Zinger Key Points

- S&P 500 index has now fully recovered the downside suffered post the Silicon Valley Bank fallout in March.

- Nasdaq 100 index officially entered a bull market this week.

- Fed's Barkin reiterates a hawkish stance, pushing back expectations for rate cuts.

- Our government trade tracker caught Pelosi’s 169% AI winner. Discover how to track all 535 Congress member stock trades today.

The U.S. stock market extended its gains on Thursday, with the S&P 500 index on track to notch its third straight week of gains, a bullish run not seen since late August 2022.

Easing worries about a broader financial crisis continue to spur risk appetite among investors, while applications for unemployment benefits rose somewhat more than expected last week, assisting in maintaining Fed rate expectations roughly steady.

Tech continued to outperform other sectors, with the Nasdaq 100 index officially entering a bull market.

Cues From Thursday's Trading:

The S&P 500 index rose 0.4% on the day, hitting an intraday high of 4,056 points, the highest since March 6, when the stock market started to plummet on rising banking fears.

The Nasdaq composite added nearly 100 points or 0.75%, breaking above the psychological 12,000 mark.

The Dow Jones Industrial average was slightly more muted, slightly up by 0.2%.

| Index | Performance (+/-) | Value | |

|---|---|---|---|

| Nasdaq Composite | +0.75% | 12,010.18 | |

| S&P 500 Index | +0.4% | 4,045.34 | |

| Dow Industrials | +0.18% | 32,757.40 |

Analyst Color:

The stock market could be primed for a strong year, Ryan Detrick, chief market strategist at Carson Group implied this week. He premised his optimism on the historical data that showed strong gains whenever the S&P 500 ends the first quarter above December lows.

The average gain for the full year under this condition is 18.6% and the median gain is 18.1%, he said. About 94.4% of the time when this happens, the market has finished higher, he added.

Here's what happens the final three quarters of the year (and full year) when the S&P 500 doesn't close beneath the December low close during Q1.

— Ryan Detrick, CMT (@RyanDetrick) March 29, 2023

I added the final three quarters from a study I did earlier today.

Once again, quite bullish results. pic.twitter.com/FhlTxxrO9Z

The S&P 500 Index bottomed at 3,783.22 on Dec. 28 and has run up nicely since then.

Another data point highlighted by media is the Nasdaq 100 Index, made up of blue-chip tech stocks, moving into bull market territory, having gained over 20% from its December lows of 10,679.34. If tech stocks continue their upward trajectory, it could be good news for the overall market, given the sector typically leads a market recovery.

Thursday's Trading In Major Equity ETFs:

In midday trading Thursday, the SPDR S&P 500 ETF Trust SPY climbed 0.45% to $403.17, the SPDR Dow Jones Industrial Average ETF DIA was 0.1% up to $327.47 and the Invesco QQQ TrustQQQ moved up 0.94% to $315.60, according to Benzinga Pro data.

