Zinger Key Points

- Fed funds futures are pricing in a 86% probability of a quarter point hike to 4.75%-5%.

- Jeremey Siegel says a pause is unlikely as it may send a wrong message about the Fed's perception of the banking crisis.

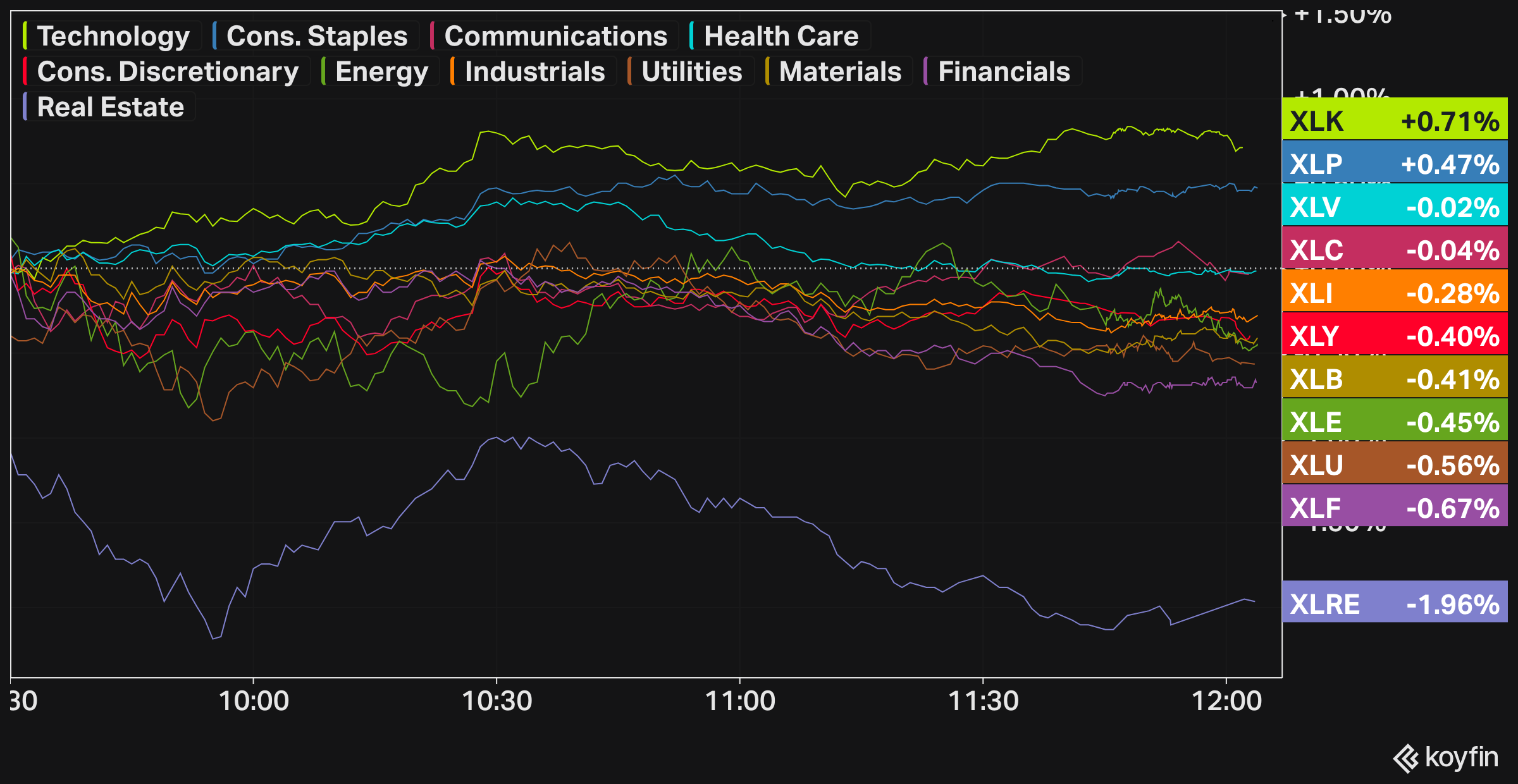

- Real Estate sector extended drops, while Tech and Staples slightly outperformed

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Following days of strong gains, the stock market is having a quite session, as investors await the FOMC's monetary policy announcement later in the day.

The market has nearly fully discounted a 25-basis-point hike today, but the attention will be on the Fed's future rate guidance, particularly the potential of a higher terminal rate or more rate hikes down the road.

Rate expectations for the second half of the year have repriced slightly higher in recent days, after they collapsed due to the banking crisis.

Cues From Tuesday’s Trading:

The major indices were mostly flat on the day. The Cboe Volatility Index or VIX VIX, the market's so-called fear gauge, continued to trend lower, and it has dropped 20% over the week.

