profit occuring when the market settles between the two spreads

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.