Recent Analyst Stock Rating News

What Are Analyst Stock Ratings?

Analyst ratings measure the expected performance of a stock during a given time period. Analysts and brokerage firms often use ratings when they issue stock recommendations to stock traders.

Analysts arrive at stock ratings after they research companies’ public financial statements, communicate with executives and customers and interact with companies in other ways.

Most analysts issue ratings 4 times a year, usually at 3-month intervals.

How to Use Analyst Ratings

As an investor or trader, you want to be able to use analyst ratings effectively. Here are steps you can take to understand how to synthesize all the information analysts report about a particular company and how to apply it to your own trades.

Step 1: Check Ratings History

In the short term, look to see whether analysts suggest an initiation, upgrade or downgrade for a particular stock. Understand how the rating changed compared to the previous rating and whether a price target gets announced or changed.

Sometimes the rating stays the same and only the price target changes, which could cause the stock to move in either direction, depending on the significance of the change between the 2 price targets.

Step 2: Check for Other News

In the short term, check to see how the stock reacts to positive or negative news. This will be an indication of the company’s outlook because analyst ratings usually come out after the company announces news (it’ll typically be earnings news).

Step 3: Look at the Sector for News

Check to see if other stocks in the sector also received similar ratings. This could indicate micro news, which refers to when the whole sector or specific company trades in a specific way due to news outside of one company.

Step 4: Look at the Note

If available, look over the analyst note itself. The beginning of the note has the main information of the rating and price target. Investors should also take a look at the summary of the note, which you can find in the first couple pages and give you a concrete overview of the company. This can help you get an understanding of how analysts arrived at their thesis on the stock.

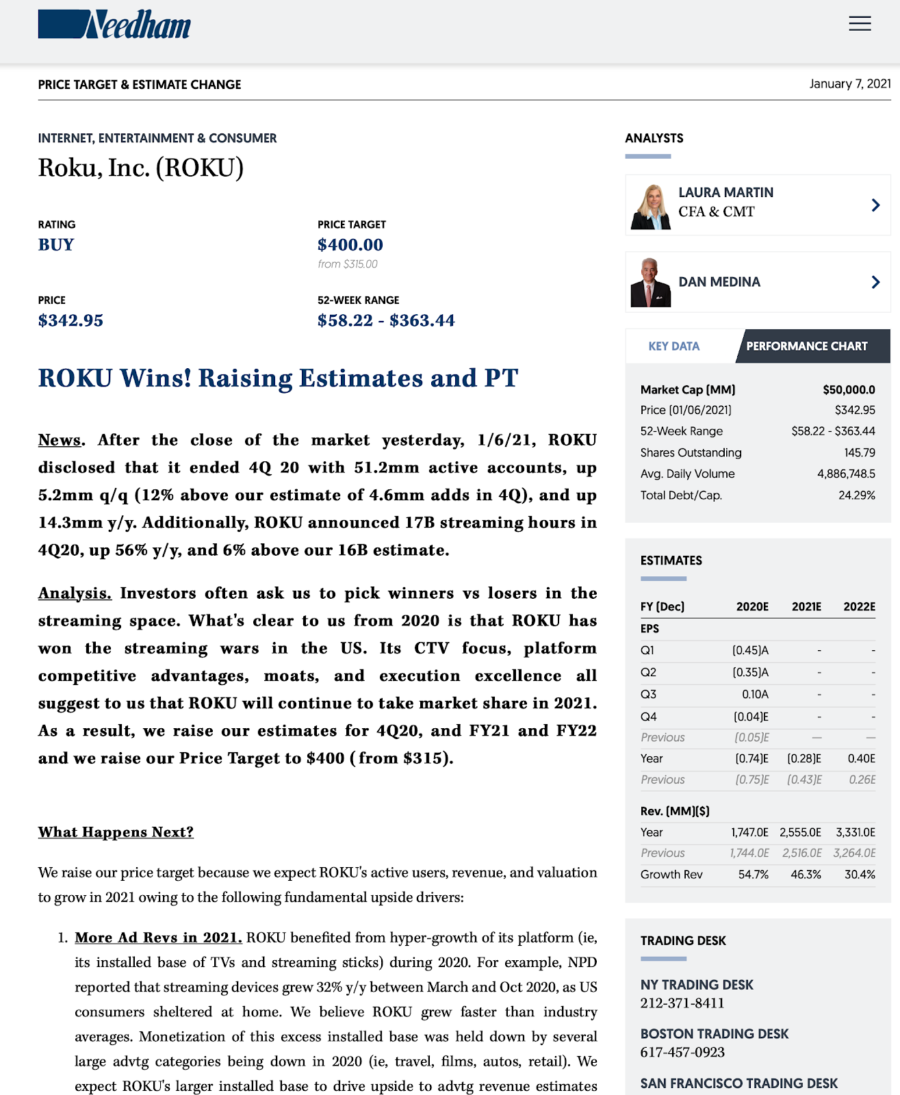

An example of an analyst note. Source: Needham

Step 5: Make a Decision

After reviewing the analyst ratings (and whether the analyst proposes a change or initiation) and find the reason for that note. Make a decision based on the analyst thesis on the company. This should give you guidance on how to make your thesis. Analyst ratings are a good indication of what professionals believe the company or sector will do, helping you get a better understanding of the companies you’re interested in.

