Every month, the Nonfarm Payrolls (NFP), also known as employment change, is released. Traders expectations that the markets will move creates implied volatility, which can lead to Iron Condor and Straddle trade opportunities.

The nonfarm payrolls for this month will come out Friday at 8:30 a.m. ET. The market movement usually takes place within the first 15 minutes of the release. Spreads entered at 7 a.m. ET with the most time remaining before the 3 p.m. expiration are ideal, however, they will have greater width between the floor and ceiling of the spreads. Entry can also be at 8 a.m. ET for 10 a.m. expirations.

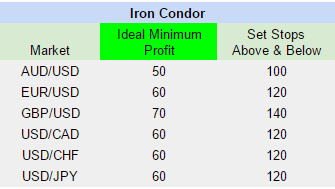

For the Iron Condor setup, follow the table below. One spread can be bought below the market with the ceiling of where the market is trading at the time, and one spread could be sold above the market with the floor of where the market is trading at the time. Follow the trade opportunities in the table below based on tracked average moves of the listed markets. For example, if trading AUD/USD, each spread should have a profit potential of $25, for a combined profit potential of $50. Then, double that amount and place stops that many pips above and below (i.e., 100 pips above and below from where market is at entry). The Iron Condor can be left on until settlement to give the market plenty of time to pull back.

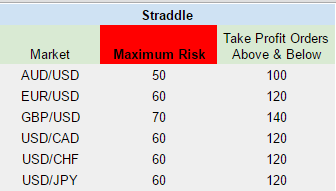

The Straddle setup involves buying the upper spread with the floor where the market is trading at the time and selling the lower spread with the ceiling where the market is at the time. This is a low risk setup and no stops are required. Take profit orders are required though, and should be placed right after entry.

Referencing the table below, each spread should have no more than a $25 risk for a combined max risk of $50. Take profit orders should be placed at double the max risk amount i.e., 100 pips above and below where the market is at entry. If one side profits, leave the other spread on, as it may profit as well or the cost of the spread may go down, should the market pull back far enough.

For free access to the Apex Spread Scanner, designed specifically for optimal execution trading Nadex spreads, and free day trading education, visit Apex Investing.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.