See Also: Best Futures Brokers

The S&P 500 index continues to hover flat around 4,000 points, while the Dow Jones Industrial eased about 30 pts or 0.1%. The Nasdaq Composite index was down slightly. midday.

Among sectors, the Real Estate Select Sector SPDR Fund XLRE extended its losses and underperformed versus the others, dropping 2% on the day and now losing 10% since a month ago.

The Financial Select Sector SPDR Fund XLF slightly eased by 0.7% after the strong gains over the past sessions, while the Technology Select Sector SPDR Fund XLK and the Consumer Staples Select Sector SPDR Fund XLP outperformed by rising 0.8% and 0.4%, respectively.

| Index | Performance (+/-) | Value | |

|---|---|---|---|

| Nasdaq Composite | +0.2% | 11,891.2 | |

| S&P 500 Index | -0.05% | 4,002.0 | |

| Dow Industrials | -0.1% | 32,520.18 |

Analyst Color:

Wharton professor Jeremy Siegel expects stocks to sell off for a short time after the Fed decision is announced and the summary of economic projections is released. He expects the Dot-Plot curve, a graphical representation of the FOMC members’ prediction of future interest rate trajectory, to be interpreted as hawkish, given the Fed may not have time to revise expectations based on the latest banking failures.

"[Jerome] Powell will then likely talk down expectations for future rate hikes at the press conference and give relief back to the markets," he said.

On Wednesday midday trading, the SPDR S&P 500 ETF Trust SPY was down 0.2% at $398.08, and the Invesco QQQ Trust QQQ ticked up 0.3%, to $311.42, according to Benzinga Pro data.

Upcoming Economic Data:

The customary mortgage applications volume data for the week ended March 17 is due at 7 a.m. EDT. Mortgage applications volume was higher for a second straight week in the week of March 10, rising 5% compared to the previous week. Year-over-year comparisons show that the metric is bouncing around the bottom, having plunged 74%.

The Federal Open Market Committee, or FOMC, decision is scheduled for 2 p.m. EDT. The central bank will also release the latest economic forecasts and the Dot-Plot curve. Chairman Powell will host a press briefing at 2:30 p.m. EDT to shed further light on the March policy decision and the outlook.

Stocks In Focus:

- GameStop Corp. GME spiked over 40% in premarket trading following the release of its quarterly results.

- Troubled lender First Republic Bank FRC continued its upward momentum and was seen up over 4%.

- Virgin Galactic Holdings Inc. SPCE climbed over 2.50%.

First Republic Bank FRC tapped Lazard Ltd LAZ for help with review of strategic options. The stock has been moved from neutral to under review by Citigroup. FRC is down 4% on the day. - Nvidia Corp NVDA soared 3.4% after company's CEO Jensen Huang said that generative AI will constitute a large portion of revenues in the coming year.

- Nike Inc. NKE lost nearly 2%, despite reporting higher-than-expected EPS in Q4 2022 (0.79 vs 0.555), as the company warned on rising margin pressures.

- Chewy Inc. CHWY, KB Home KBH, Steelcase Inc. SCS and Worthington Industries Ltd. WOR are among the notable companies reporting their earnings on Wednesday.

Top Analysts’ Call

- Adobe Systems Inc. ADBE: Piper Sandler reiterated Overweight rating and $415 price target.

- Luminar Technologies Inc. LAZR: Goldman Sachs downgrades from Neutral to Sell with $5 price target.

- Meta Platforms Inc. META: KeyBanc Capital Markets upgrades from Sector Weight to Overweight with $240 price target.

Commodities, Bonds, Other Global Equity Markets:

Crude oil futures surged after a somewhat mixed EIA report that showed a rise in U.S. crude inventories but large declines in stockpiles of gasoline and diesel. Three OPEC+ delegates also announced that the cartel is expected to stick to its plan to cut output by 2 million barrels per day through the end of 2023. A barrel of WTI-grade crude oil rose 0.8% to $70.

Gold prices ticked 0.4% higher to $1,946/oz, with the SPDR Gold Trust ETF GLD posting a 0.3% gain.

Treasury yields remained broadly stable ahead of today's FOMC. The benchmark 10-year Treasury yield, which broke above the 3.6% mark on Tuesday, has retreated to 3.56%, down 3 basis points.

The major European markets also took a breather on Wednesday, following hawkish ECB remarks and a higher-than-expected inflation rate print in the UK. The iShares MSCI Eurozone ETF EZU held steady (0.02%).

Read Next: 5 Bond ETFs To Watch Ahead Of The Fed's Key Interest Rate Call Wednesday

Staff writer Piero Cingari updated this story midday Wednesday.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.