Analyst Rating Accuracy

Analyst ratings are not set in stone and nobody knows indefinitely what a stock will do. Therefore, analyst ratings should be taken as an educated guess made by professionals who carefully study the specific company and sector in question. It's not a surprise that the accuracy of each rating can vary by each individual analyst and specific ratings on companies.

In other words, there’s no hard number or percentage on how accurate analyst ratings are because they are like educated guesses on what they think the stock will do based on their research, within that particular sector. In addition, each firm has so many analysts and so many different companies to review that you can compare ratings to glean what you believe is the truth.

Where Analyst Ratings Come From

Analyst ratings come from stock analysts. Analysts “go deep” on companies within a particular industry or sector. Some analysts employ a top-down approach (they start with an industry or sector and look for excellent companies within that industry or sector) and other stock analysts choose a bottom-up approach, which means they start with the company first and connect the dots within that company’s sector or industry. Analysts evaluate:

- Financial statements

- Economic fundamentals

- Suppliers, customers and competitors

- Management quality

- Business model

- Revenue

- Expenses

- Assets

- Liabilities

While these evaluations are done using facts and figures that any investor can access, they come down to a conclusion the analyst must draw. While this isn’t an unqualified opinion, analysts will disagree because their interpretations of the data could vary.

Types of Stock Ratings

Stock ratings can range from simple “buy” and “sell” ratings to “equal weight” and “outperform” ratings. Here’s a quick overview of how analysts rate stocks.

Buy Rating

A “buy” rating indicates that an analyst is optimistic about a stock’s short-term or mid-term growth and recommends that traders purchase the stock. An analyst may even go so far as to indicate that a stock is a “strong buy.” At the same time, you may choose to swing trade the asset for a profit and come back later to start the process all over again.

Sell Rating

A “sell” rating means that an analyst believes the stock will trend downward in a particular time frame. Analysts might even refer to a security as a “strong sell.” Remember, though, you may want to swing trade and come back to this asset in the future even though you just chose to sell, just as you would under a “buy” rating.

Hold

A “hold” rating suggests that investors should not buy more of or sell the specified stock because they believe the stock should perform in a way that’s consistent with the market or will perform similarly to comparable companies within that particular sector. This is akin to the value investing approach that Warren Buffett uses, looking to gain long-term value from a single stock rather than flipping it because of a bad week. As many have said, it’s not a loss until you sell.

Underperform

An “underperform” rating means an analyst indicates that a stock is expected to perform below the market or sector average. And yes, while the underperform rating may not bode well for an asset in the next few weeks, it may not stay that way. Continue to carefully monitor your portfolio to ensure that an underperforming asset hasn’t turned itself around. As companies are faced with the Herculean task of pleasing shareholders, they will push to fix their underperforming stocks, meaning that a stock you wrote off could rise again.

Outperform

An “outperform” rating means that an analyst expects a stock to outperform the market or sector average. While the stock may look to outperform the market or a sector’s average, that doesn’t mean it will continue to soar forever. You must look at an outperform rating as what that asset will do in recent times, but it may not maintain that trajectory.

Equal-Weight

An equal weight rating means that an analyst believes that an individual stock's performance will tie to the average of all the stocks that an analyst covers in that particular sector. This type of rating helps investors get a true comparison of stocks to each other within a particular sector or industry. At the same time, equal-weight ratings could change at any time.

Price Target

A price target is an analyst’s projection of a stock’s future price. A price target is generally set up in a general trade or area where the asset might land. This means that the analyst could get close without hitting the figure on the head. Even so, the analyst wants to get close and better predict the movement of the marketplace and the asset.

Understanding Stock Ratings

Stock ratings are assessments of the investment potential of a particular stock. They are typically created by financial analysts who evaluate a company's financial performance, competitive positioning, and market outlook to provide guidance on the stock's expected future performance.

Ratings typically range from "buy" to "sell," with variations in between, such as "hold," "accumulate," or "neutral." A "buy" rating suggests that the stock is likely to perform well in the future, and investors should consider purchasing it. Conversely, a "sell" rating indicates that the stock is expected to underperform, and investors should consider selling it.

It's important to note that ratings are not guarantees of performance and should not be relied upon solely when making investment decisions. Ratings are just one factor to consider when evaluating a stock's potential, and investors should also conduct their own research and analysis to make informed decisions.

Another thing to keep in mind is that different analysts may have different opinions on a stock, so it's a good idea to consider multiple ratings before making an investment decision.

In addition to analyst ratings, investors can also consider other factors when evaluating a stock, such as its financial statements, management team, industry trends, and overall market conditions. By combining all of these factors, investors can make informed decisions about which stocks to buy or sell.

In summary, stock ratings are an important tool for investors to consider when evaluating a stock's potential, but they should not be the only factor used in investment decision-making. It's important to conduct your own research, consider multiple ratings, and take into account other factors before making an investment decision.

Should You Use Analyst Ratings to Inform Your Own Trades?

You can definitely use analyst ratings to inform your own trades and inform your own thesis but it’s a good idea to do your own research. However, analyst ratings are just one step in what should be a much larger investment strategy. Don’t fall in love with just one analyst. Compare notes. Look into how these ratings match with activity on the market and current events. Plus, remember that an analyst rating could easily be incorrect. No one is perfect, but these ratings are a good place to start.

Visit Benzinga News for more guidance on how to research companies and make decisions about research, trading and investing.