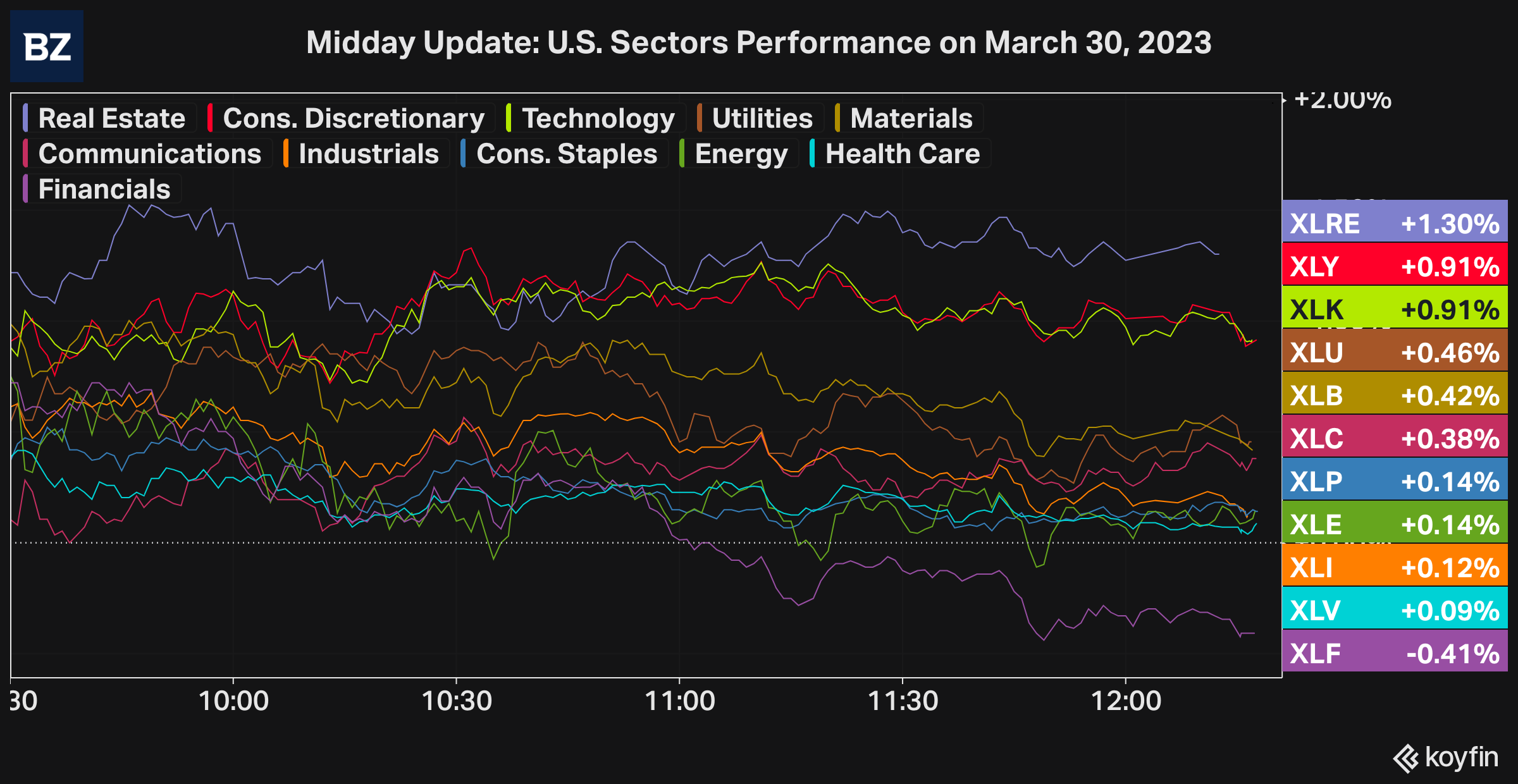

The Real Estate Select Sector SPDR Fund XLRE gained 1.3%, after gaining 2% the previous session, outperforming all other S&P 500's sectors. The Technology Select Sector SPDR Fund XLE rose 0.9%, also extending gains and the Consumer Discretionary Select Sector SPDR Fund XLY gained 0.8%. The Financial Select Sector SPDR Fund XLF was the only sector screening negative performance on the day, down 0.4%.

Latest Economic Data:

- Unemployment claims rose by 7,000 from the previous week to 198,000 on the week ending March 25th, slightly above expectations of 196,000, as reported by the U.S. Department of Labor.

- The final-fourth quarter GDP has been revised lower from initial estimates of 2.7 to 2.6%, according to the U.S. Bureau of Economic Analysis.

Richmond Fed President Tom Barkin reiterated that case for raising rates was pretty clear and that the Fed still has work to do. The official pushed back against expectations for Fed rate cuts and speculations on rising the inflation target to 3%. He said he could see rates at 5.5%-5.75%.

Treasury Secretary Janet Yellen is due to speak at 3:45 p.m. EDT.

See also: Best Futures Trading Software

Stocks In Focus:

Intel Corp INTC rose 1.7% as investors welcommed the company's AI presentation, and after Raymond James and Deutsche Bank analysts raised the price target.

AngioDynamics ANGO plummeted 24% on the day, after reporting a loss, lower-than-expected revenues and a guidance cut.

Charles Schwab Corp. SCHW shares fell about 5% on Morgan Stanley’s downgrade.

Advanced Micro Devices Inc. AMD rose 2.5%, amid a broader rally in chipmakers.

- Manchester United plc MANU reported a fiscal loss in the quarter but higher-than-expected revenues ($201.5 million vs $168.7 million expected). The share rose 1.6% on the day.

- BlackBerry Limited BB will report after the market close on Thursday.

Commodities, Bonds, Forex, and Other Global Equity Markets:

Crude oil resumed its ascent, with a barrel of WTI-grade crude rising to $74, up 1.9% on the day. Natural gas fell 3.3%, hitting 30-month lows, after lower-than-expected withdrawals from storage last week.

The benchmark 10-year Treasury yield was flat at 3.55%. The yield on the two-year yield Treasury Note was also stable at 4.10%.

The dollar further weakened against the euro by 0.6%, with EUR/USD rising above 1.09.

Major European equity indices has a positive session on Thursday. The iShares MSCI Eurozone ETF EZU rose 1.5%.

Gold soared 1% to $1,982/oz, with the SPDR Gold Trust GLD up 0.9% to 184.33. Silver rose 2.3% to $23.85, with the iShares Silver Trust SLV up 2.3% to 21.93. Bitcoin was flat at $28,289.

Read Next: A Plain And Simple Dip-Buying Strategy On The S&P 500 Would Have Beaten Many Hedge Funds In 2023

Staff writer Piero Cingari updated this story midday Thursday.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.