U.S. stocks could start the holiday-shortened week on a positive note, with the momentum from the past week likely to carry over. The developments around Friday’s boardroom coup at OpenAI and its implications for Microsoft Corp. MSFT and other AI stalwarts could create some ripple in the tech space. More importantly, traders could look ahead to Nvidia Corp.’s NVDA earnings due Tuesday after the market close to give a lift to the sector and the broader market.

Energy stocks are likely to gain ground amid oil’s strong rebound. Bond yields remain flattish to slightly up, and the Treasury auctions scheduled for the day remain on traders’ radar. Volume could be thin, as is typical of pre-holiday trade, lending less credence to the moves.

Cues From Past Week's Trading:

Tamer inflation and softer growth data points kept the market afloat in the week ended November 17, with the major averages posting solid weekly gains. After the inflation-induced sharp advances early in the week, the indices traded in a lackluster manner, although maintaining a positive bias. Negative reaction to some key earnings reports served as a drag.

US Index Performance In Week Ended Nov. 17

| Index | Performance (+/-) | Value |

| Nasdaq Composite | +2.37% | 14,125.48 |

| S&P 500 Index | +2.24% | 4,514.02 |

| Dow Industrials | +1.94% | 34,283.10 |

| Russell 2000 | +5.42% | 1,797.77 |

The Nasdaq Composite and the S&P 500 indices closed at their highest levels in 3-1/2 and 2-1/2 months, respectively. The Dow Industrials ended just shy of a three-month high hit last week.

Analyst Color:

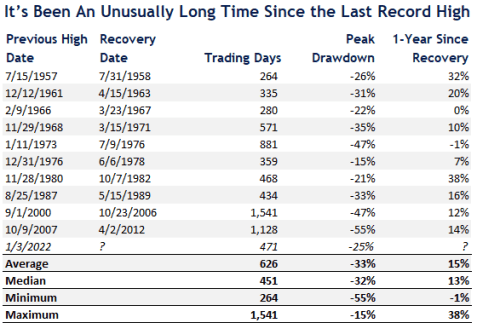

As the S&P 500 Index trades 6.32% off its Jan. 4, 2022, high (intraday) of 4,818.62, an analyst at LPL Financial delved into what is in store for the remainder of the year. “It's been 471 trading days since the S&P 500 reached its all-time high of 4,796.56 on January 3, 2022,” said Jeffrey Buchbinder, the firm’s chief equity strategist, referring to the closing high.

Source: LPL

Buchbinder noted that LPL has a year-end fair value of 4,300-4,400 based on estimated earnings of $230 for 2024. “Technical evaluations show a recent breakout above resistance at 4,400 and a possible re-test of a key 4,600 level,” he said.

“The next six weeks are among the best seasonally for stocks on the calendar,” the analyst said. Pointing to what the history tells about the timetable for the market to recover from bear market losses, the analyst said a “new record high may not be far off.”

Futures Today

Futures Performance On Monday

| Future | Performance (+/-) |

| Nasdaq 100 | +0.11% |

| S&P 500 | +0.04% |

| Dow | +0.02% |

| R2K | -0.17% |

In premarket trading on Monday, the SPDR S&P 500 ETF Trust SPY rose 0.05% to $451.01, and the Invesco QQQ ETF QQQ gained 0.14% to $386.58, according to Benzinga Pro data.

Upcoming Economic Data:

The economic calendar of the unfolding week is fairly light, although the traders do get to sift through some market-moving catalysts. The Conference Board’s leading economic index for October, the durables goods orders for October, the existing homes sales report for October, the routinely scheduled weekly jobless claims report, and S&P Global’s flash services and manufacturing purchasing managers’ indices for November are among the reports that can move markets.

The spotlight will likely be on the minutes of the October 31- November 1 Federal Open Market Committee meeting, in which the central bank decided to leave the fed funds rate unchanged at 5.25%-5.50% for a second straight meeting.

The Conference Board is scheduled to release its leading economic index for October at 10 a.m. ET. The index, which is a composite measure, is expected to show a decline of 0.7% month-over-month, the same pace of decline as in September.

The Treasury is set to auction three- and six-month bills at 11:30 a.m. ET and 20-year bonds at 1 p.m. ET.

Richmond Fed President Thomas Barkin is scheduled to make a TV appearance at 12 p.m. ET.

See also: Futures Vs. Options

Stocks In Focus:

- Microsoft rose 1.39% in premarket trading after the company welcomed on board ousted OpenAI CEO Sam Altman and former president Greg Brockman, along with some of their ex-colleagues to set up a new AI team.

- Boeing Co. BA rose over 1.50% after Deutsche Bank upgraded the stock to a Buy on improved free cash flow outlook.

- Agilent Technologies, Inc. A and Zoom Video Communications, Inc. ZM are among the notable companies reporting their quarterly results after the market closes.

Commodities, Bonds, Other Global Equity Markets:

Crude oil futures rose 1.70% to $77.33 in early European session on Monday following the 1.66% retreat for the week ended November 17.

The benchmark 10-year Treasury note edged up 0.028 percentage points to 4.469% on Monday.

Cryptocurrencies are firmer in the European session, led by the apex crypto, Bitcoin BTC/USD. The upside could be traced back to the election win of pro-crypto candidate Javier Milei in the Argentinian presidential race.

In the currency market, the U.S. dollar is against most major currencies, reflecting expectations of a Fed pivot on the back of recent soft U.S. economic data.

Most major Asian markets advanced on Monday, led by the Hong Kong and Chinese markets. The People’s Bank of China left the benchmark lending rates unchanged at a monthly fixing, in line with expectations, to assess the impact of previous easing on credit demand.

The Japanese, Indian, Malaysian, and Singaporean markets, however, settled lower.

Photo by Jirapong Manustrong on Shutterstock

European stocks showed tentativeness and were mixed by late-morning trading on Monday.

Read Next: Small-Caps Grossly Underperform Broader Market Amid This Red Flag: 5 Stocks On The Scanner

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.