Editor’s note: This story has been updated to reflect the U.S. markets have normal trading hours Wednesday, and the market is closed Thursday for the Thanksgiving holiday.

Sentiment appears to have reversed course after Tuesday’s pullback, with stock futures pointing to a modestly higher open. The positive shift comes despite a slew of retail earnings disappointments, potentially buoyed by Nvidia Corp.’s NVDA positive movement. Key economic data on the jobs market, consumer sentiment, and durable goods orders could create ripples in the market.

Trading volume could be light in thin pre-holiday trade, lending less credence to the day’s moves. The market is closed on Thursday on account of the Thanksgiving Day holiday.

Cues From Tuesday’s Trading:

Stocks had an off-day on Tuesday amid profit-taking following recent gains that propelled the broader market to its highest level in over 3-1/2 months. Negative commentary from retailers and a pullback in Nvidia’s shares tempered the new-found momentum of the market. The Federal Reserve’s meeting minutes did not offer any surprises and conveyed the message that the central bank may be in a “wait-and-watch” mode.

The major averages opened lower and moved roughly sideways below the unchanged line throughout the session. In the process, the S&P 500 Index and the Nasdaq Composite snapped a five-session winning streak.

IT, consumer discretionary, and real estate stocks served as drags on the broader market, while healthcare stocks gained ground.

Small-cap stocks underperformed their larger counterparts, with the Russell 2000 Index closing down over 1%.

US Index Performance On Tuesday

| Index | Performance (+/-) | Value |

| Nasdaq Composite | -0.59% | 14,199.98 |

| S&P 500 Index | -0.20% | 4,538.19 |

| Dow Industrials | -0.18% | 35,088.29 |

| Russell 2000 | -1.32% | 1,783.26 |

Analyst Color:

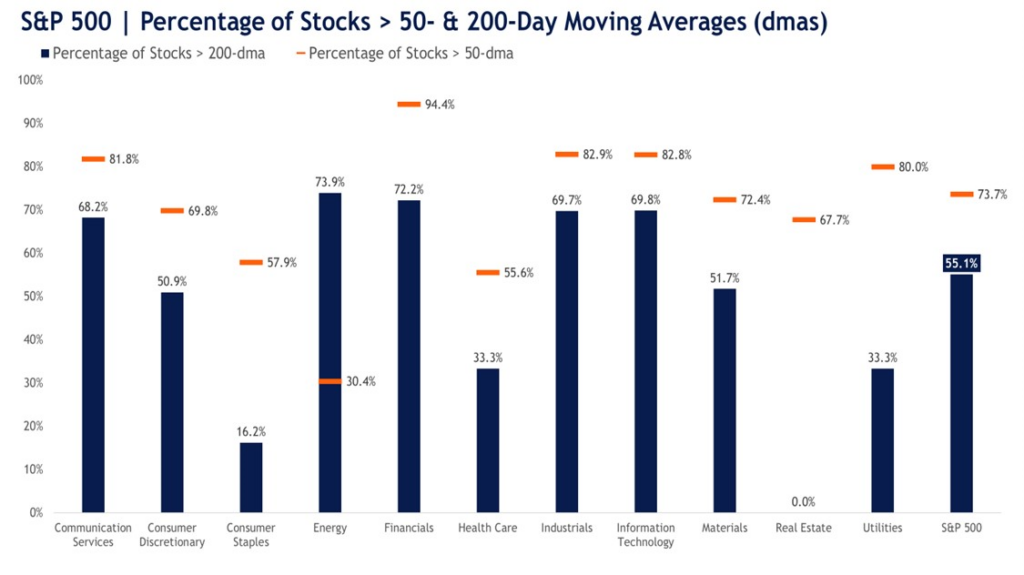

The breadth of the broader market rally has widened and this is a constructive sign for the health and sustainability of the current recovery, said LPL Financial Chief Technical Strategist Adam Turnquist. He noted that the rally off the October lows has pushed the S&P 500 Index up over 10% and through several overhead resistance levels.

“Investor attention has now turned to 4,600—a resistance area tracing back to the February/March 2022 highs and a spot that ended the summer rally,” he said. With participation in the current recovery improving significantly over the past few weeks, it appears that the current recovery is not just a “Magnificent Seven” story, the analyst said.

Turnquist noted that as of Monday, 55% of S&P 500 stocks closed above their 200-day moving average, more than doubling since the end of October. Additionally, cyclical sectors are exhibiting the broadest breadth readings, including financials, which are finally participating in the rally, he said.

Chart Courtesy of LPL Financial

Futures Today

Futures Performance On Wednesday

| Futures | Performance (+/-) |

| Nasdaq 100 | +0.29% |

| S&P 500 | +0.18% |

| Dow | +0.02% |

| R2K | +0.42% |

In premarket trading on Wednesday, the SPDR S&P 500 ETF Trust SPY rose 0.19% to $454.11 and the Invesco QQQ ETF QQQ gained 0.29% to $389.60, according to Benzinga Pro data.

Upcoming Economic Data:

The weekly jobless claims data is due to be released at 8:30 a.m. ET, with the customary release schedule pushed forward by a day due to Thursday’s public holiday. Economists, on average, expect the number of individuals claiming unemployment benefits to come in at 225,000 in the week ended November 18 compared to 231,000 in the week ended November 11.

The Commerce Department will release the durables goods orders data for October at 8:30 a.m. ET. The consensus estimate calls for a 3.1% month-over-month drop in durable goods orders, reversing some of the 4.7% gain in September. Core durable goods orders that exclude volatile transportation orders may have edged up 0.1%, slower than September’s 0.5% growth.

The University of Michigan’s final consumer sentiment index for November is due at 10 a.m. ET. The headline index is expected to be left unrevised at the preliminary reading of 60.4, although lower than the November reading of 63.8. The one-year and five-year inflation expectations are likely to come in at 4.4% and 3.2%, respectively.

The Energy Information Administration will release its weekly petroleum status report at 10:30 a.m.ET.

The Treasury will auction four- and eight-week notes at 11:30 a.m. ET.

See also: Best Futures Trading Software

Stocks In Focus:

- Nvidia rose over 1.30% in premarket trading, recouping losses from early pre-market hours, as traders shrugged off the China weakness flagged by the company.

- Farm equipment manufacturer Deere & Co. DE slumped more than 6.50% after the company issued a soft 2023 outlook.

- Among the other stocks reacting to earnings news are Autodesk, Inc. ADSK (down nearly 6%), Guess?, Inc. GES (down about 15%), HP Inc. HPQ (down over 2%), Jack in the Box Inc. JACK (down over 5.5%), and Urban Outfitters, Inc. URBN (down over 6.5%).

Commodities, Bonds, Other Global Equity Markets:

Crude oil futures fell 1.21% to $76.83 in early European session on Wednesday following Tuesday’s modest gain. The United States Oil Fund, LP USO declined 1.30% in premarket.

The benchmark 10-year Treasury note fell 0.043 percentage points to 4.375% on Wednesday. iShares 20+ Year Treasury Bond ETF TLT was up 0.64% in premarket trading.

The cryptocurrency space continued to reel under the negative headlines surrounding Binance and the stepping down of Changpeng Zhao as the exchange’s CEO. CZ has pleaded guilty to money laundering charges. Bitcoin BTC/USD traded below the $37,000 mark ahead of the U.S. session.

In the currency market, the U.S. dollar was firmer against most major currencies, except the Australian dollar.

The Chinese market led most major Asian markets lower, while European stocks were mostly higher by late-morning trading.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.